Question: please help with this QUESTION 4 (13 MARKS) (a) How much should you pay for an investment that will give you a return of RM5,000

please help with this

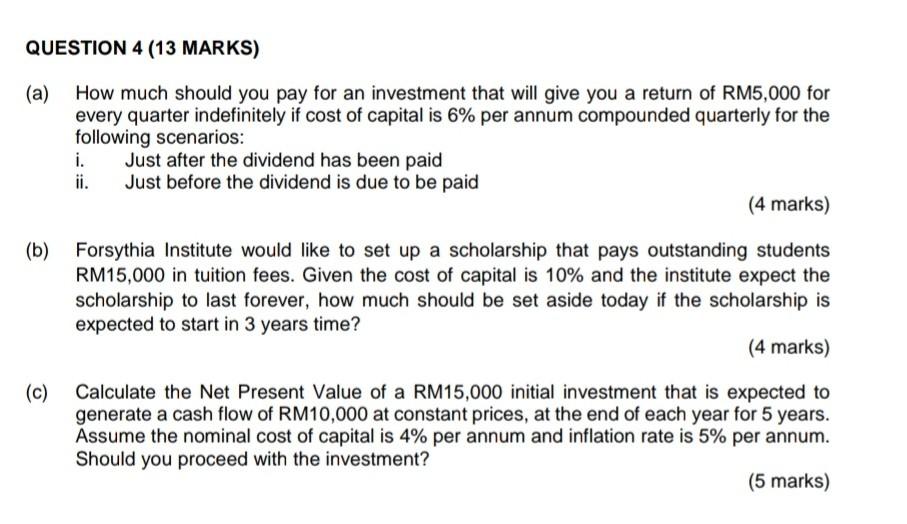

QUESTION 4 (13 MARKS) (a) How much should you pay for an investment that will give you a return of RM5,000 for every quarter indefinitely if cost of capital is 6% per annum compounded quarterly for the following scenarios: i. Just after the dividend has been paid ii. Just before the dividend is due to be paid (4 marks) (b) Forsythia Institute would like to set up a scholarship that pays outstanding students RM15,000 in tuition fees. Given the cost of capital is 10% and the institute expect the scholarship to last forever, how much should be set aside today if the scholarship is expected to start in 3 years time? (4 marks) (c) Calculate the Net Present Value of a RM15,000 initial investment that is expected to generate a cash flow of RM10,000 at constant prices, at the end of each year for 5 years. Assume the nominal cost of capital is 4% per annum and inflation rate is 5% per annum. Should you proceed with the investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts