Question: please help with the following help ... ... 1.Privott, Inc., manufactures and sells two products: Product Z9 and Product N0. The company is considering adopting

please help with the following

help

...

...

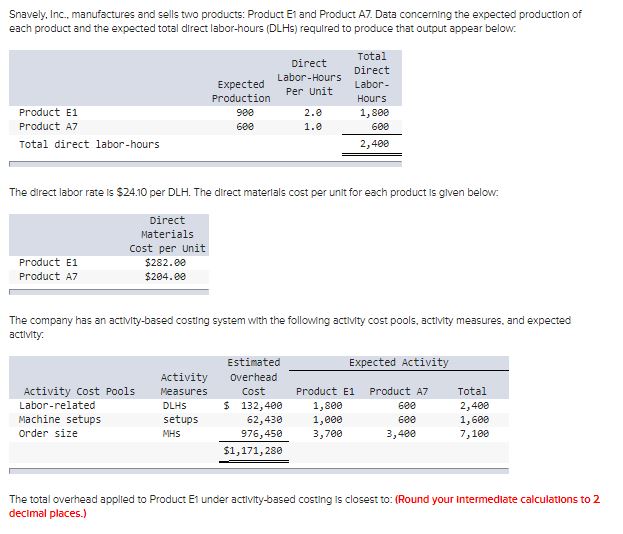

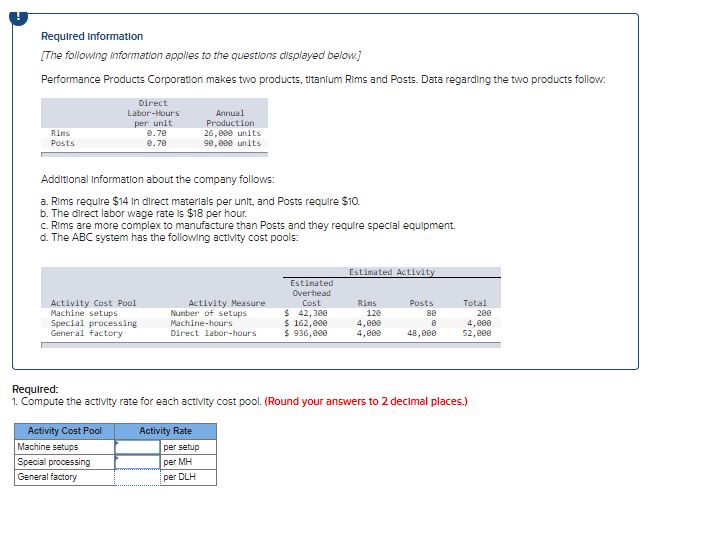

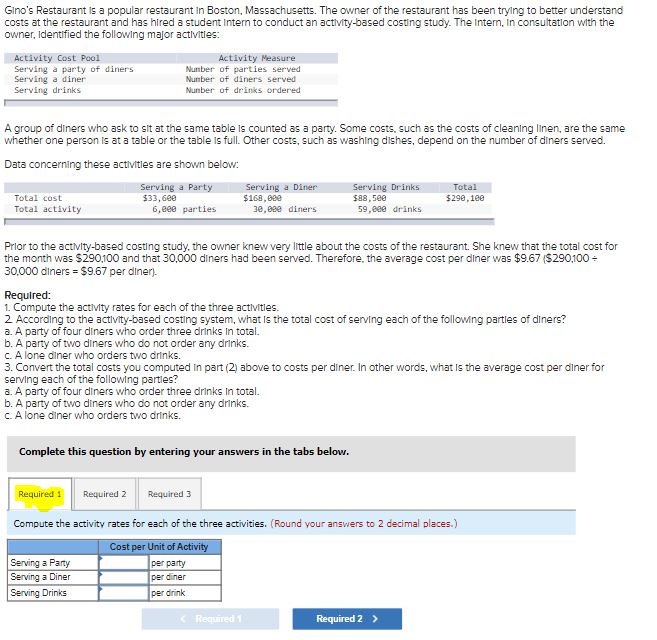

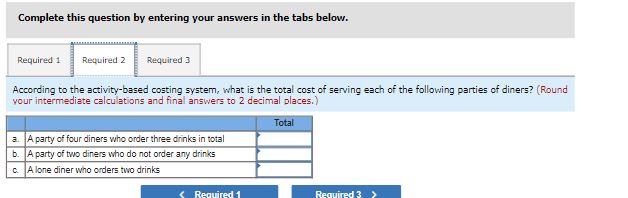

1.Privott, Inc., manufactures and sells two products: Product Z9 and Product N0. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

Estimated Expected Activity

Activity Cost Pools Activity Measures Overhead Cost Product Z9 Product N0 Total

Labor-related DLHs $343,018 8,300 4,900 13,200

Product testing tests 55,247 1,350 1,450 2,800

Order size MHs 480,608 5,900 6,200 12,100

$878,873

The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to:

A. $38.10 per DLH

B. $313.88 per DLH

C. $40.92 per DLH

D. 25.99 per DLH

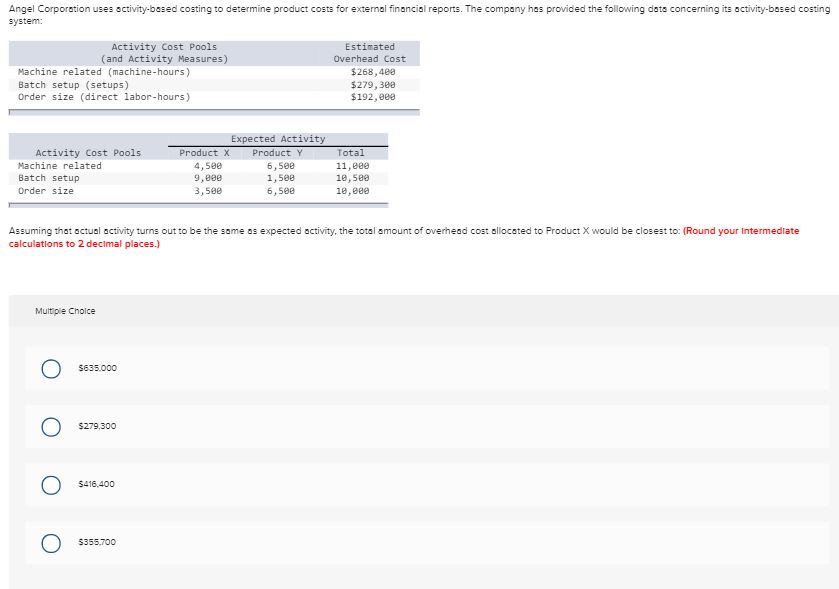

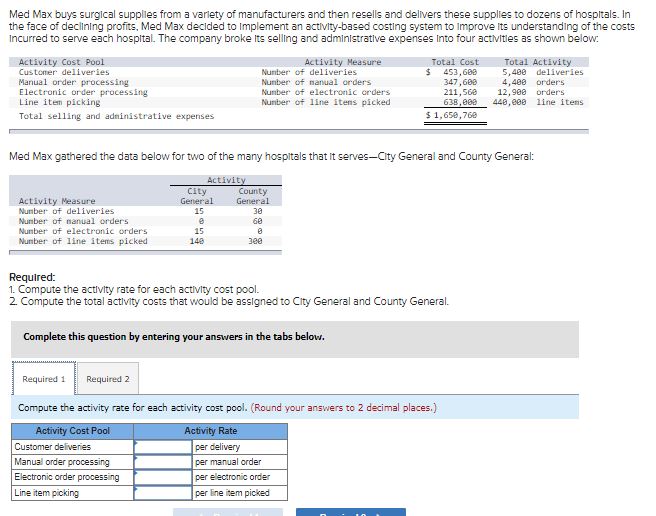

2.Ravelo Corporation has provided the following data from its activity-based costing system:

Activity Cost Pools

Ravelo Corporation has provided the following data from its activity-based costing system:

Estimated

Overhead

Activity Cost Pools Cost Expected Activity

Assembly $518,520 54,000machine-hours

Processing orders $64,263 2,100 orders

Inspection $87,589 2,110 Inspection-hours

Data concerning the company's product L19B appear below:

Annual unit production and sales 630

Annual machine-hours 1,190

Annual number of orders 270

Annual inspection hours 220

Direct materials cost $57.74per unit

Direct labor cost $30.45per unit

According to the activity-based costing system, the unit product cost of product L19B is closest to:(Round your intermediate calculations to 2 decimal places.)

Multiple Choice

- a.$88.19 per unit

- b.$130.68 per unit

- c.$133.93 per unit

- d.$70.65 per unit

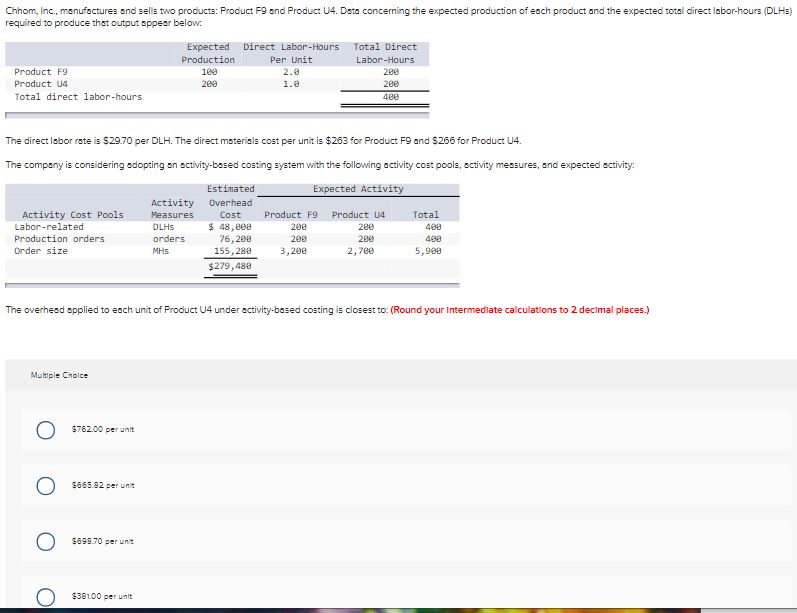

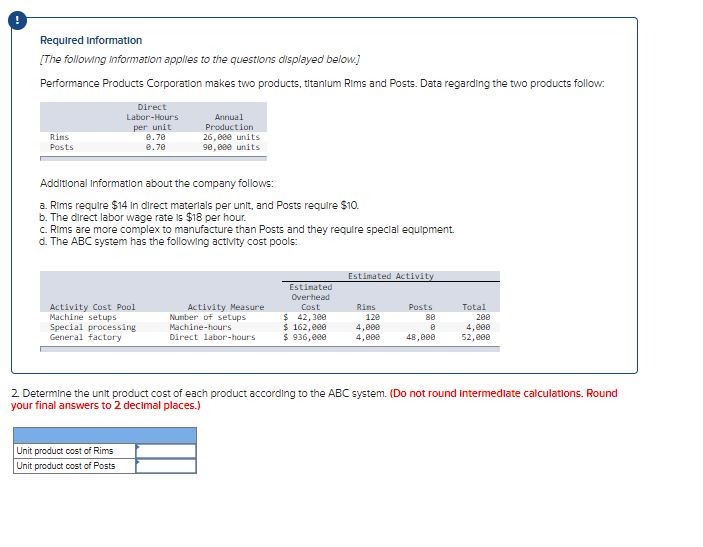

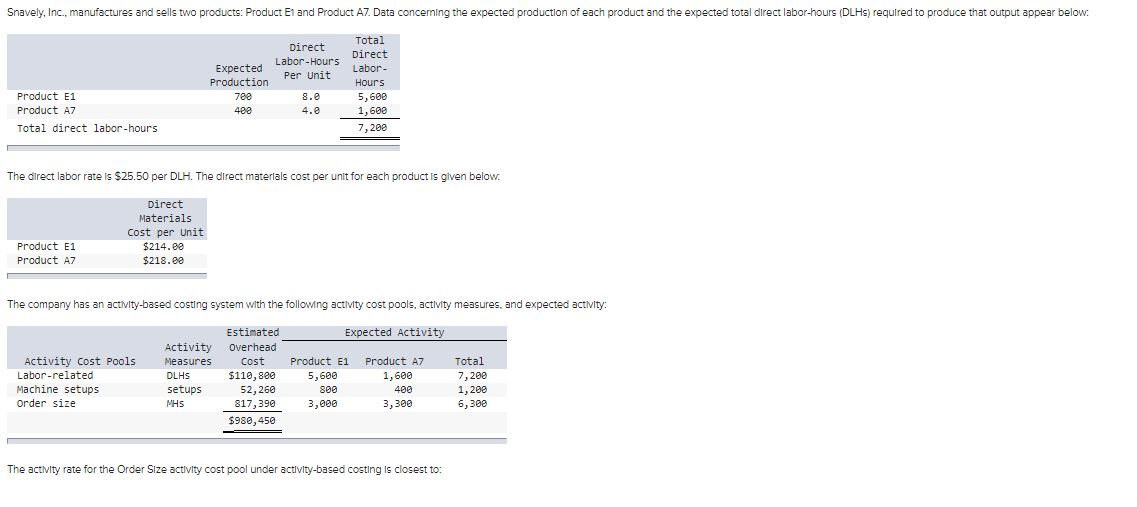

3.Mahaley, Inc., manufactures and sells two products: Product Q9 and Product F0. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:

Expected Production Direct Labor-Hours Per Unit Total Direct Labor-Hours

Product Q9 870 8.7 7,569

Product F0 870 6.7 5,829

Total direct labor-hours 13,398

The direct labor rate is $22.50 per DLH. The direct materials cost per unit for each product is given below:

Direct Materials Cost per Unit

Product Q9 $175.60

Product F0 $147.40

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

Estimated Expected Activity

Activity Cost Pools Activity Measures Overhead Cost Product Q9 Product F0 Total

Labor-related DLHs $386,680 7,569 5,829 13,398

Machine setups setups 47,330 650 550 1,200

Order size MHs 288,200 3,800 3,600 7,400

$722,210

The unit product cost of Product F0 under activity-based costing is closest to:(Round your intermediate calculations to 2 decimal places.)

- a. $750.82 per unit

- b. $677.62 per unit

- c. $371.35 per unit

- d. $526.87 per unit

4.Belsky Corporation has provided the following data from its activity-based costing system:

Activity Cost Pools Estimated Overhead Cost Expected Activity

Assembly $999,600 68,000 machine-hours

Processing orders $101,300 2,000 orders

Inspection $138,700 1,900 inspection-hours

The company makes 450 units of product Q19S a year, requiring a total of 710 machine-hours, 42 orders, and 12 inspection-hours per year. The product's direct materials cost is $36.31 per unit and its direct labor cost is $30.05 per unit.

According to the activity-based costing system, the unit product cost of product Q19S is closest to:(Round your intermediate calculations to 2 decimal places.)

Multiple Choice

- a.$96.23 per unit

- b.$66.36 per unit

- c.$94.61 per unit

- d.$87.70 per unit

5.Bera Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:

Activity Cost Pools Activity Rate

Assembling products $3.16per assembly hour

Processing customer orders $48.53per customer order

Setting up batches $76.53per batch

Data for one of the company's products follow:

Product Q79P

Number of assembly hours' 255

Number of customer orders 45

Number of batches 71

How much overhead cost would be assigned to Product Q79P using the activity-based costing system?(Round your intermediate calculations to 2 decimal places.)

Multiple Choice

- a.$8,423.28

- b.$47,569.62

- c.$5,433.63

- d.$128.22

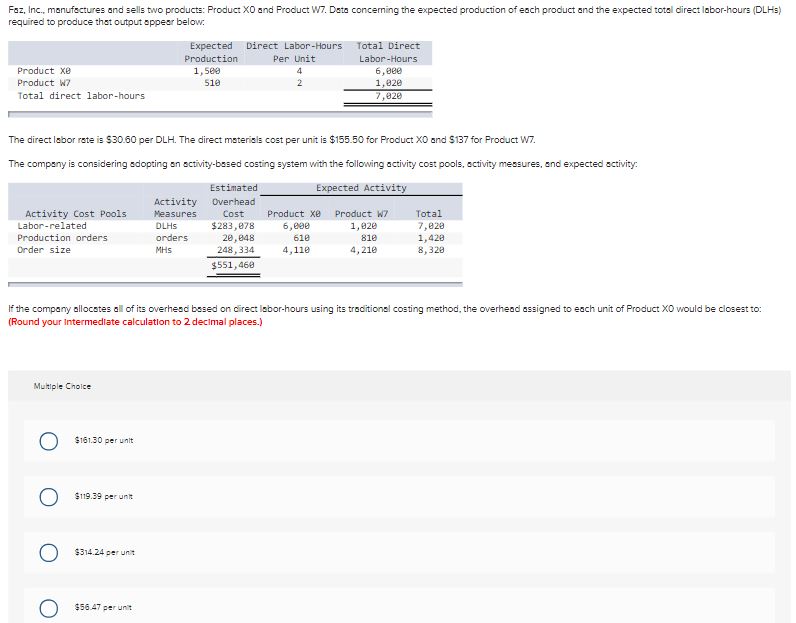

6.Spates, Inc., manufactures and sells two products: Product H2 and Product E0. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:

Expected Production Direct Labor-Hours Per Unit Total Direct Labor-Hours

Product H2 300 8.0 2,400

Product E0 300 7.0 2,100

Total direct labor-hours 4,500

The company's expected total manufacturing overhead is $276,468.

If the company allocates all of its overhead based on direct labor-hours, the overhead assigned to each unit of Product H2 would be closest to:(Round your intermediate calculations to 2 decimal places.)

Multiple Choice

- a.$68.67 per unit

- b.$54.21 per unit

- c.$122.88 per unit

- d.$491.52 per unit

7.Weirick, Inc., manufactures and sells two products: Product T8 and Product P4. The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

Estimated Expected Activity

Activity Cost Pools Activity Measures Overhead Cost Product T8 Product P4 Total

Labor-related DLHs $139,700 11,000 5,500 16,500

Production orders orders 65,880 1,200 400 1,600

Order size MHs 1,030,410 3,900 3,700 7,600

$1,235,990

The total overhead applied to Product P4 under activity-based costing is closest to:(Round your intermediate calculations to 2 decimal places.)

- a.$964,530

- b.$501,646

- c.$564,703

- d.$1,096,290

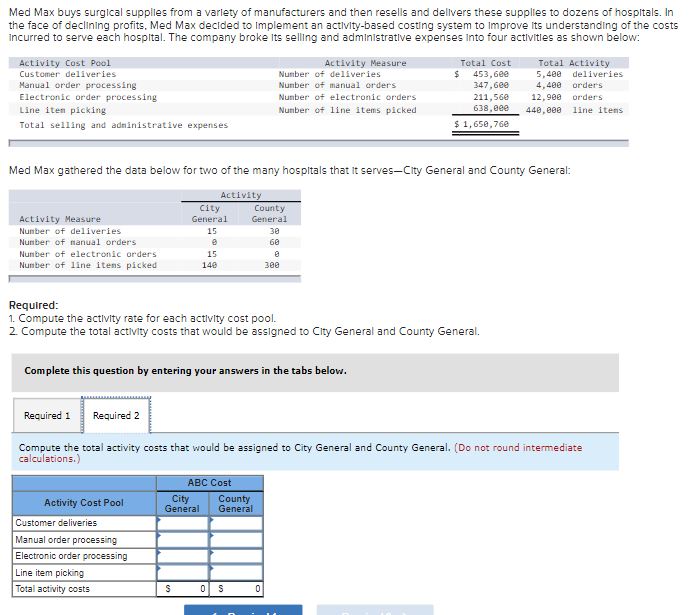

8.

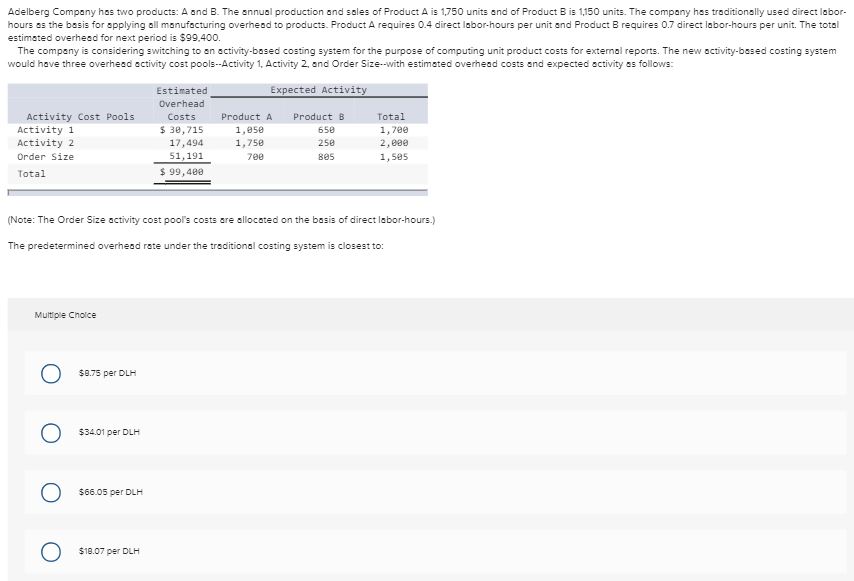

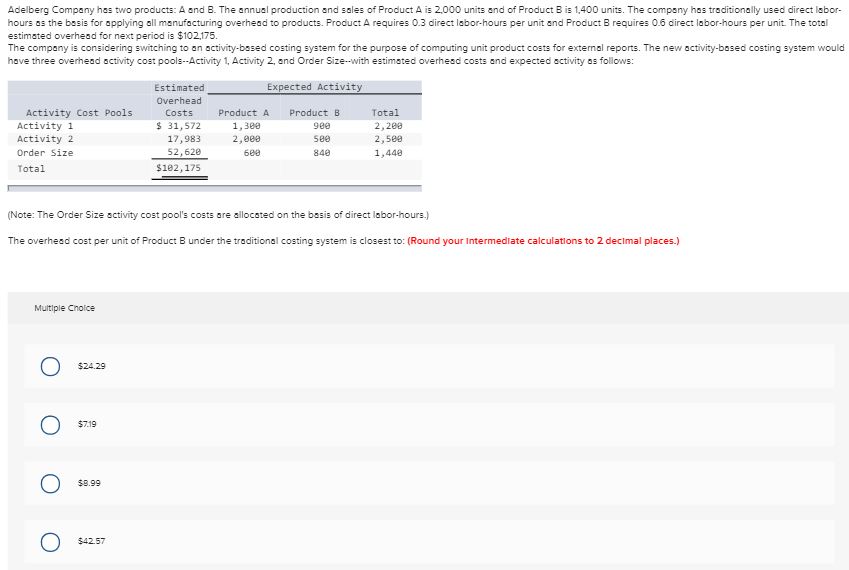

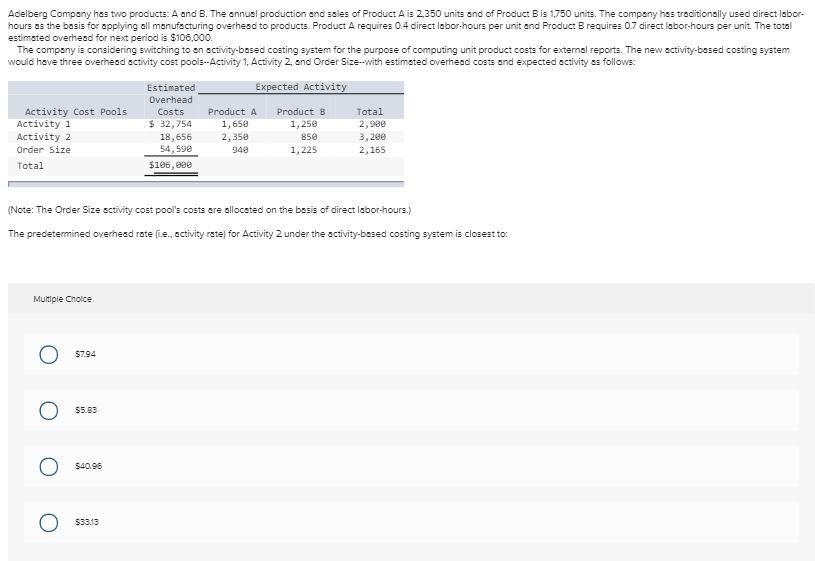

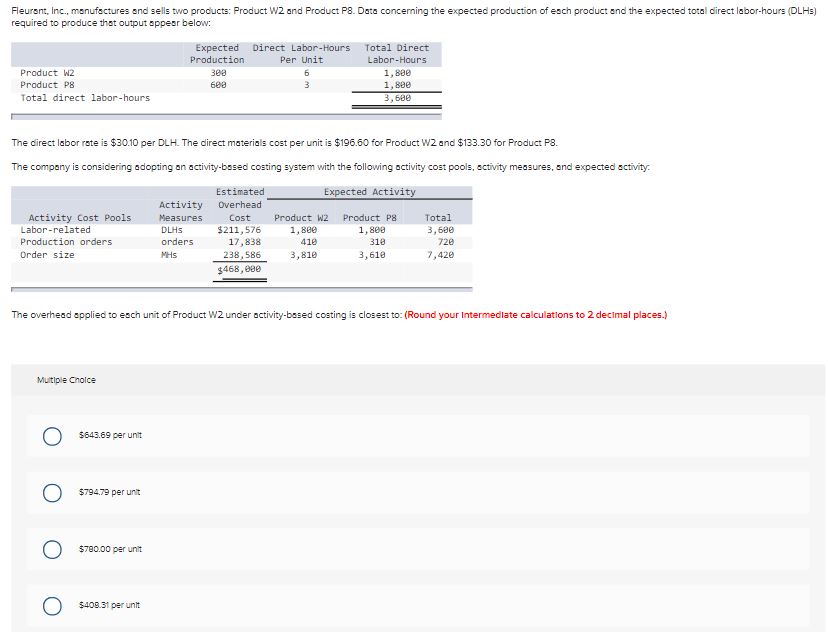

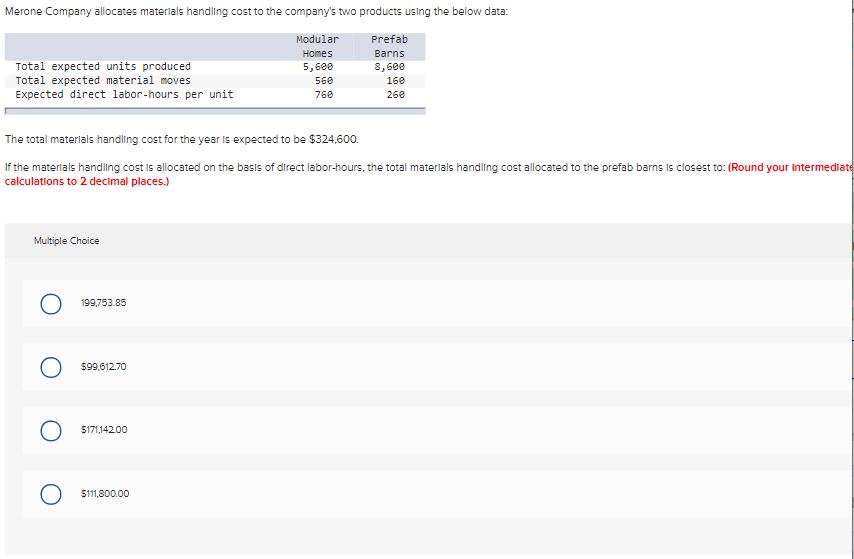

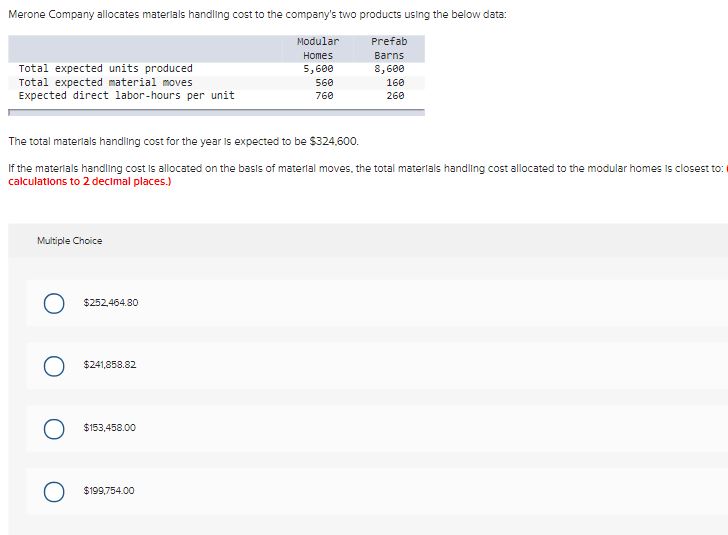

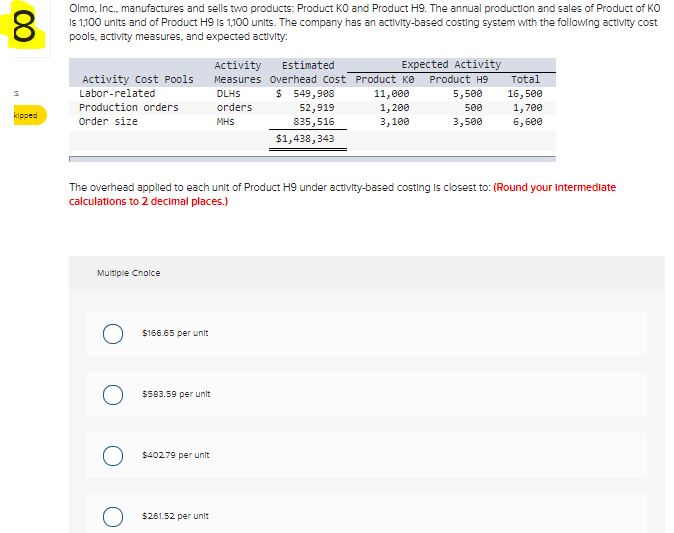

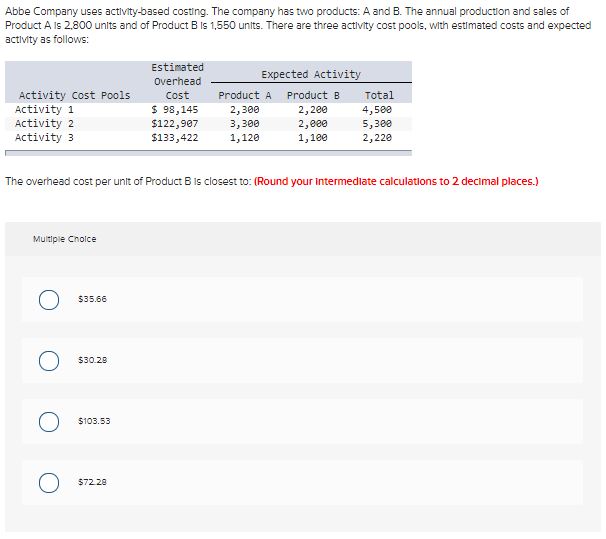

Adelberg Company has two products: A and B. The annual production and sales of Product A is 2,350 units and of Product B is 1,750 units. The company has traditionally used direct labor- hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.7 direct labor-hours per unit. The total estimated overhead for next period is $106,000. The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and Order Size-with estimated overhead costs and expected activity as follows: Estimated Expected Activity Overhead Activity Cost Pools Costs Product A Product B Total Activity 1 $ 32, 754 1, 650 1, 250 2,908 Activity 2 18, 656 2,358 3,208 Order Size 54, 590 948 1, 225 2,165 Total $106,096 (Note: The Order Size activity cost pool's costs are allocated on the basis of direct labor-hours.) The predetermined overhead rate (ie., activity rate) for Activity 2 under the activity-based costing system is closest to: Multiple Choice O $7.94 O $5.83 O $40.96 O $33.13Fleurant, Inc., manufactures and sells two products: Product W2 and Product PB. Date concerning the expected production of each product and the expected total direct labor-hours (DLHE) required to produce that output appear below: Expected Direct Labor-Hours Total Direct Production Per Unit Labor-Hours Product W2 383 1, 890 Product PB 1, 898 Total direct labor-hours 3,680 The direct labor rate is $30.10 per DLH. The direct materials cost per unit is $196.60 for Product W/2 and $133.30 for Product PB. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity. Estimated Expected Activity Activity Overhead Activity Cost Pools Measures Cost Product W2 Product P8 Total Labor-related DLHS $211, 576 1, 809 3,690 Production orders orders 17, 838 418 318 728 Order size MHS 238, 586 3, 810 3, 610 7,420 $468, 090 The overhead applied to each unit of Product W2 under activity-based costing is closest to: (Round your Intermediate calculations to 2 decimal places.) Multiple Choice O $643.69 per unit O $794.79 per unit O $780.00 per unit O $408.31 per unitMerone Company allocates materials handling cost to the company's two products using the below data: Modular Prefab Homes Barns Total expected units produced 5, 600 8,608 Total expected material moves 560 160 Expected direct labor-hours per unit 760 260 The total materials handling cost for the year is expected to be $324,600. If the materials handling cost is allocated on the basis of direct labor-hours, the total materials handling cost allocated to the prefab barns is closest to: (Round your Intermediate calculations to 2 decimal places.) Multiple Choice O 199.753.85 O $99.612.70 O $17114200 O $111,800.00Merone Company allocates materials handling cost to the company's two products using the below data: Modular Prefab Homes Barns Total expected units produced 5,600 8, 600 Total expected material moves 560 160 Expected direct labor-hours per unit 760 260 The total materials handling cost for the year is expected to be $324.600. If the materials handling cost is allocated on the basis of material moves, the total materials handling cost allocated to the modular homes is closest to: calculations to 2 decimal places.) Multiple Choice O $252,464.80 O $241,858.82 O $153,458.00 O $199,754.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts