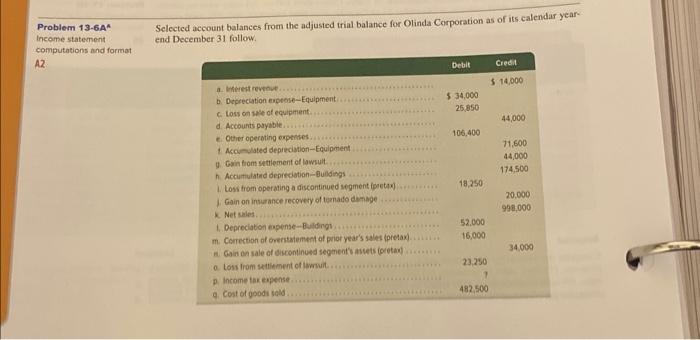

Question: please help with this question been trying for hours Required 1. Assume that the company's income tax rate is 30% for all items. Identify the

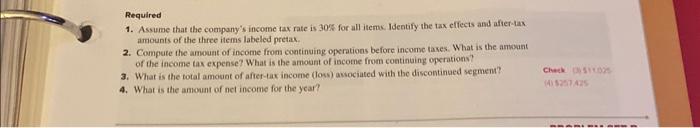

Required 1. Assume that the company's income tax rate is 30% for all items. Identify the tax effects and after-tax. amounts of the three items labeled pretas. 2. Compute the amouat of income from continuing operations before income tases. What is the amoant of the income tax expense? What is the amount of income from continuing operations? 3. What is the total amoust of after-tax income (loss) associated with the discontinued segmen? 4. What is the amount of net income for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts