Question: please help with the wrong ones. which are the balance sheet (liab and stockholders equity) and the journal entries to the ledger accounts. On November

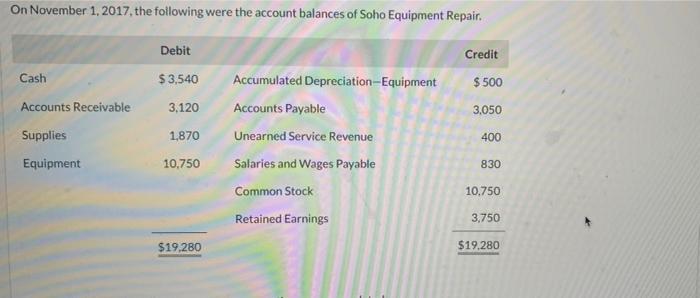

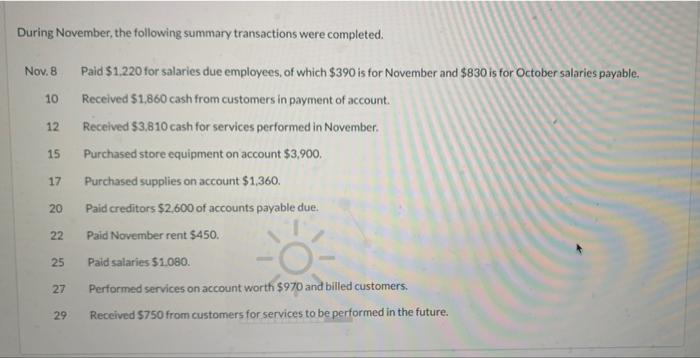

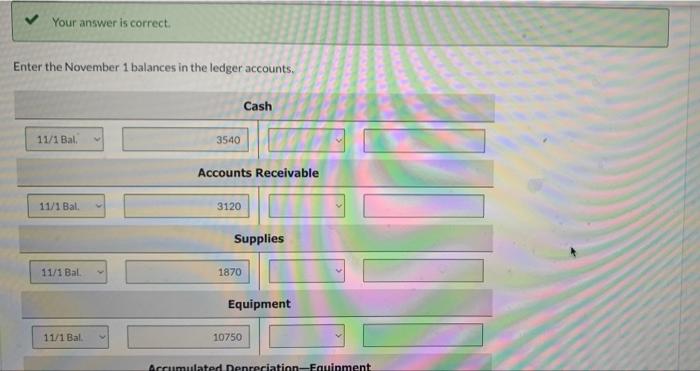

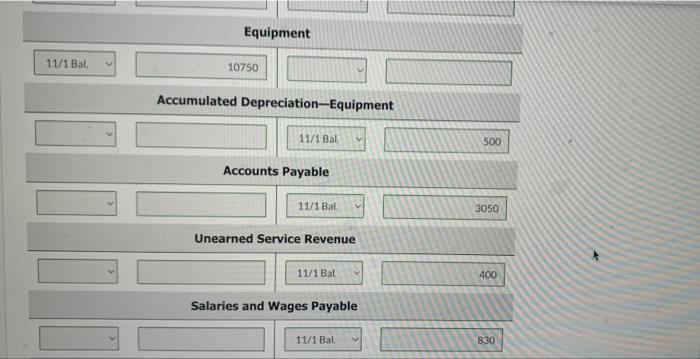

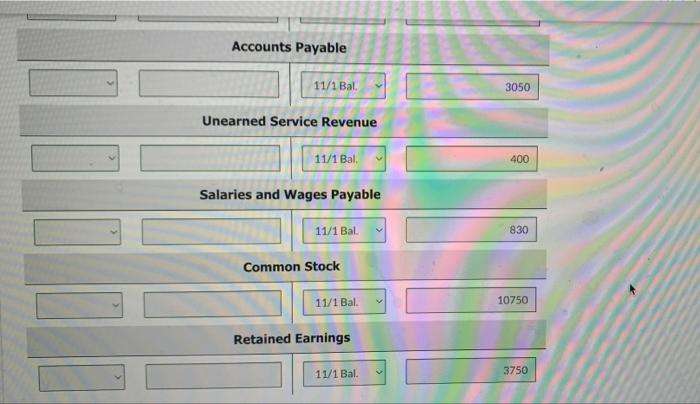

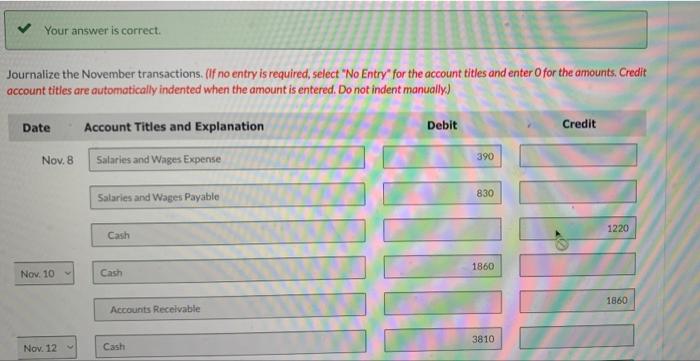

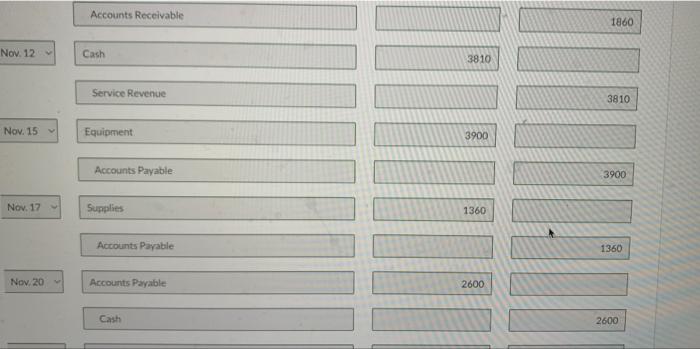

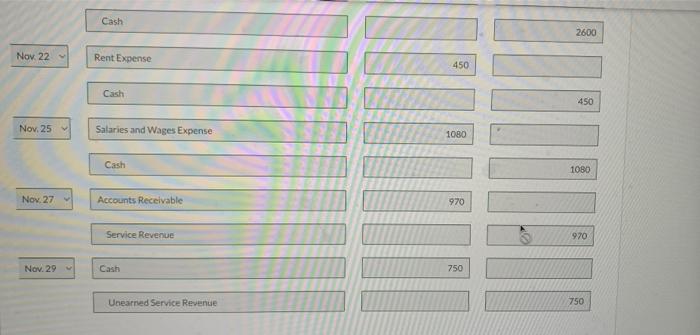

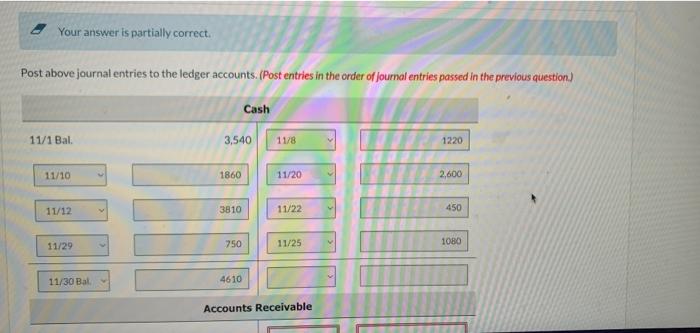

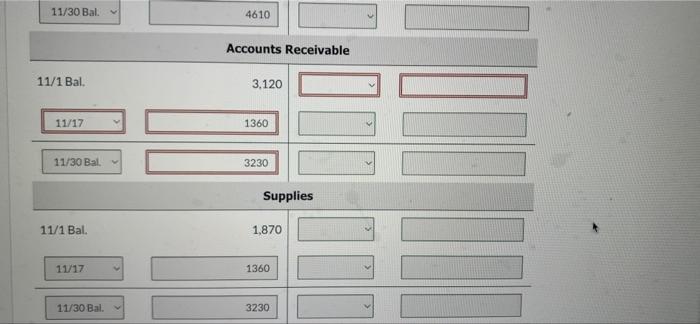

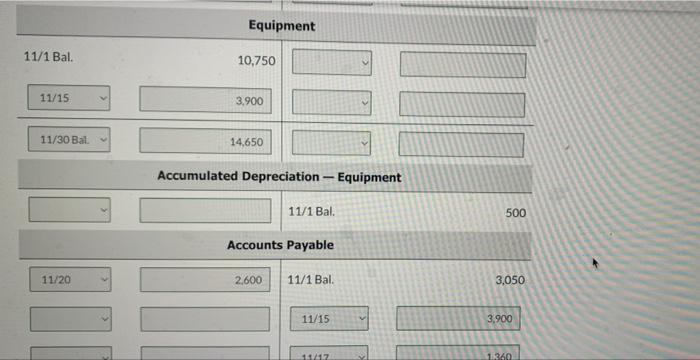

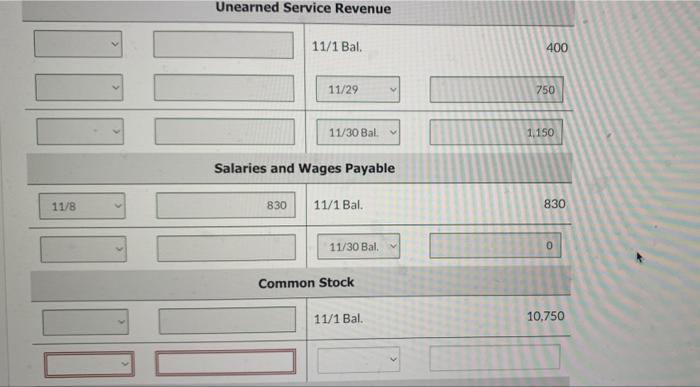

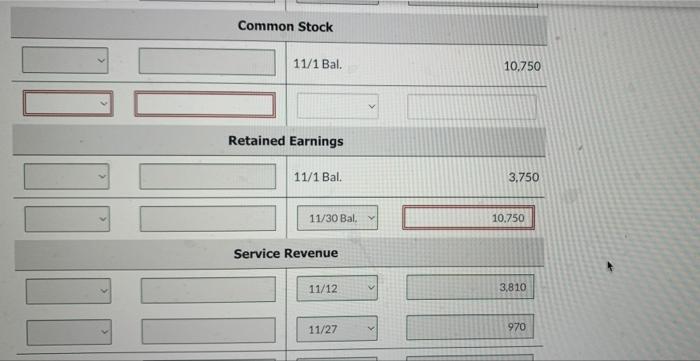

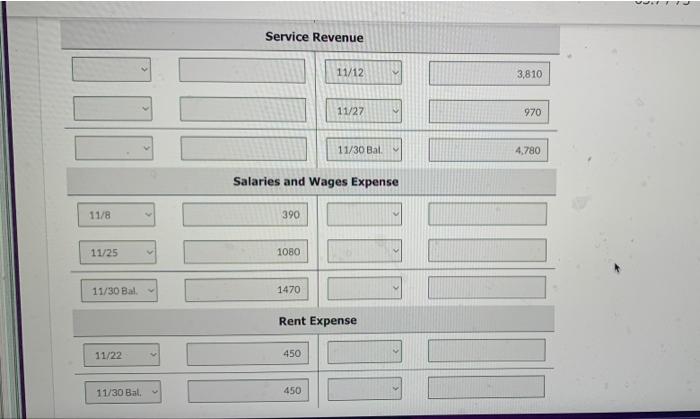

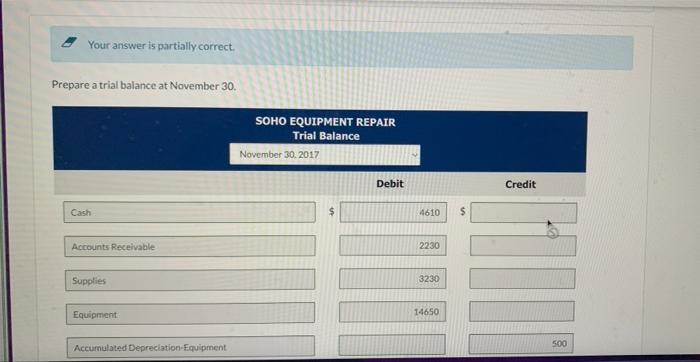

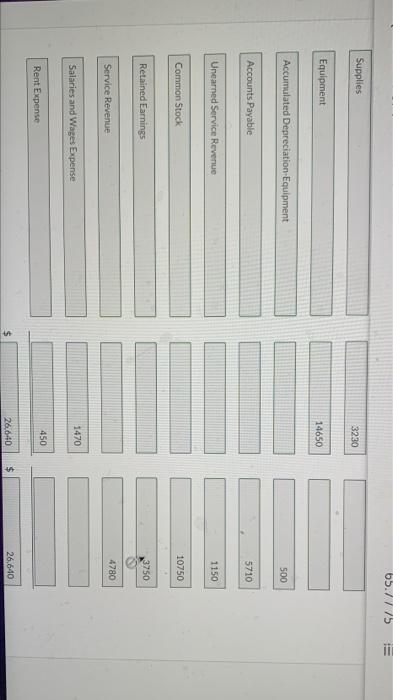

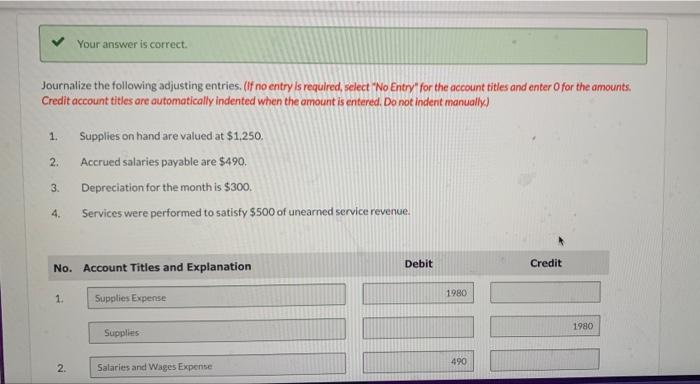

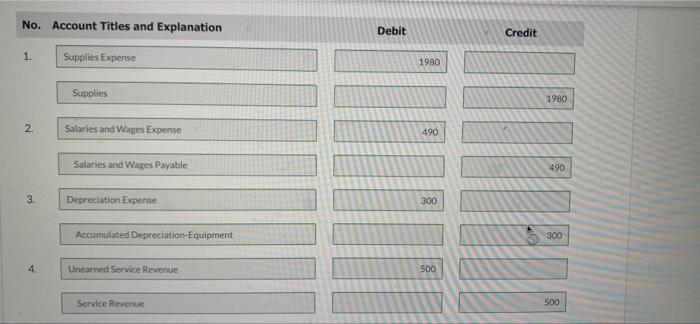

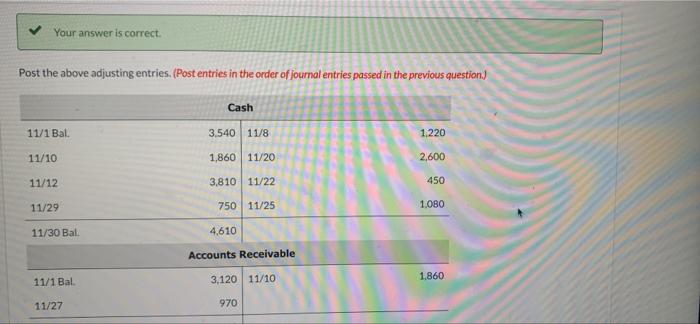

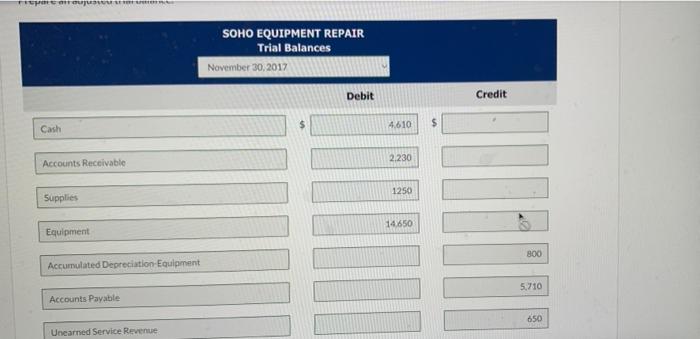

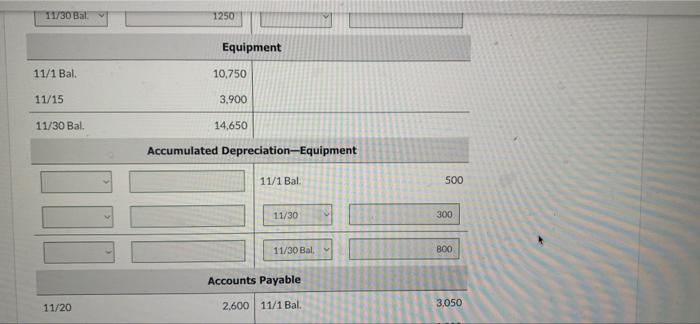

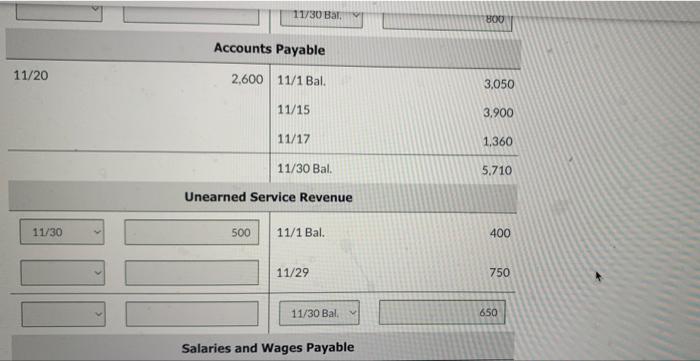

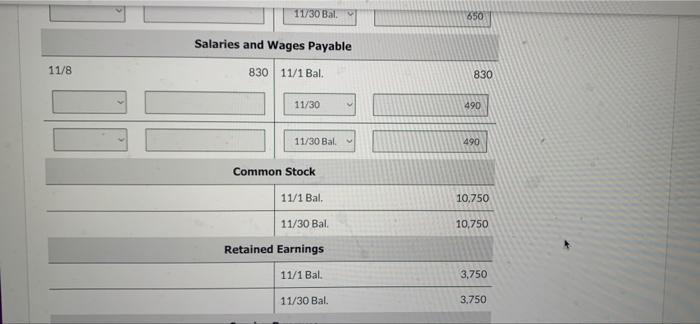

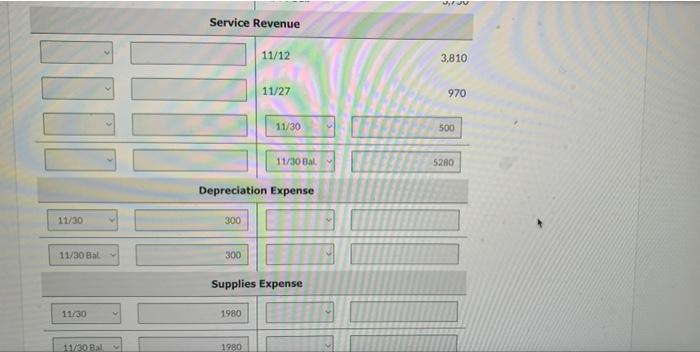

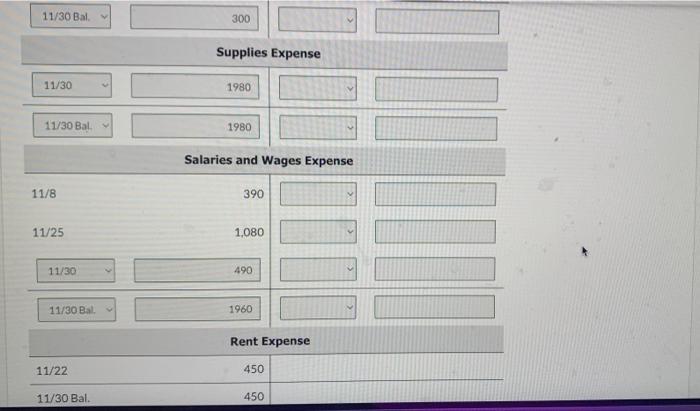

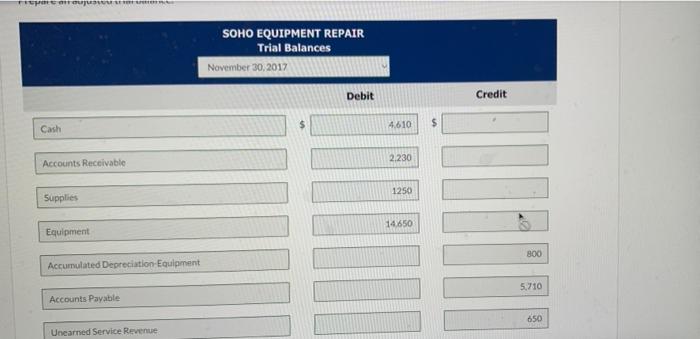

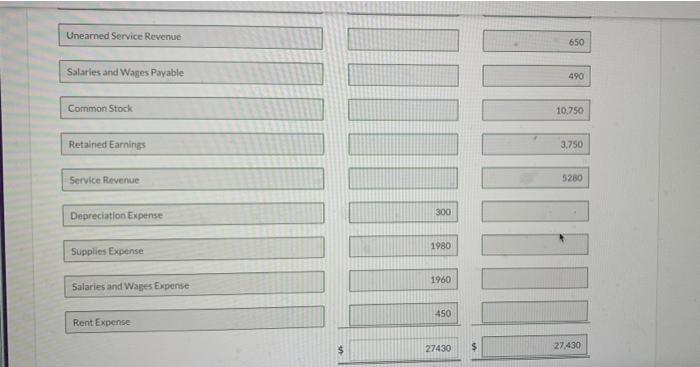

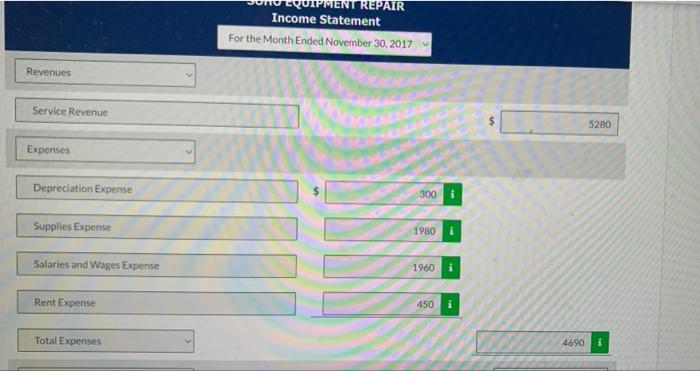

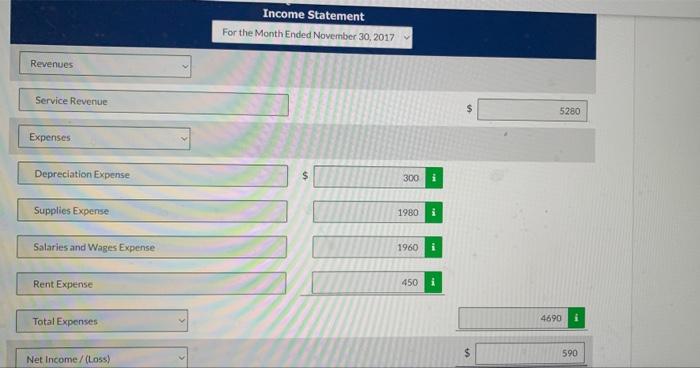

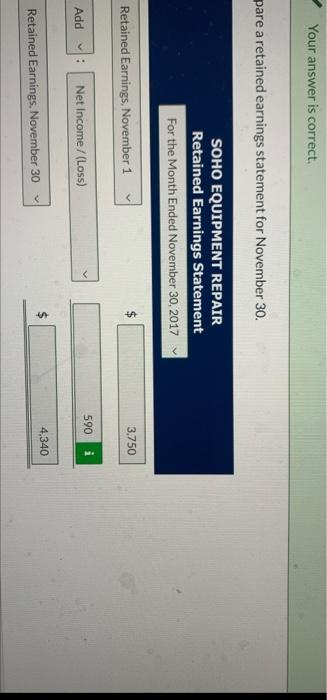

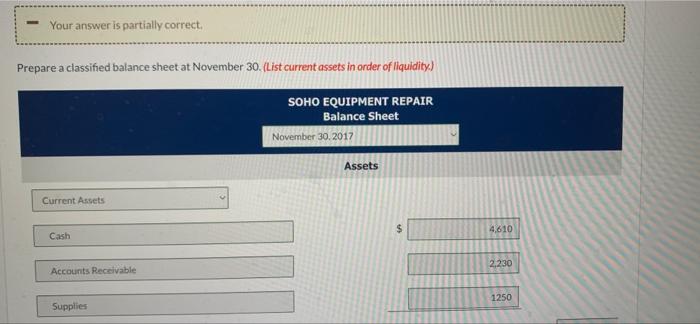

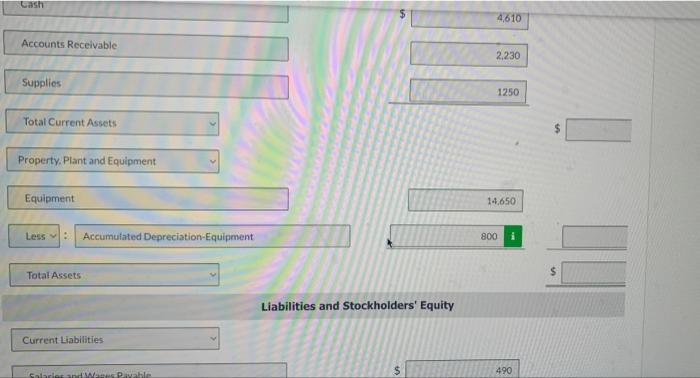

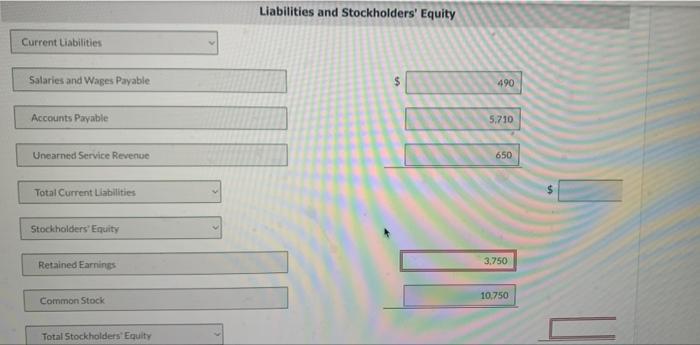

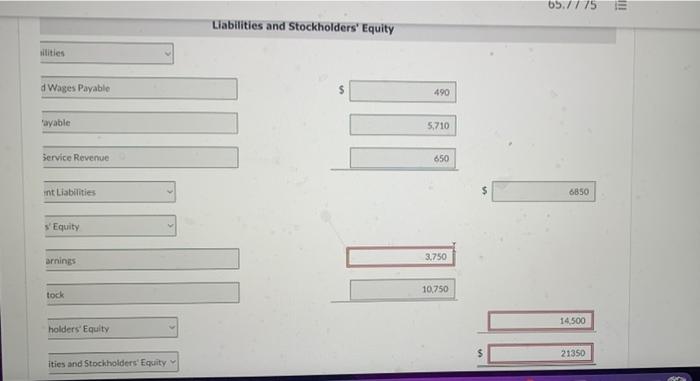

On November 1, 2017, the following were the account balances of Soho Equipment Repair. Debit Credit Cash $ 3,540 $ 500 Accounts Receivable 3,120 3,050 1,870 400 Supplies Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Service Revenue Salaries and Wages Payable Common Stock Retained Earnings 10.750 830 10.750 3,750 $19,280 $19.280 During November, the following summary transactions were completed. Nov. 8 10 12 15 17 Paid $1.220 for salaries due employees, of which $390 is for November and $830 is for October salaries payable. Received $1,860 cash from customers in payment of account. Received $3,810 cash for services performed in November Purchased store equipment on account $3,900. Purchased supplies on account $1,360. Paid creditors $2,600 of accounts payable due. Paid November rent $450. Paid salaries 51.080 Performed services on account worth $970 and billed customers. Received $750 from customers for services to be performed in the future. 20 22 25 27 29 Your answer is correct. Enter the November 1 balances in the ledger accounts. Cash 11/1 Bal. 3540 Accounts Receivable 11/1 Bal 3120 Supplies 11/1 Bal 1870 Equipment 11/1 Bal 10750 Accumulated Depreciation Equinment Equipment 11/1 Bal 10750 Accumulated Depreciation-Equipment 11/1 Bal 500 Accounts Payable 11/1 Bal. 3050 Unearned Service Revenue 11/1 Bal. 400 Salaries and Wages Payable 11/1 Bal 830 Accounts Payable 11/1 Bal. 3050 Unearned Service Revenue 11/1 Bal. 400 Salaries and Wages Payable 11/1 Bal 830 Common Stock 11/1 Bal. 10750 Retained Earnings 11/1 Bal 3750 Your answer is correct. Journalize the November transactions of no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually) Date Account Titles and Explanation Debit Credit Nov. 8 Salaries and Wages Expense 390 830 Salaries and Wages Payable DEN 1220 Cash 1860 Nov. 10 Cash 1860 Accounts Receivable 3810 Nov. 12 Cash Accounts Receivable 1860 Nov. 12 Cash 3810 Service Revenue 3810 Nov. 15 Equipment 3900 Accounts Payable 3900 Nov. 17 Supplies 1360 Accounts Payable 1360 Nov. 20 Accounts Payable 2600 Cash 2600 Cash 2600 Nov 22 Rent Expense 450 Cash 450 Nov. 25 Salaries and Wages Expense 1080 Cash 1080 Nov, 27 Accounts Receivable 970 Service Revenue 970 Nov. 29 Cash 750 Uneared Service Revenue 750 Your answer is partially correct. Post above journal entries to the ledger accounts. (Post entries in the order of journal entries passed in the previous question) Cash 11/1 Bal 3,540 11/8 1220 11/10 1860 11/20 2,600 11/12 3810 11/22 450 11/29 750 11/25 1080 11/30 Bal 4610 Accounts Receivable 11/30 Bal. 4610 Accounts Receivable 11/1 Bal. 3.120 11/17 1360 11/30 Bal. 3230 Supplies 11/1 Bal. 1,870 11/17 1360 11/30 Bal. 3230 Equipment 11/1 Bal. 10,750 11/15 3.900 11/30 Bal 14,650 Accumulated Depreciation - Equipment 11/1 Bal. 500 Accounts Payable 11/20 2,600 11/1 Bal. 3,050 11/15 3,900 11/17 10360 Unearned Service Revenue 11/1 Bal. 400 IL 11/29 750 11/30 Bal 1,150 Salaries and Wages Payable 11/8 830 11/1 Bal. 830 11/30 Bal. 0 Common Stock 11/1 Bal. 10.750 Common Stock 11/1 Bal. 10.750 Retained Earnings 11/1 Bal 3.750 11/30 Bal. V 10.750 Service Revenue 11/12 3,810 11/27 970 Service Revenue 11/12 3,810 11/27 970 11/30 Bal. 4.780 Salaries and Wages Expense 11/8 390 11/25 1080 11/30 Bal 1470 Rent Expense 11/22 450 11/30 Bal. 450 Your answer is partially correct. Prepare a trial balance at November 30. SOHO EQUIPMENT REPAIR Trial Balance November 30, 2017 Debit Credit Cash $ 4610 $ Accounts Receivable 2230 HE Supplies 3230 Equipment 14650 500 Accumulated Depreciation Equipment 65.// /5 !! Supplies 3230 Equipment 14650 Accumulated Depreciation Equipment 500 Accounts Payable 5710 Unearned Service Revenue 1150 Common Stock 10750 Retained Earnings 3750 Service Revenue 4780 Salaries and Wages Expense 1470 450 Rent Expense 26,640 $ 26,640 Your answer is correct. 0 Journalize the following adjusting entries. Of no entry is required, select "No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) 1. 2. Supplies on hand are valued at $1,250. Accrued salaries payable are $490. Depreciation for the month is $300. Services were performed to satisfy $500 of unearned service revenue. 3. 4. Debit No. Account Titles and Explanation Credit 1980 1. Supplies Expense 1980 Supplies 490 2. Salaries and Wages Expense No. Account Titles and Explanation Debit Credit 1 Supplies Expense 1980 Supplies 1980 2 Salaries and Wages Expense 490 Salaries and Wages Payable 490 3 Depreciation Expense 300 Accumulated Depreciation Equipment 300 4 Unearned Service Revenue 500 Service Revenue 500 Your answer is correct. Post the above adjusting entries. (Post entries in the order of journal entries passed in the previous question) Cash 11/1 Bal. 3,540 11/8 1.220 11/10 1,860 11/20 2,600 11/12 3,810 11/22 450 11/29 750 11/25 1.080 11/30 Bal 4,610 Accounts Receivable 11/1 Bal 1.860 3,120 11/10 11/27 970 TER SOHO EQUIPMENT REPAIR Trial Balances November 30, 2017 Debit Credit 4.610 $ Cash Accounts Receivable 2.230 1250 Supplies 14650 Equipment 800 Accumulated Depreciation Equipment 5,710 Accounts Payable 650 Unearned Service Revenue 11/30 Bal 1250 Equipment 11/1 Bal. 10.750 11/15 3.900 11/30 Bal. 14,650 Accumulated Depreciation-Equipment 11/1 Bal. 500 11/30 300 11/30 Bal Accounts Payable 11/20 2.600 11/1 Bal. 3,050 11/30 Bar HOU Accounts Payable 11/20 2,600 11/1 Bal. 3,050 11/15 3.900 11/17 1,360 11/30 Bal. 5,710 Unearned Service Revenue 11/30 500 11/1 Bal. 400 11/29 750 11/30 Bal 650 Salaries and Wages Payable 11/30 Bal. 650 Salaries and Wages Payable 11/8 830 11/1 Bal 830 11/30 490 11/30 Bal 490 Common Stock 11/1 Bal. 10,750 11/30 Bal 10.750 Retained Earnings 11/1 Bal. 3,750 11/30 Bal. 3.750 UV Service Revenue 11/12 3,810 11/27 970 11/30 500 11/0 BAL 5280 Depreciation Expense 11/30 300 11/30 Bal 300 Supplies Expense 11/30 1980 1130 1980 11/30 Bal 300 Supplies Expense 11/30 1980 11/30 Bal 1980 Salaries and Wages Expense 11/8 390 11/25 1,080 11/30 490 11/30 Bal 1960 Rent Expense 11/22 450 11/30 Bal. 450 Unearned Service Revenue 650 Salaries and Wages Payable 490 Common Stock 10,750 Retained Earnings 3.750 Service Revenue 5280 Depreciation Expense 300 1980 Supplies Expense 1960 Salaries and Wages Expense 450 Rent Expense 27430 $ 27430 REPAIR Income Statement For the Month Ended November 30, 2017 Revenues Service Revenue 5280 Expenses Depreciation Expense 300 i Supplies Expense 1980 i Salaries and Wages Expense 1960 i Rent Expense 450 i Total Expenses 4690 i Income Statement For the Month Ended November 30, 2017 Revenues Service Revenue 5280 Expenses Depreciation Expense $ 300 i Supplies Expense 1980 Salaries and Wages Expense 1960 i Rent Expense 450 Total Expenses 4690 590 Net Income /(Loss) Your answer is correct. pare a retained earnings statement for November 30. SOHO EQUIPMENT REPAIR Retained Earnings Statement For the Month Ended November 30, 2017 Retained Earnings, November 1 3.750 590 i Add : Net Income /(Loss) $ 4,340 Retained Earnings, November 30 Your answer is partially correct. Prepare a classified balance sheet at November 30. (List current assets in order of liquidity) SOHO EQUIPMENT REPAIR Balance Sheet November 30, 2017 Assets Current Assets $ 4,610 Cash 2.230 Accounts Receivable 1250 Supplies 4,610 Accounts Receivable 2,230 Supplies 1250 Total Current Assets Property, plant and Equipment Equipment 144,650 Less: Accumulated Depreciation-Equipment 800 Total Assets Liabilities and Stockholders' Equity Current Liabilities 490 Salaries and Wes Pawable Liabilities and Stockholders' Equity Current Liabilities Salaries and Wages Payable $ 490 Accounts Payable 5.710 Unearned Service Revenue 650 Total Current Liabilities Stockholders' Equity Retained Earnings 3.750 Common Stock 10.750 Total Stockholders' Equity 65./775 ITI ! Liabilities and Stockholders' Equity ilities d Wages Payable $ 490 ayable 5,710 Service Revenue 650 int Liabilities 6850 s Equity arnings 3.750 10.750 tock 14.500 holders' Equity 21350 ities and Stockholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts