Question: Please help with this project. if you can connect the code in. .ipynb file it would be better. if not its fine. provide all the

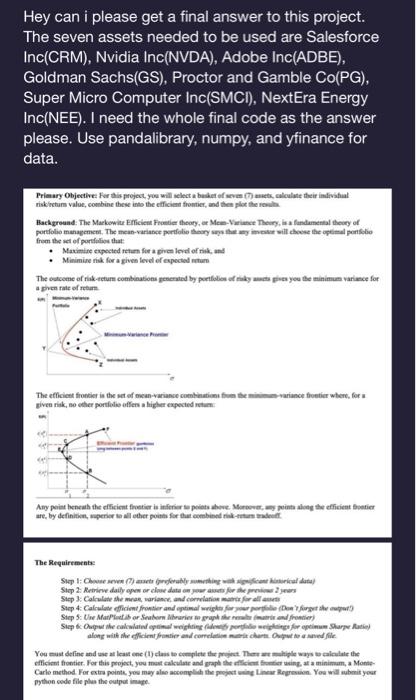

Hey can i please get a final answer to this project. The seven assets needed to be used are Salesforce Inc(CRM), Nvidia Inc(NVDA), Adobe Inc(ADBE), Goldman Sachs(GS), Proctor and Gamble Co(PG), Super Micro Computer Inc(SMCI), NextEra Energy Inc(NEE). I need the whole final code as the answer please. Use pandalibrary, numpy, and yfinance for data. riskircturn value, combine these into the efficient fromtier, and thes plor the resils. frem the set of porthalios that: - Maximine expected retam for a pives level of riak, and - Minimine rk for a given fevel ef expected nowar a pien raie of retarm vives rilk, wo edher portivle offen a ligher expected netarn: The Requirements: efficient frontier. For this project, you mast ealculate and erapt the efficiemt foretier using, at a minimam, a Montepytion code file plua the eutpar inape

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts