Question: please help with the numbers i cannot seem to get it right On January 1 of this year, Clearwater Corporation sold bonds with a face

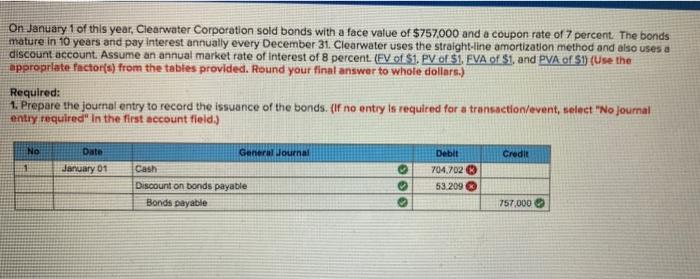

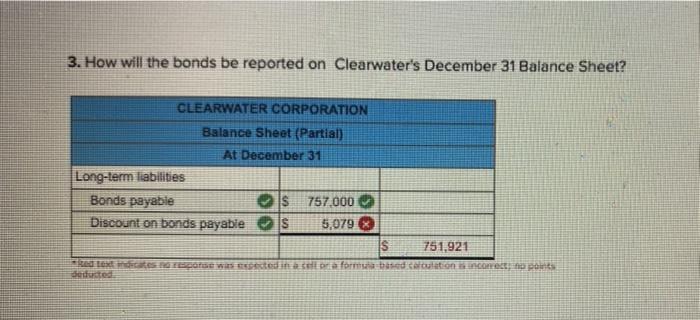

On January 1 of this year, Clearwater Corporation sold bonds with a face value of $757000 and a coupon rate of 7 percent. The bonds mature in 10 years and pay interest annually every December 31. Clearwater uses the straight-line amortization method and also uses a discount account. Assume an annual market rate of interest of 8 percent. (FV of $1. PV of $1. FVA of $1. and PVA of S1) (Use the appropriate factor(s) from the tables provided. Round your final answer to whole dollars.) Required: 1. Prepare the journal entry to record the issuance of the bonds. (If no entry is required for a transaction/event, select "No Journal entry required" in the first account field.) No Credit Date January 01 1 General Journal Cash Discount on bonds payable Bonds payable Debit 704,702 53.209 OO 757,000 3. How will the bonds be reported on Clearwater's December 31 Balance Sheet? CLEARWATER CORPORATION Balance Sheet (Partial) At December 31 Long-term liabilities Bonds payable S 757 000 Discount on bonds payable S 5,079 IS 751,921 sked to recorDE WASHED formation connect to put tuted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts