Question: Please help with the payroll register, general journal, and general ledger accounts. Please help with the payroll register, general journal, and general leger accounts. Willis

Please help with the payroll register, general journal, and general ledger accounts.

Please help with the payroll register, general journal, and general leger accounts.

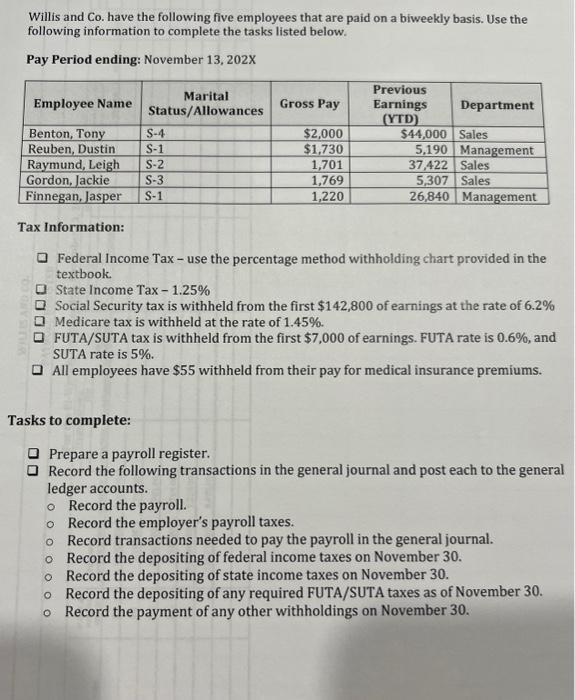

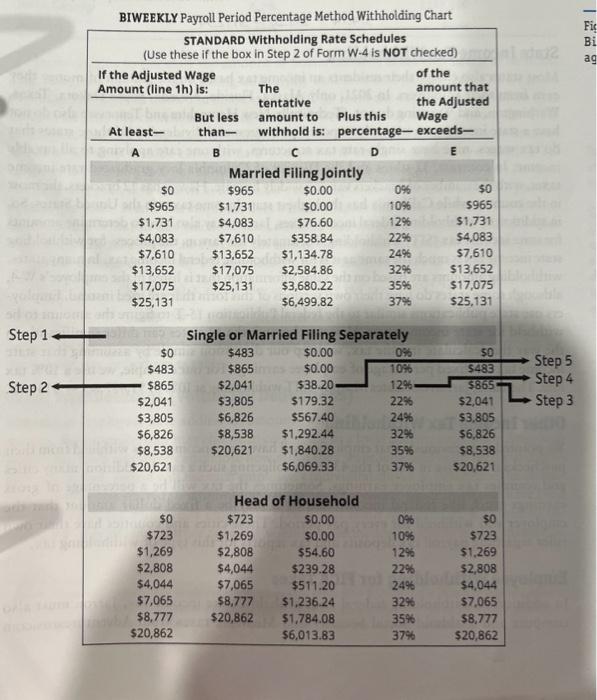

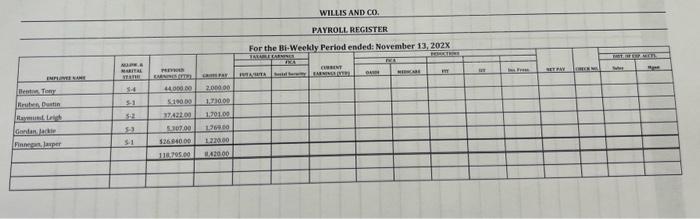

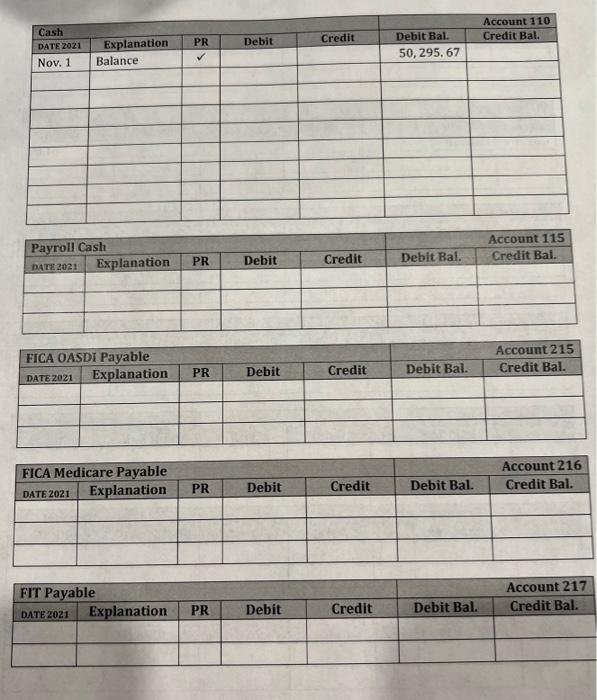

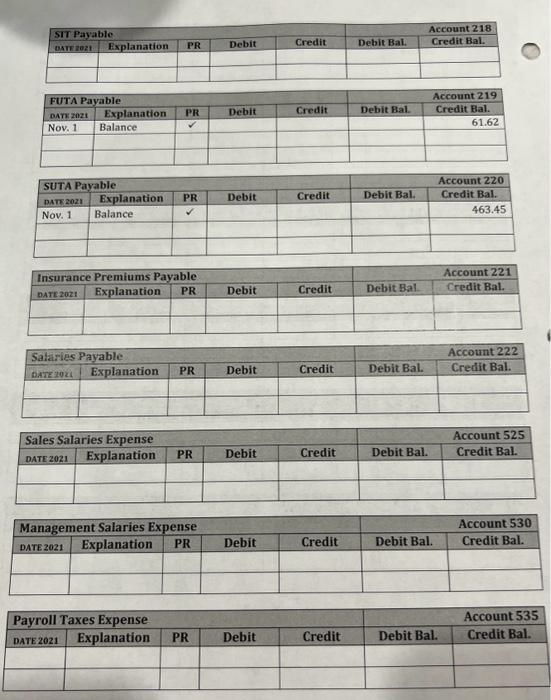

Willis and Co. have the following five employees that are paid on a biweekly basis. Use the following information to complete the tasks listed below. Pay Period ending: November 13, 202X Tax Information: Federal Income Tax - use the percentage method withholding chart provided in the textbook. State Income Tax - 1.25\% Social Security tax is withheld from the first $142,800 of earnings at the rate of 6.2% Medicare tax is withheld at the rate of 1.45%. FUTA/SUTA tax is withheld from the first $7,000 of earnings. FUTA rate is 0.6%, and SUTA rate is 5%. All employees have $55 withheld from their pay for medical insurance premiums. Tasks to complete: Prepare a payroll register. Record the following transactions in the general journal and post each to the general ledger accounts. Record the payroll. Record the employer's payroll taxes. Record transactions needed to pay the payroll in the general journal. Record the depositing of federal income taxes on November 30. Record the depositing of state income taxes on November 30 . Record the depositing of any required FUTA/SUTA taxes as of November 30 . Record the payment of any other withholdings on November 30 . BIWEEKLY Payroll Period Percentage Method Withholding Chart WILIS AND CO. PAYROLL RECISTER \begin{tabular}{|l|l|l|l|l|l|l|} \hline \multicolumn{2}{|l|}{ Payroll Cash } & Credit & Debit Bal. & Credit Bal. \\ \hline natez2021 & Explanation & PR & Debit & Crecount 115 \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|} \hline \multicolumn{2}{|l|}{ FICA OASDI Payable } & & \multicolumn{2}{|c|}{ Account 215 } \\ \hline DATEzoz1 & Explanation & PR & Debit & Credit & Debit Bal. & Credit Bal. \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|} \hline \multicolumn{2}{|l|}{ FICA Medicare Payable } & Account 216 \\ \hline DATE 2021 & Explanation & PR & Debit & Credit & Debit Bal. & Credit Bal. \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|c|c|c|c|c|} \hline \multicolumn{2}{|l|}{ FIT Payable } & & Account 217 \\ \hline DATE 2021 & Explanation & PR & Debit & Credit & Debit Bal. & Credit Bal. \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|} \hline \multicolumn{2}{|l|}{ STT Payable } & Credit & Debit Bal. & Credit Bal. \\ \hline 0atrzezt & Explanation & PR & Debit & Credit \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|} \hline \multicolumn{2}{|l|}{ FUTA Payable } & & Account 219 \\ \hline oarizanz & Explanation & PR & Debit & Credit & Debit Bal. Credit Bal. \\ \hline Nov. 1 & Balance & & & & & 61.62 \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|c|c|c|c|} \hline \multicolumn{2}{|l|}{ Salaries Payable } & \multicolumn{2}{|c|}{ Account 222} \\ \hline Dare 202t & Explanation & PR & Debit & Credit & Deblt Bal. & Credit Bal. \\ \hline & & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|c|c|} \hline \multicolumn{3}{|l|}{ Sales Salaries Expense } & & \multicolumn{2}{|c|}{ Account 525} \\ \hline DAte 2021 & Explanation & PR & Debit & Credit & Debit Bal. & Credit Bal. \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|c|c|} \hline \multicolumn{2}{|l|}{ Management Salaries Expense } & \multicolumn{2}{|c|}{ Account 530} \\ \hline DAtE2021 & Explanation & PR & Debit & Credit & Debit Bal. & Credit Bal. \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|} \hline \multicolumn{2}{|l|}{ Payroll Taxes Expense } & & Account 535 \\ \hline DATE 2021 & Explanation & PR & Debit & Credit & Debit Bal. & Credit Bal. \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} Willis and Co. have the following five employees that are paid on a biweekly basis. Use the following information to complete the tasks listed below. Pay Period ending: November 13, 202X Tax Information: Federal Income Tax - use the percentage method withholding chart provided in the textbook. State Income Tax - 1.25\% Social Security tax is withheld from the first $142,800 of earnings at the rate of 6.2% Medicare tax is withheld at the rate of 1.45%. FUTA/SUTA tax is withheld from the first $7,000 of earnings. FUTA rate is 0.6%, and SUTA rate is 5%. All employees have $55 withheld from their pay for medical insurance premiums. Tasks to complete: Prepare a payroll register. Record the following transactions in the general journal and post each to the general ledger accounts. Record the payroll. Record the employer's payroll taxes. Record transactions needed to pay the payroll in the general journal. Record the depositing of federal income taxes on November 30. Record the depositing of state income taxes on November 30 . Record the depositing of any required FUTA/SUTA taxes as of November 30 . Record the payment of any other withholdings on November 30 . BIWEEKLY Payroll Period Percentage Method Withholding Chart WILIS AND CO. PAYROLL RECISTER \begin{tabular}{|l|l|l|l|l|l|l|} \hline \multicolumn{2}{|l|}{ Payroll Cash } & Credit & Debit Bal. & Credit Bal. \\ \hline natez2021 & Explanation & PR & Debit & Crecount 115 \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|} \hline \multicolumn{2}{|l|}{ FICA OASDI Payable } & & \multicolumn{2}{|c|}{ Account 215 } \\ \hline DATEzoz1 & Explanation & PR & Debit & Credit & Debit Bal. & Credit Bal. \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|} \hline \multicolumn{2}{|l|}{ FICA Medicare Payable } & Account 216 \\ \hline DATE 2021 & Explanation & PR & Debit & Credit & Debit Bal. & Credit Bal. \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|c|c|c|c|c|} \hline \multicolumn{2}{|l|}{ FIT Payable } & & Account 217 \\ \hline DATE 2021 & Explanation & PR & Debit & Credit & Debit Bal. & Credit Bal. \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|} \hline \multicolumn{2}{|l|}{ STT Payable } & Credit & Debit Bal. & Credit Bal. \\ \hline 0atrzezt & Explanation & PR & Debit & Credit \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|} \hline \multicolumn{2}{|l|}{ FUTA Payable } & & Account 219 \\ \hline oarizanz & Explanation & PR & Debit & Credit & Debit Bal. Credit Bal. \\ \hline Nov. 1 & Balance & & & & & 61.62 \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|c|c|c|c|} \hline \multicolumn{2}{|l|}{ Salaries Payable } & \multicolumn{2}{|c|}{ Account 222} \\ \hline Dare 202t & Explanation & PR & Debit & Credit & Deblt Bal. & Credit Bal. \\ \hline & & & & & & \\ \hline & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|c|c|} \hline \multicolumn{3}{|l|}{ Sales Salaries Expense } & & \multicolumn{2}{|c|}{ Account 525} \\ \hline DAte 2021 & Explanation & PR & Debit & Credit & Debit Bal. & Credit Bal. \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|c|c|} \hline \multicolumn{2}{|l|}{ Management Salaries Expense } & \multicolumn{2}{|c|}{ Account 530} \\ \hline DAtE2021 & Explanation & PR & Debit & Credit & Debit Bal. & Credit Bal. \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|} \hline \multicolumn{2}{|l|}{ Payroll Taxes Expense } & & Account 535 \\ \hline DATE 2021 & Explanation & PR & Debit & Credit & Debit Bal. & Credit Bal. \\ \hline & & & & & & \\ \hline & & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts