Question: Please help with the calculation for the following question. 1. Calculate your number of working years. To do this estimate the year you will start

Please help with the calculation for the following question.

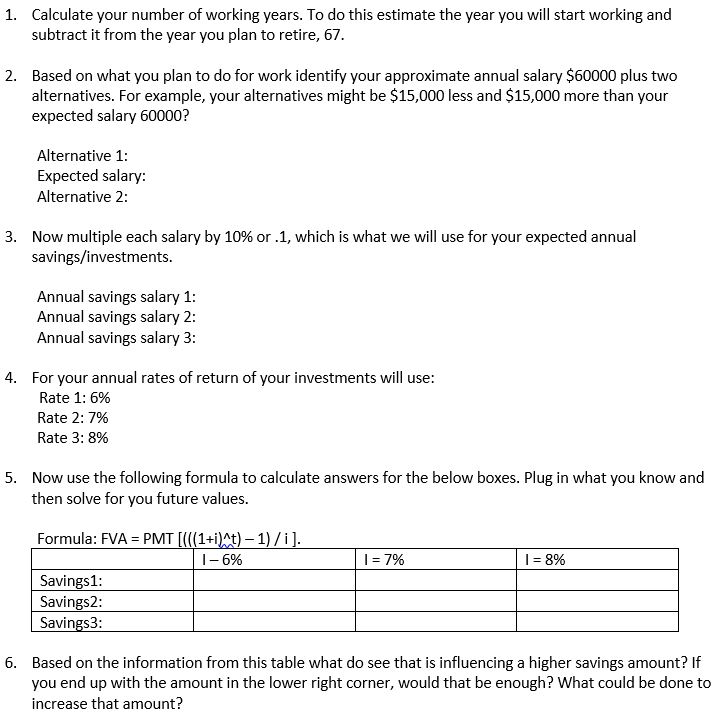

1. Calculate your number of working years. To do this estimate the year you will start working and subtract it from the year you plan to retire, 67. 2. Based on what you plan to do for work identify your approximate annual salary $60000 plus two alternatives. For example, your alternatives might be $15,000 less and $15,000 more than your expected salary 60000? Alternative 1: Expected salary: Alternative 2: 3. Now multiple each salary by 10% or .1, which is what we will use for your expected annual savings/investments. Annual savings salary 1: Annual savings salary 2: Annual savings salary 3: 4. For your annual rates of return of your investments will use: Rate 1: 6% Rate 2: 7% Rate 3: 8% 5. Now use the following formula to calculate answers for the below boxes. Plug in what you know and then solve for you future values. 1 = 7% I = 8% Formula: FVA = PMT [(((1+i)At) - 1)/i]. 1-6% Savings1: Savings2: Savings3: 6. Based on the information from this table what do see that is influencing a higher savings amount? If you end up with the amount in the lower right corner, would that be enough? What could be done to increase that amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts