Question: Please help with this. Thank you very much 3 Problem 1-8A Analyzing effects of transactions LO P1, A1 Lita Lopez started Biz Consulting a new

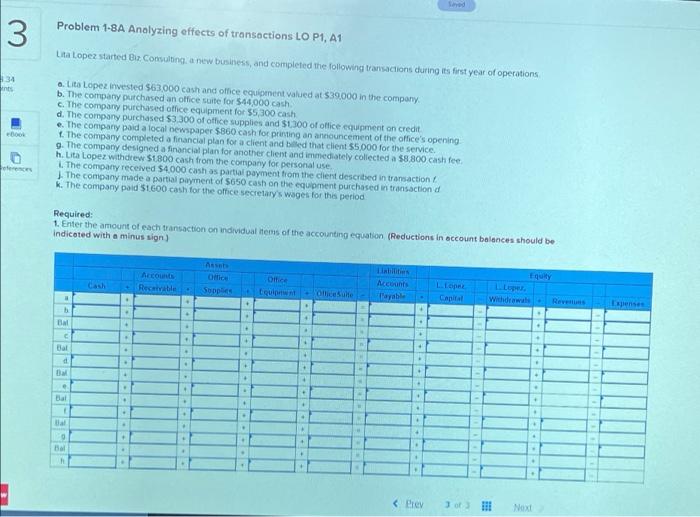

3 Problem 1-8A Analyzing effects of transactions LO P1, A1 Lita Lopez started Biz Consulting a new business, and completed the following transactions during its first year of operations 134 nts a Lita Lopez invested $63.000 cash and office equipment valued at $39.000 in the company b. The company purchased an office suite for $44.000 cash c. The company purchased otfice equipment for 55,300 cash d. The company purchased $3.300 of office supplies and $1300 of office equipment on credit e. The company paid a local newspaper $860 cash for printing an announcement of the office's opening The company completed a financial plan for a client and bed that client $5,000 for the service, 9. The company designed a financial plan for another client and immediately collected a $8.800 cash fee h. Lita Lopez withdrew $1800 cash from the company for personal use. The company received $4.000 cash as partial payment from the client described in transaction J. The company made a partial payment of $650 cash on the equipment purchased in transaction k. The company paid $1600 cash for the office secretary's wages for this period Required: 1. Enter the amount of each transaction on individuales of the accounting equation (Reductions in account balances should be indicated with a minus sign) Ass Office Supplies Reco Recible Equity Office qui liceulte Mccounts Canal Withdraw Reve + Expenses . + b BAL * + + + Bal . . + + . Bal B.E.E. . -

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts