Question: Please help with this whenever you can! Assignment 6 - Investment Decision Criteria Please work in Excel and submit an .xlsx file. When calculating the

Please help with this whenever you can!

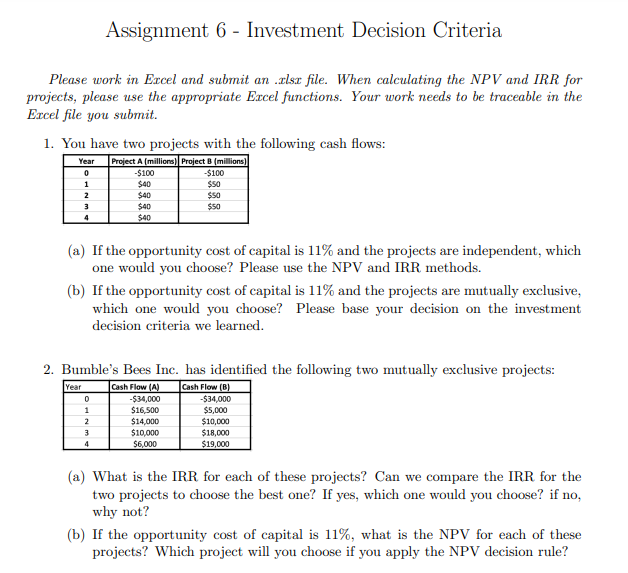

Assignment 6 - Investment Decision Criteria Please work in Excel and submit an .xlsx file. When calculating the NPV and IRR for projects, please use the appropriate Excel functions. Your work needs to be traceable in the Excel file you submit. 1. You have two projects with the following cash flows: (a) If the opportunity cost of capital is 11% and the projects are independent, which one would you choose? Please use the NPV and IRR methods. (b) If the opportunity cost of capital is 11% and the projects are mutually exclusive, which one would you choose? Please base your decision on the investment decision criteria we learned. 2. Bumble's Bees Inc. has identified the following two mutually exclusive projects: (a) What is the IRR for each of these projects? Can we compare the IRR for the two projects to choose the best one? If yes, which one would you choose? if no, why not? (b) If the opportunity cost of capital is 11%, what is the NPV for each of these projects? Which project will you choose if you apply the NPV decision rule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts