Question: Please help with this multi layered foreign exchange question. definite thumbs up, thanks!!! Assume today's settlement price on a CME GBP futures contract is $1.4948/E.

Please help with this multi layered foreign exchange question. definite thumbs up, thanks!!!

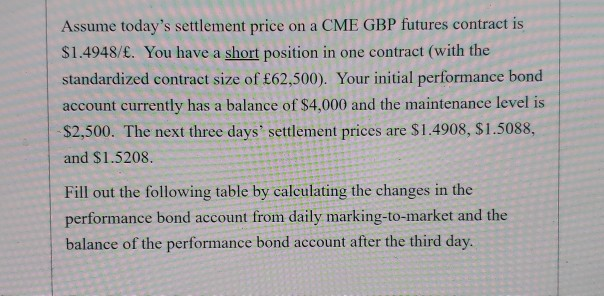

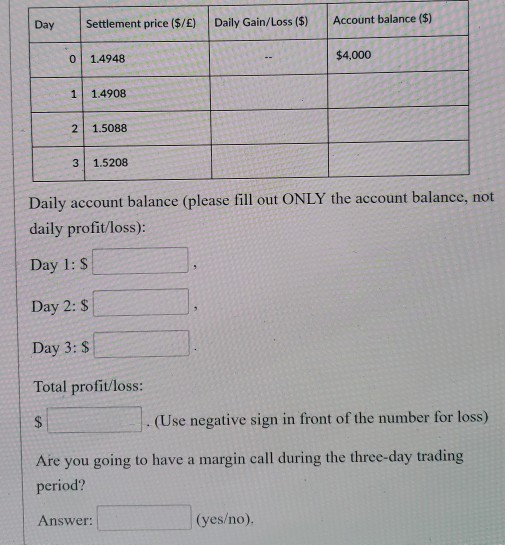

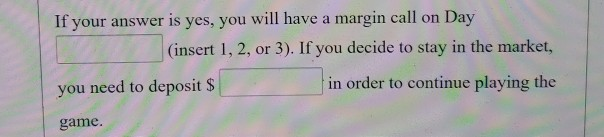

Assume today's settlement price on a CME GBP futures contract is $1.4948/E. You have a short position in one contract (with the standardized contract size of 62,500). Your initial performance bond account currently has a balance of $4,000 and the maintenance level is S2,500. The next three days' settlement prices are $1.4908, S1.5088 and $1.5208. Fill out the following table by calculating the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day Day Settlement price ($/E) Daily Gain/Loss ($) Account balance ($) $4,000 0 1.4948 1 14908 2 1.5088 3 1.5208 Daily account balance (please fill out ONLY the account balance, not daily profit/loss): Day 1: S Day 2: S Day 3:S Total profit/loss: (Use negative sign in front of the number for loss) Are you going to have a margin call during the three-day trading period? Answer: (yeso). If your answer is yes, you will have a margin call on Day (insert 1, 2, or 3). If you decide to stay in the market, in order to continue playing the you need to deposit S game

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts