Question: Please help with the solution. Please refer to these two images to compute for the answers. I badly need help with the solutions for each

Please help with the solution. Please refer to these two images to compute for the answers. I badly need help with the solutions for each question. Thank you!

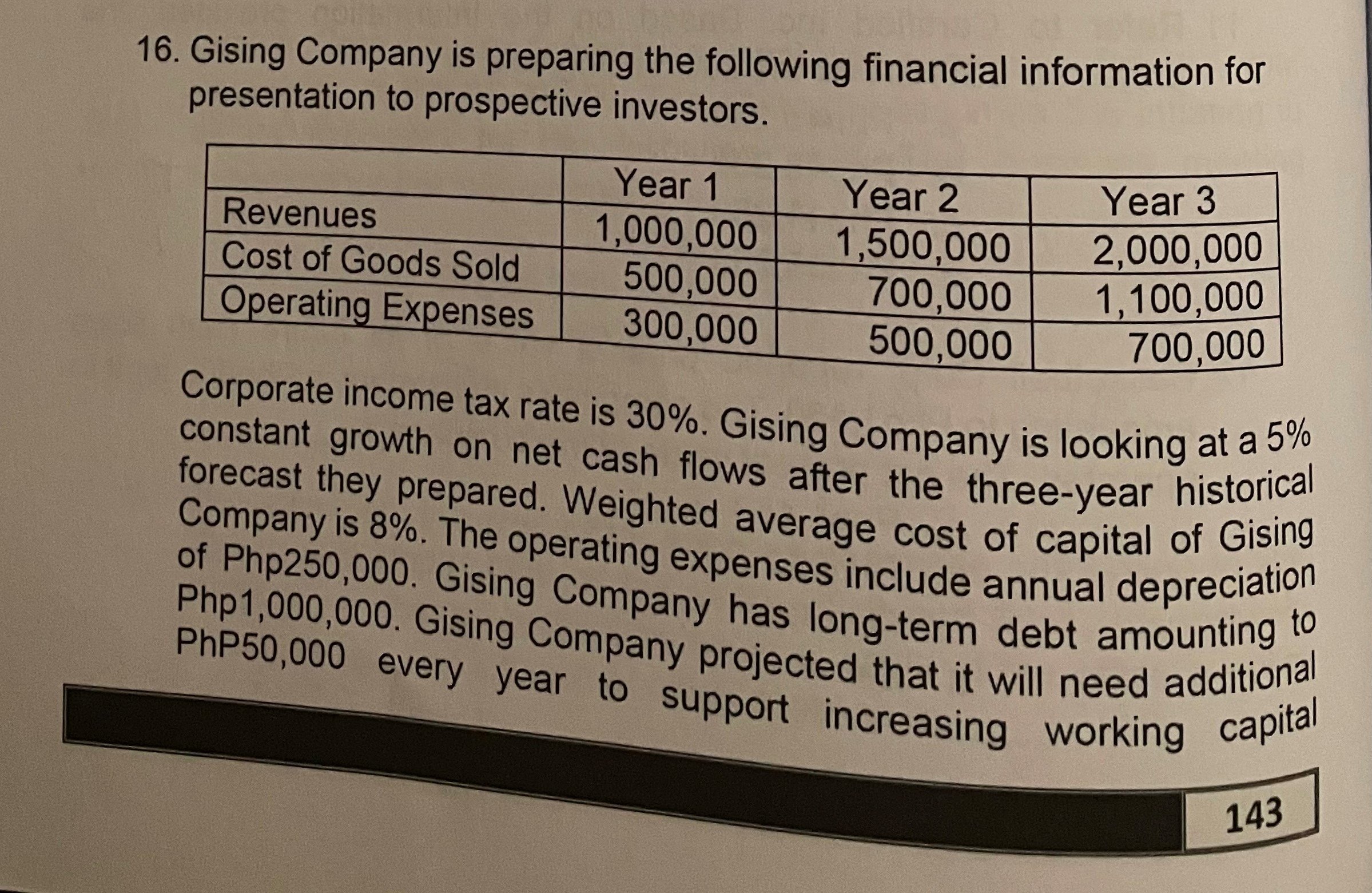

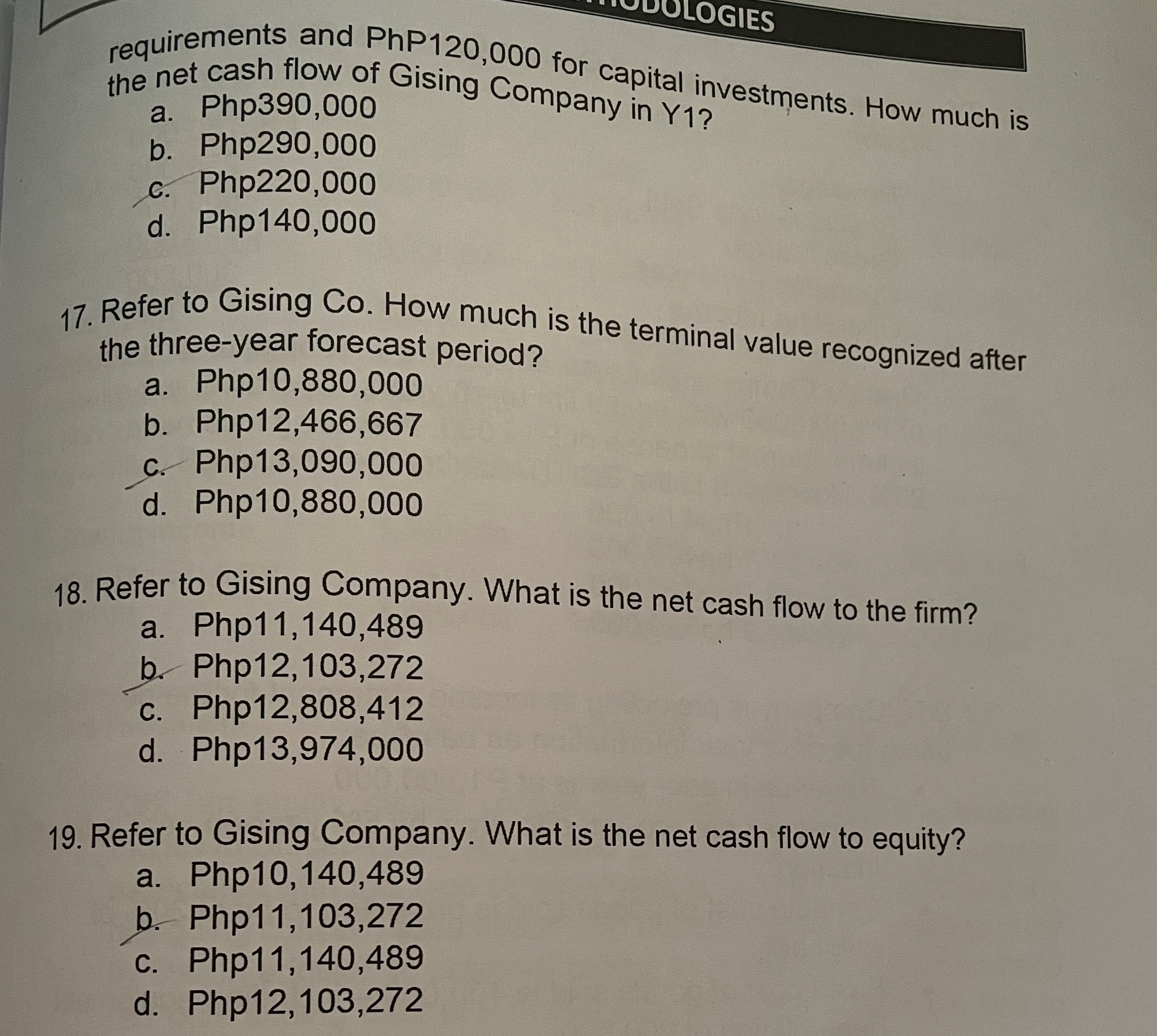

16. Gising Company is preparing the following financial information for presentation to prospective investors. Year 1 Year 2 Year 3 Revenues 1,000,000 1,500,000 2,000,000 Cost of Goods Sold 500,000 700,000 1, 100,000 Operating Expenses 300,000 500,000 700,000 Corporate income tax rate is 30%. Gising Company is looking at a 5% constant growth on net cash flows after the three-year historical forecast they prepared. Weighted average cost of capital of Gising Company is 8%. The operating expenses include annual depreciation of Php250,000. Gising Company has long-term debt amounting to Php1,000,000. Gising Company projected that it will need additional PhP50,000 every year to support increasing working capital 143DOLOGIES requirements and Php 120,000 for capital investments. How much is the net cash flow of Gising Company in Y1? a. Php390,000 b. Php290,000 c. Php220,000 d. Php140,000 17. Refer to Gising Co. How much is the terminal value recognized after the three-year forecast period? a. Php10,880,000 b. Php12,466,667 c. Php13,090,000 d. Php10,880,000 18. Refer to Gising Company. What is the net cash flow to the firm? a. Php11, 140,489 b. Php12, 103,272 c. Php12,808,412 d. Php13,974,000 19. Refer to Gising Company. What is the net cash flow to equity? a. Php10, 140,489 b. Php11, 103,272 c. Php11, 140,489 d. Php12, 103,272

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts