Question: please help with these WACC problems. show calculations Financial Management (FIN 6020) Cost of Capital Problem Set Instructions: Complete the following problem set. Submit a

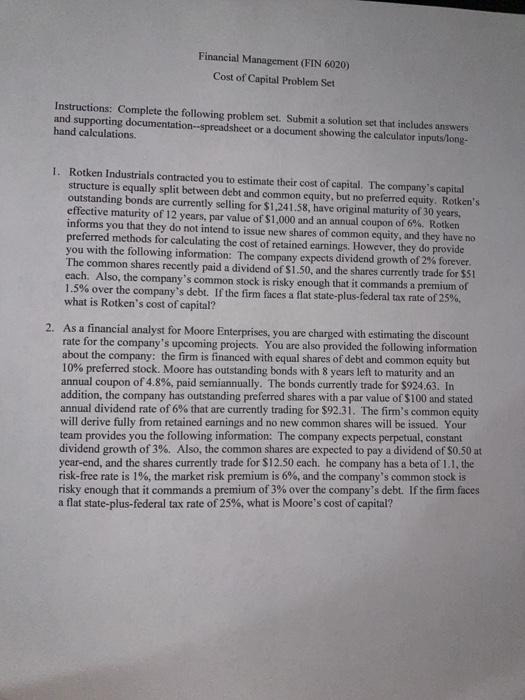

Financial Management (FIN 6020) Cost of Capital Problem Set Instructions: Complete the following problem set. Submit a solution set that includes answers and supporting documentation--spreadsheet or a document showing the calculator inputs long- hand calculations. 1. Rotken Industrials contracted you to estimate their cost of capital. The company's capital structure is equally split between debt and common equity, but no preferred equity. Rotken's outstanding bonds are currently selling for $1,241.58, have original maturity of 30 years, effective maturity of 12 years, par value of $1,000 and an annual coupon of 6%. Rotken informs you that they do not intend to issue new shares of common equity, and they have no preferred methods for calculating the cost of retained earnings. However, they do provide you with the following information: The company expects dividend growth of 2% forever. The common shares recently paid a dividend of $1.50, and the shares currently trade for $51 each. Also, the company's common stock is risky enough that it commands a premium of 1.5% over the company's debt. If the firm faces a flat state-plus-federal tax rate of 25%, what is Rotken's cost of capital? 2. As a financial analyst for Moore Enterprises, you are charged with estimating the discount rate for the company's upcoming projects. You are also provided the following information about the company: the firm is financed with equal shares of debt and common equity but 10% preferred stock. Moore has outstanding bonds with 8 years left to maturity and an annual coupon of 4.8%, paid semiannually. The bonds currently trade for $924.63. In addition, the company has outstanding preferred shares with a par value of $100 and stated annual dividend rate of 6% that are currently trading for $92.31. The firm's common equity will derive fully from retained earnings and no new common shares will be issued. Your team provides you the following information: The company expects perpetual, constant dividend growth of 3%. Also, the common shares are expected to pay a dividend of $0.50 at year-end, and the shares currently trade for $12.50 each. he company has a beta of 1.1. the risk-free rate is 1%, the market risk premium is 6%, and the company's common stock is risky enough that it commands a premium of 3% over the company's debt. If the firm faces a flat state-plus-federal tax rate of 25%, what is Moore's cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts