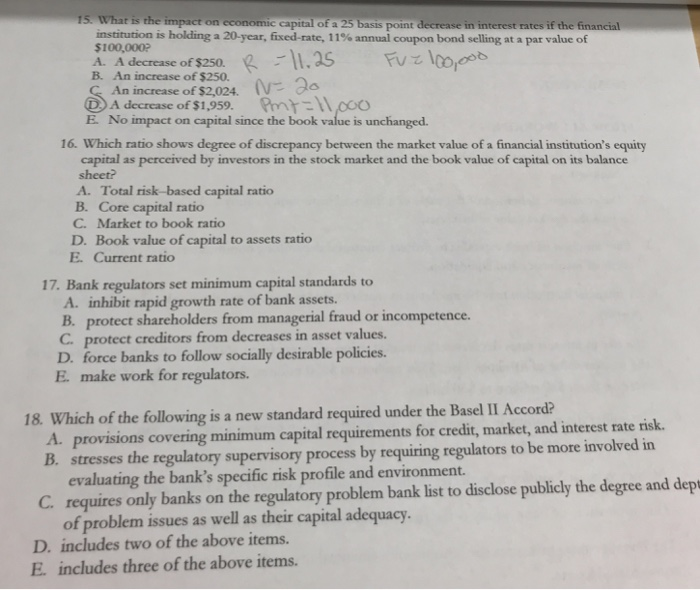

Question: please help with the following problems, thank you! What is the institution is holding a 20-year, fixed-rate, 1 1% annual coupon bond selling at a

What is the institution is holding a 20-year, fixed-rate, 1 1% annual coupon bond selling at a par value of $100,000? A. A decrease of $250. B. An increase of $250. An increase of $2,024. DA decrease of $1,959. Pmt E. No impact on capital since the book value is unchanged. 16. Which ratio shows degree of discrepancy between the market value of a financial institution's equity capital as perceived by investors in the stock market and the book value of capital on its balance sheet? A. Total risk-based capital ratio B. Core capital ratio C. Market to book ratio D. Book value of capital to assets ratio E. Current ratio 17. Bank regulators set minimum capital standards to A. inhibit rapid growth rate of bank assets. B. protect shareholders from managerial fraud or incompetence. C. protect creditors from decreases in asset values. D. force banks to follow socially desirable policies. E. make work for regulators. 18. Which of the following is a new standard required under the Basel II Accord? provisions covering minimum capital requirements for credit, market, and interest rate risk. stresses the regulatory supervisory process by requiring regulators to be more involved in evaluating the bank's specific risk profile and environment. B. C. requires only banks on the regulatory problem bank list to disclose publicly the degree and dep D. includes two of the above items. of problem issues as well as their capital adequacy E. includes three of the above items

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts