Question: Please help with this question 4 Consumers should comparison shop for credit just as they would for any other consumer good or service. How might

Please help with this question 4

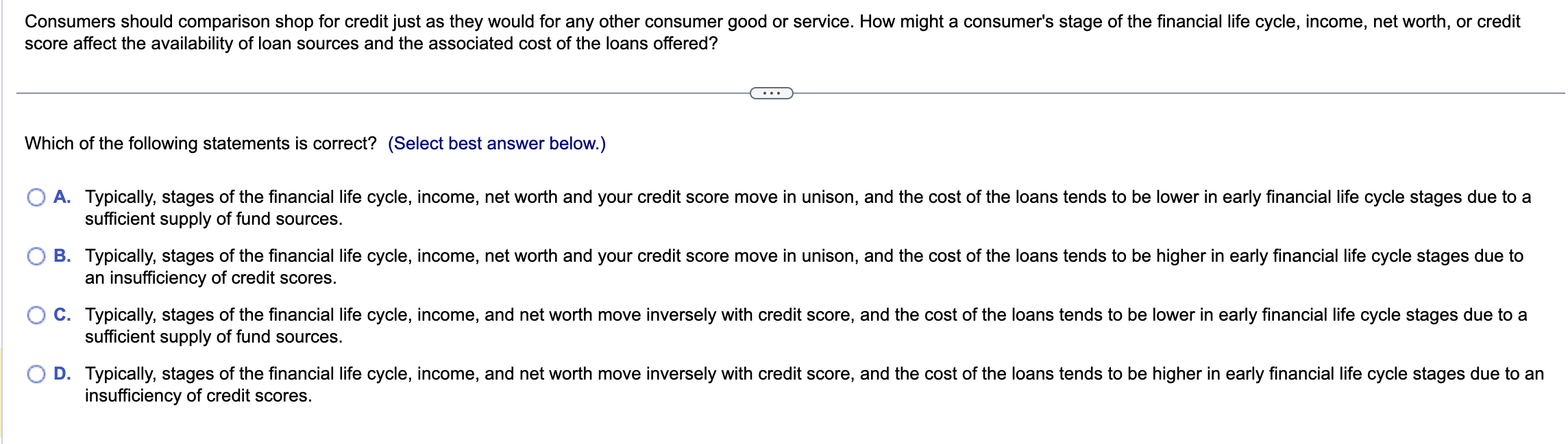

Consumers should comparison shop for credit just as they would for any other consumer good or service. How might a consumer's stage of the financial life cycle, income, net worth, or credit score affect the availability of loan sources and the associated cost of the loans offered? Which of the following statements is correct? (Select best answer below.) A. Typically, stages of the financial life cycle, income, net worth and your credit score move in unison, and the cost of the loans tends to be lower in early financial life cycle stages due to a sufficient supply of fund sources. B. Typically, stages of the financial life cycle, income, net worth and your credit score move in unison, and the cost of the loans tends to be higher in early financial life cycle stages due to an insufficiency of credit scores. C. Typically, stages of the financial life cycle, income, and net worth move inversely with credit score, and the cost of the loans tends to be lower in early financial life cycle stages due to a sufficient supply of fund sources. D. Typically, stages of the financial life cycle, income, and net worth move inversely with credit score, and the cost of the loans tends to be higher in early financial life cycle stages due to an insufficiency of credit scores

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts