Question: Please help with the following question. The final graph is supposed to downward sloping. You are CEO of Rivet Networks, maker of ultra-high performance network

Please help with the following question. The final graph is supposed to downward sloping.

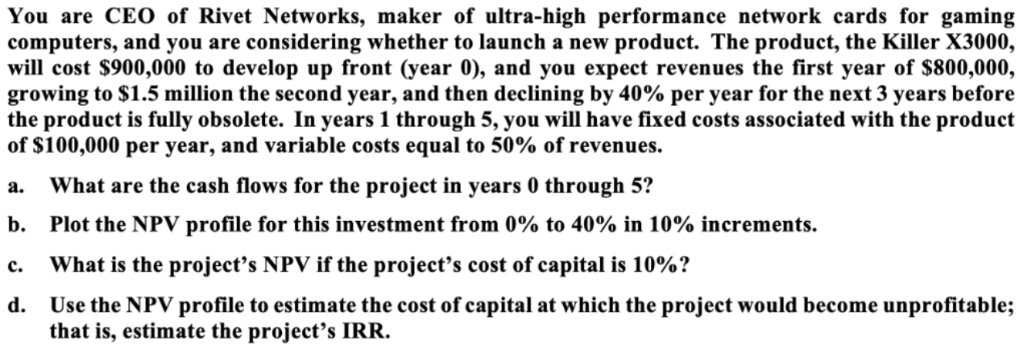

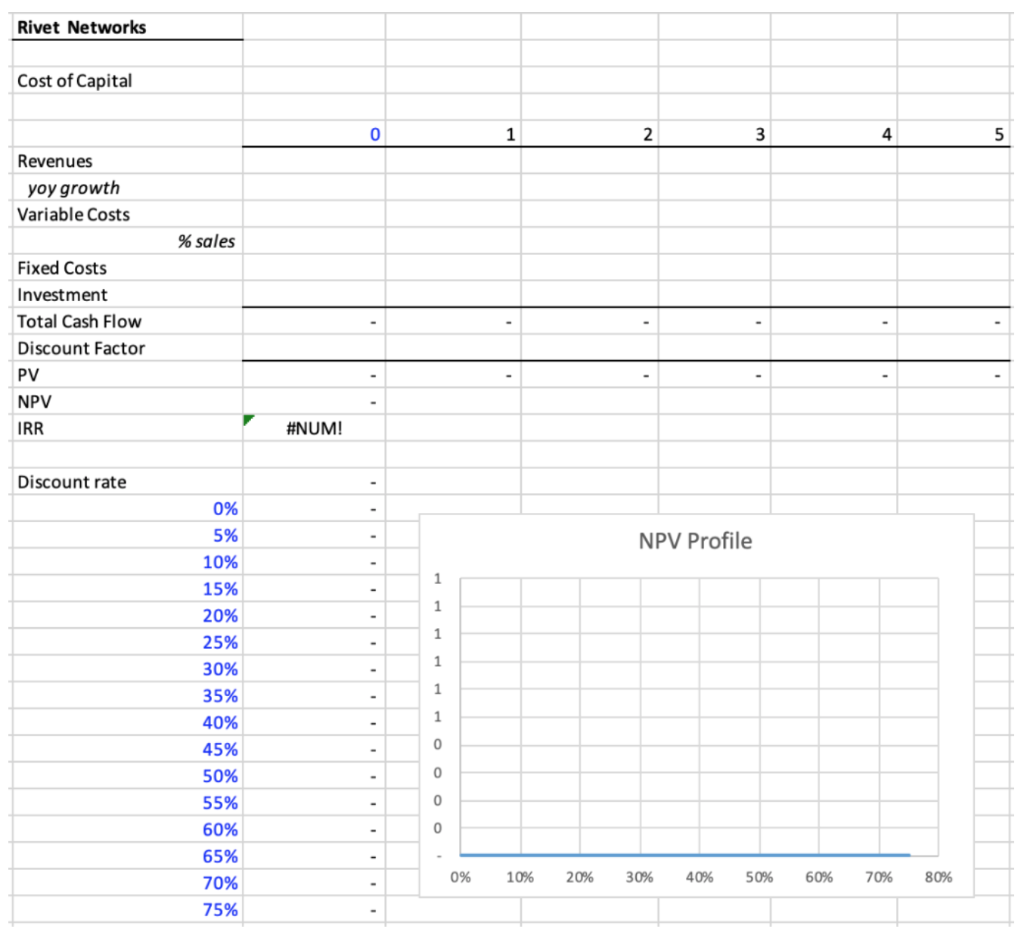

You are CEO of Rivet Networks, maker of ultra-high performance network cards for gaming computers, and you are considering whether to launch a new product. The product, the Killer X3000, will cost $900,000 to develop up front (year 0), and you expect revenues the first year of $800,000, growing to $1.5 million the second year, and then declining by 40% per year for the next 3 years before the product is fully obsolete. In years 1 through 5, you will have fixed costs associated with the product of $100,000 per year, and variable costs equal to 50% of revenues. What are the cash flows for the project in years 0 through 5? Plot the NPV profile for this investment from 0% to 40% in 10% increments. what is the project's NPV if the project's cost of capital is 10%? Use the NPV profile to estimate the cost of capital at which the project would become unprofitable; a. b. C. d. that is, estimate the project's IRR. Rivet Networks Cost of Capital 0 1 Revenues oy growth Variable Costs % sales Fixed Costs Investment Total Cash Flow Discount Factor PV NPV IRR #NUM! Discount rate 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 55% 60% 65% 70% 75% NPV Profile 0 0 0% 1096 2096 3096 4096 5096 60% 706 8096

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts