Question: Please help with this question asap. I have provided the drop down options for the income statement. Thank you The following balances were taken from

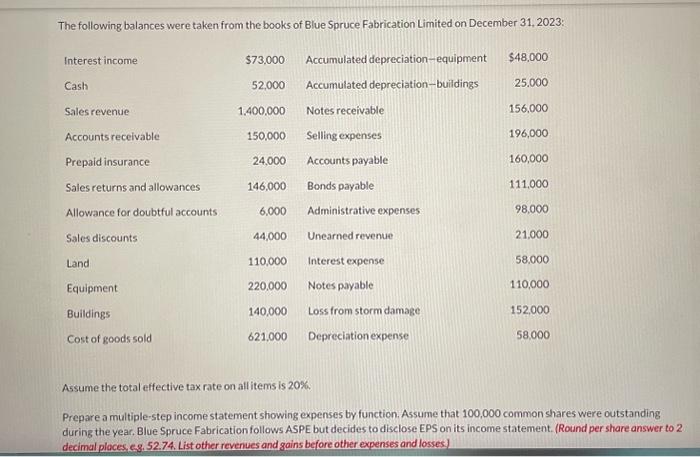

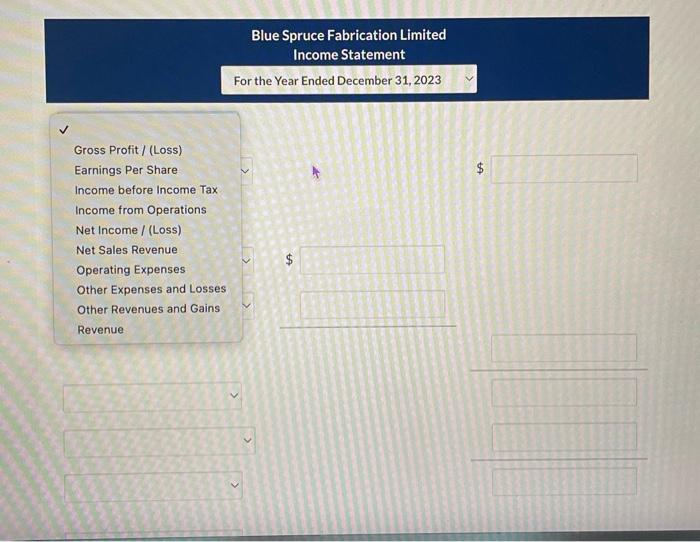

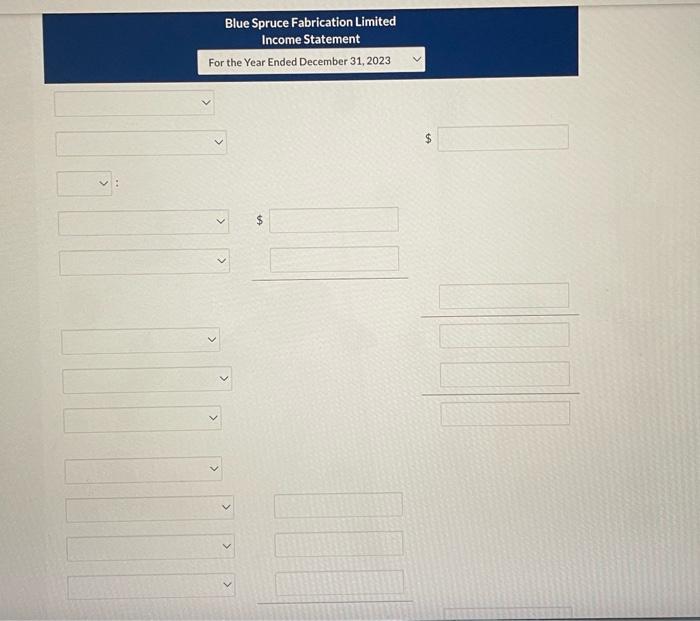

The following balances were taken from the books of Blue Spruce Fabrication Limited on December 31, 2023: Assume the total effective tax rate on all items is 20%. Prepare a multiple-step income statement showing expenses by function. Assume that 100,000 common shares were outstanding during the year, Blue Spruce Fabrication follows ASPE but decides to disclose EPS on its income statement. (Round per share answer to 2 . decimal places, eg, 52.74. List other revenues and gains before other expenses and losses] Blue Spruce Fabrication Limited Income Statement For the Year Ended December 31, 2023 Gross Profit / (Loss) Earnings Per Share Income before Income Tax Income from Operations Net Income / (Loss) Net Sales Revenue Operating Expenses Other Expenses and Losses Other Revenues and Gains Revenue Blue Spruce Fabrication Limited Income Statement For the Year Ended December 31, 2023 $ : $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts