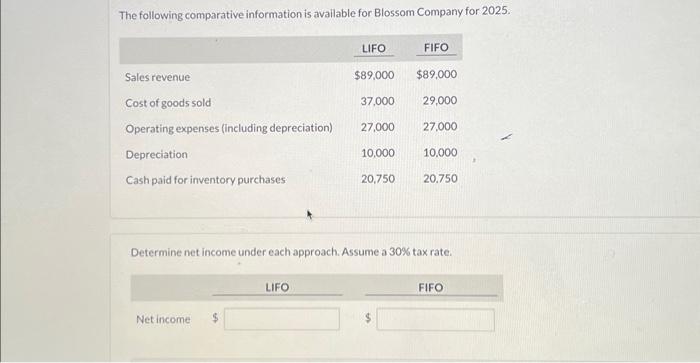

Question: please help with this The following comparative information is available for Blossom Company for 2025. Determine net income under each approach. Assume a 30% tax

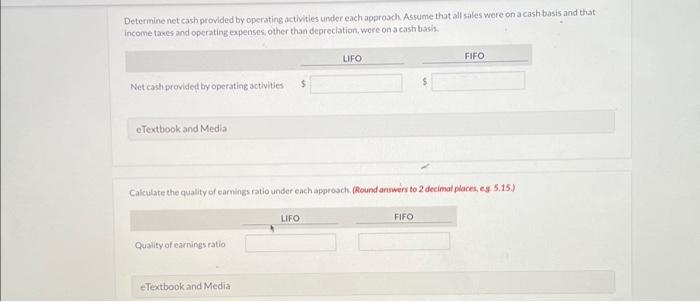

The following comparative information is available for Blossom Company for 2025. Determine net income under each approach. Assume a 30% tax rate. Determine net cash provided by operating activities under each approach. Assume that all sales were on a cash basis and that income taxes and operating expenses, other than depreciation, were on a cash bash. eTextbook and Media Calculate the quality of eamings ratio under each approsch. (Round answern to 2 decimal places, eg. 5.15.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts