Question: PLEASE HELP WITH THE BELOW PROBLEMS ******DATA TABLES***** Comparative financial statement data of Hamden Optical Mart follow Click on the lcon to view the (Click

PLEASE HELP WITH THE BELOW PROBLEMS

******DATA TABLES*****

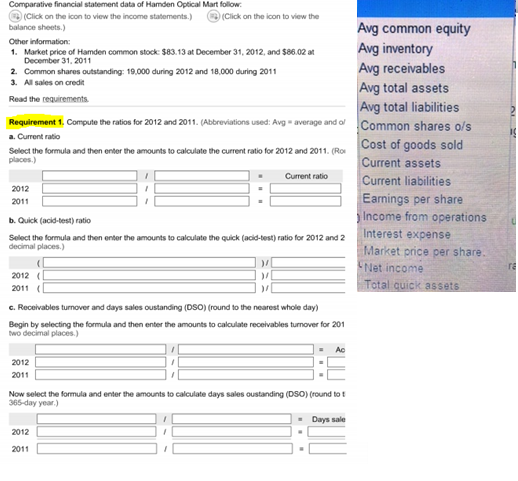

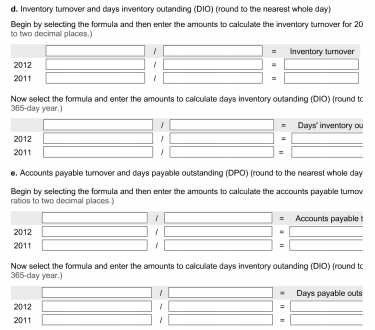

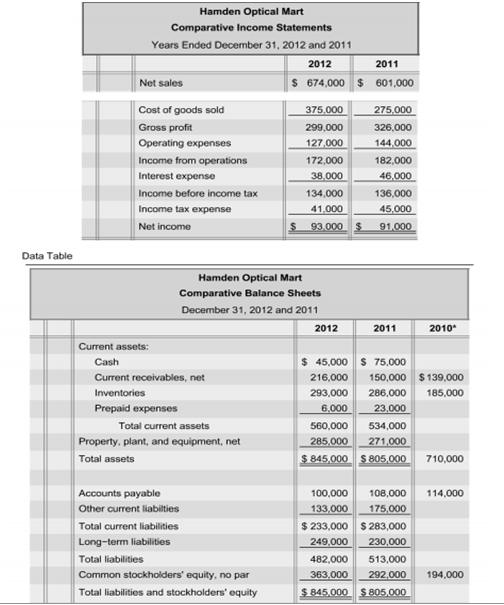

Comparative financial statement data of Hamden Optical Mart follow Click on the lcon to view the (Click on the lcon to view the income statements balance sheets Other information: 1. Market price of Hamden common stock: $83.13 at December 31, 2012, and $86.02 at Avg common equity inventory December 31, 2011 Avg receivables 2. Common shares outstanding: 19,000 during 2012 and 18,000 during 2011 3. All sales on credit Read the requirements total assets total liabilities Requirement 1, Compute the ratios for 2012 and 2011. (Abbreviations used: Avg average and Common shares o/s a. Current ratio Cost of goods sold Current assets Current liabilities Earnings per share Income from operations Select the formula and then enter the amounts to calculate the current ratio for 2012 and 2011. (Ro places Current ratio 2012 2011 b. Quick (acld-test) ratio Select the formula and then enthens to caloulate the uick (acid-test) ratio for 2012 and 2 Interest expense Select the formula and then enter the amounts to calculate the quick (acid-test) ratio for 2012 and 2 decimal places) Market price per share Net income )7 )r 2012 2011 G. Receivables turnover and days sales oustanding (DSO) (round to the nearest whole day) Begin by selecting the formula and then enter the amounts to caloulate receivables turnover for 201 wo decimal places) 2012 2011 Now select the formula and enter the amounts to calculate days sales oustanding (DSO) (round to 365-day year) Days sale 2012 2011

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts