Question: please help with this project! Individual Tax Return Team Project ACCT 351: Federal Tax Law, Spring 2023 Instruction: Complete the 2022 federal income tax retum

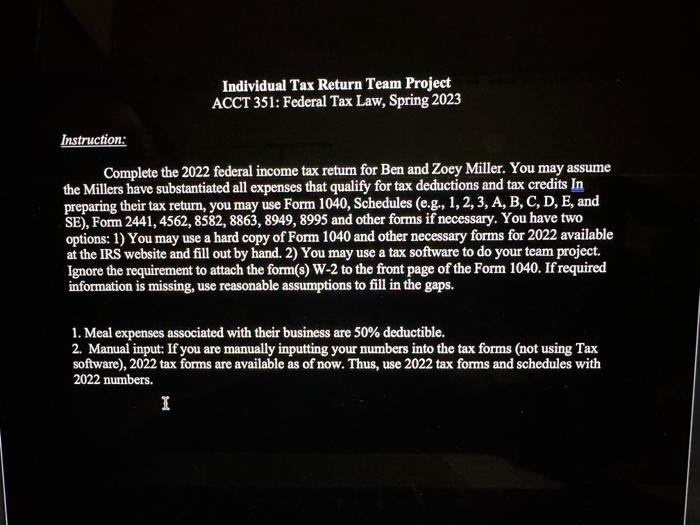

Individual Tax Return Team Project ACCT 351: Federal Tax Law, Spring 2023 Instruction: Complete the 2022 federal income tax retum for Ben and Zoey Miller. You may assume the Millers have substantiated all expenses that qualify for tax deductions and tax credits In preparing their tax return, you may use Form 1040, Schedules (e.g., 1, 2, 3, A, B, C, D, E, and SE), Form 2441, 4562, 8582, 8863, 8949, 8995 and other forms if necessary. You have two options: 1) You may use a hard copy of Form 1040 and other necessary forms for 2022 available at the IRS website and fill out by hand. 2) You may use a tax software to do your team project. Ignore the requirement to attach the form(s) W-2 to the front page of the Form 1040 . If required information is missing, use reasonable assumptions to fill in the gaps. 1. Meal expenses associated with their business are 50% deductible. 2. Manual input: If you are manually inputting your numbers into the tax forms (not using Tax software), 2022 tax forms are available as of now. Thus, use 2022 tax forms and schedules with 2022 numbers. an Individual Tax Return Team Project ACCT 351: Federal Tax Law, Spring 2023 Instruction: Complete the 2022 federal income tax retum for Ben and Zoey Miller. You may assume the Millers have substantiated all expenses that qualify for tax deductions and tax credits In preparing their tax return, you may use Form 1040, Schedules (e.g., 1, 2, 3, A, B, C, D, E, and SE), Form 2441, 4562, 8582, 8863, 8949, 8995 and other forms if necessary. You have two options: 1) You may use a hard copy of Form 1040 and other necessary forms for 2022 available at the IRS website and fill out by hand. 2) You may use a tax software to do your team project. Ignore the requirement to attach the form(s) W-2 to the front page of the Form 1040 . If required information is missing, use reasonable assumptions to fill in the gaps. 1. Meal expenses associated with their business are 50% deductible. 2. Manual input: If you are manually inputting your numbers into the tax forms (not using Tax software), 2022 tax forms are available as of now. Thus, use 2022 tax forms and schedules with 2022 numbers. an

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts