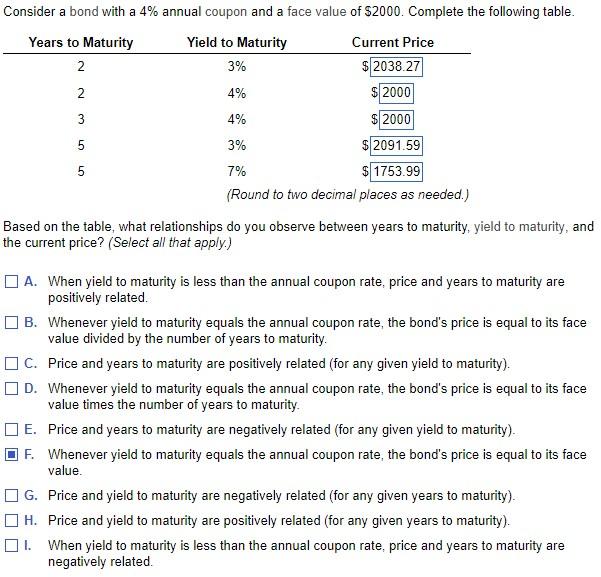

Question: Please help with the observations. N 3 Consider a bond with a 4% annual coupon and a face value of $2000. Complete the following table.

Please help with the observations.

N 3 Consider a bond with a 4% annual coupon and a face value of $2000. Complete the following table. Years to Maturity Yield to Maturity Current Price 2 3% $ 2038.27 4% $ 2000 3 4% 5 3% $2091.59 5 7% $ 1753.99 (Round to two decimal places as needed.) Based on the table, what relationships do you observe between years to maturity, yield to maturity, and the current price? (Select all that apply.) $ 2000 5 A. When yield to maturity is less than the annual coupon rate, price and years to maturity are positively related B. Whenever yield to maturity equals the annual coupon rate, the bond's price is equal to its face value divided by the number of years to maturity. OC. Price and years to maturity are positively related (for any given yield to maturity) D. Whenever yield to maturity equals the annual coupon rate, the bond's price is equal to its face value times the number of years to maturity. E. Price and years to maturity are negatively related (for any given yield to maturity). F. Whenever yield to maturity equals the annual coupon rate, the bond's price is equal to its face value. G. Price and yield to maturity are negatively related for any given years to maturity) H. Price and yield to maturity are positively related (for any given years to maturity). II. When yield to maturity is less than the annual coupon rate, price and years to maturity are negatively related

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts