Question: Please help with the part I got wrong (highlighted) Liquidation Basis of Accounting Farmworth Company entered liquidation on March 1 . The book value of

Please help with the part I got wrong (highlighted)

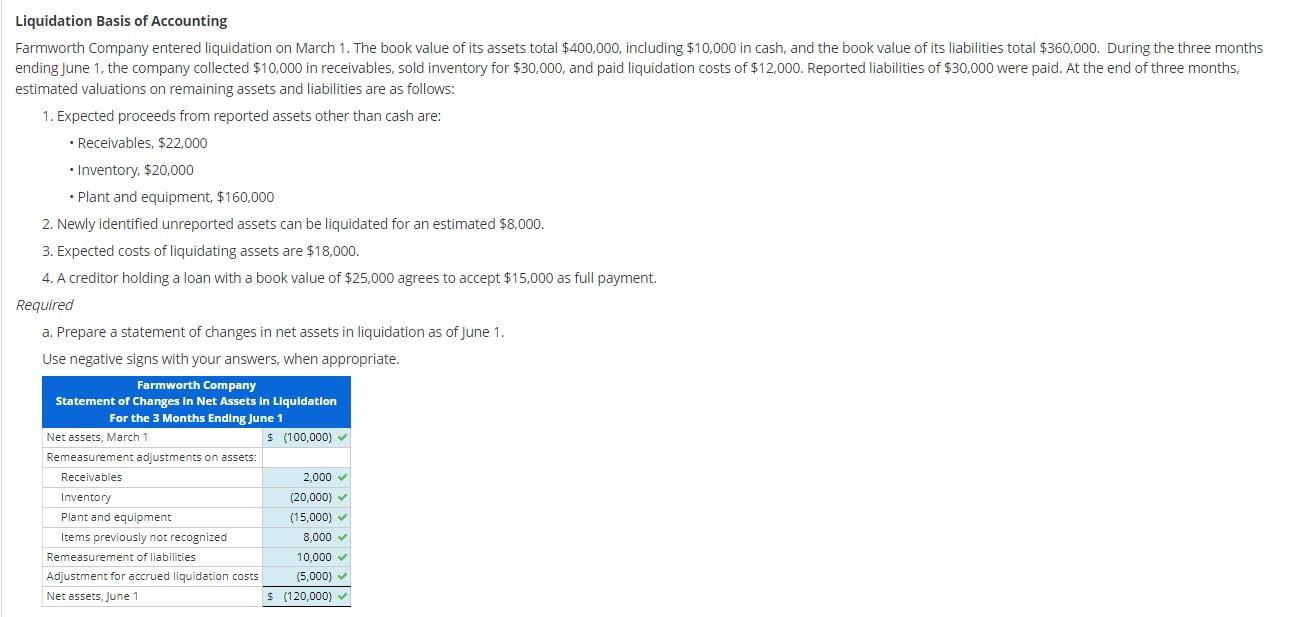

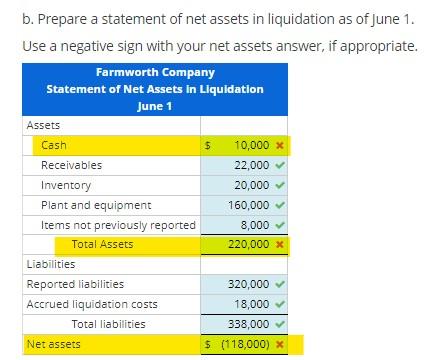

Liquidation Basis of Accounting Farmworth Company entered liquidation on March 1 . The book value of its assets total $400,000, including $10,000 in cash, and the book value of its liabilities total $360,000. During the three months ending June 1, the company collected $10,000 in receivables, sold inventory for $30,000, and paid liquidation costs of $12,000. Reported liabilities of $30,000 were paid. At the end of three months, estimated valuations on remaining assets and liabilities are as follows: 1. Expected proceeds from reported assets other than cash are: - Receivables, $22,000 - Inventory, $20,000 - Plant and equipment, $160,000 2. Newly identified unreported assets can be liquidated for an estimated $8,000. 3. Expected costs of liquidating assets are $18,000. 4. A creditor holding a loan with a book value of $25,000 agrees to accept $15,000 as full payment. Required a. Prepare a statement of changes in net assets in liquidation as of June 1. Use negative signs with your answers, when appropriate. b. Prepare a statement of net assets in liquidation as of June 1 . Use a negative sign with your net assets answer, if appropriate. Liquidation Basis of Accounting Farmworth Company entered liquidation on March 1 . The book value of its assets total $400,000, including $10,000 in cash, and the book value of its liabilities total $360,000. During the three months ending June 1, the company collected $10,000 in receivables, sold inventory for $30,000, and paid liquidation costs of $12,000. Reported liabilities of $30,000 were paid. At the end of three months, estimated valuations on remaining assets and liabilities are as follows: 1. Expected proceeds from reported assets other than cash are: - Receivables, $22,000 - Inventory, $20,000 - Plant and equipment, $160,000 2. Newly identified unreported assets can be liquidated for an estimated $8,000. 3. Expected costs of liquidating assets are $18,000. 4. A creditor holding a loan with a book value of $25,000 agrees to accept $15,000 as full payment. Required a. Prepare a statement of changes in net assets in liquidation as of June 1. Use negative signs with your answers, when appropriate. b. Prepare a statement of net assets in liquidation as of June 1 . Use a negative sign with your net assets answer, if appropriate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts