Question: please help with the whole problem. this is one problem. The following differences enter into the reconciliation of financial income and taxable income of Abbott

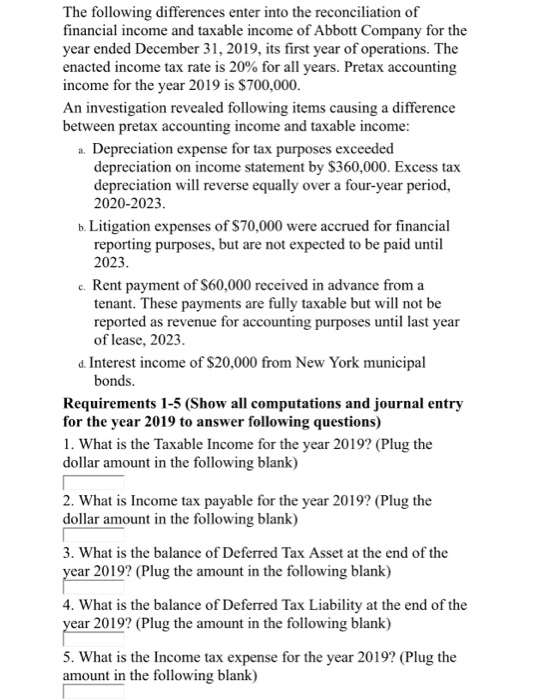

The following differences enter into the reconciliation of financial income and taxable income of Abbott Company for the year ended December 31, 2019, its first year of operations. The enacted income tax rate is 20% for all years. Pretax accounting income for the year 2019 is $ 700,000. An investigation revealed following items causing a difference between pretax accounting income and taxable income: a. Depreciation expense for tax purposes exceeded depreciation on income statement by $360,000. Excess tax depreciation will reverse equally over a four-year period, 2020-2023. b. Litigation expenses of $70,000 were accrued for financial reporting purposes, but are not expected to be paid until 2023 c. Rent payment of $60,000 received in advance from a tenant. These payments are fully taxable but will not be reported as revenue for accounting purposes until last year of lease, 2023. d. Interest income of $20,000 from New York municipal bonds. Requirements 1-5 (Show all computations and journal entry for the year 2019 to answer following questions) 1. What is the Taxable Income for the year 2019? (Plug the dollar amount in the following blank) 2. What is Income tax payable for the year 2019? (Plug the dollar amount in the following blank) 3. What is the balance of Deferred Tax Asset at the end of the year 2019? (Plug the amount in the following blank) 4. What is the balance of Deferred Tax Liability at the end of the year 2019? (Plug the amount in the following blank) 5. What is the Income tax expense for the year 2019? (Plug the amount in the following blank)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts