Question: Please, help with the following problem. Please, provide as much detail in the solution as possible. Thank you! During 2026, its first year of operations,

Please, help with the following problem. Please, provide as much detail in the solution as possible. Thank you!

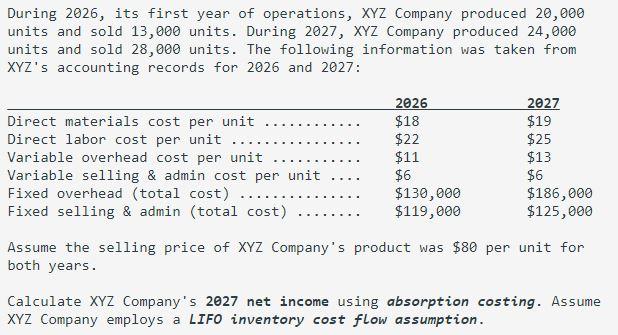

During 2026, its first year of operations, XYZ Company produced 20,000 units and sold 13,000 units. During 2027, XYZ Company produced 24,000 units and sold 28,000 units. The following information was taken from XYZ's accounting records for 2026 and 2027: Direct materials cost per unit Direct labor cost per unit Variable overhead cost per unit Variable selling & admin cost per unit Fixed overhead (total cost) Fixed selling & admin (total cost) 2026 $18 $22 $11 $6 $130,000 $119,000 2027 $19 $25 $13 $6 $186,000 $125,000 .... Assume the selling price of XYZ Company's product was $80 per unit for both years. Calculate XYZ Company's 2027 net income using absorption costing. Assume XYZ Company employs a LIFO inventory cost flow assumption

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts