Question: please help with the weighted average cost of capital problem attached Thunderhorse Oil. Thunderhorse Oil is a U.S. oil company Its current cost of debt

please help with the weighted average cost of capital problem attached

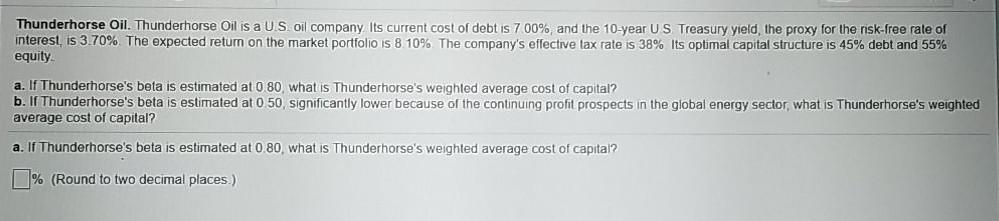

Thunderhorse Oil. Thunderhorse Oil is a U.S. oil company Its current cost of debt is 700%, and the 10-year US Treasury yield, the proxy for the nisk-free rate of interest, is 3.70% The expected return on the market portfolio is 8 10%. The company's effective tax rate is 38% Its optimal capital structure is 45% debt and 55% equity a. If Thunderhorse's beta is estimated at 0 80 what is Thunderhorse's weighted average cost of capital? b. If Thunderhorse's beta is estimated at 0 50, significantly lower because of the continuing profit prospects in the global energy sector, what is Thunderhorse's weighted average cost of capital? a. If Thunderhorse's beta is estimated at 0.80, what is Thunderhorse's weighted average cost of capital? % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts