Question: Please help with this You have ( $ 5,300.00 ) to invest and must choose between a no-load, open-end mutual fund with an annual expense

Please help with this

Please help with this

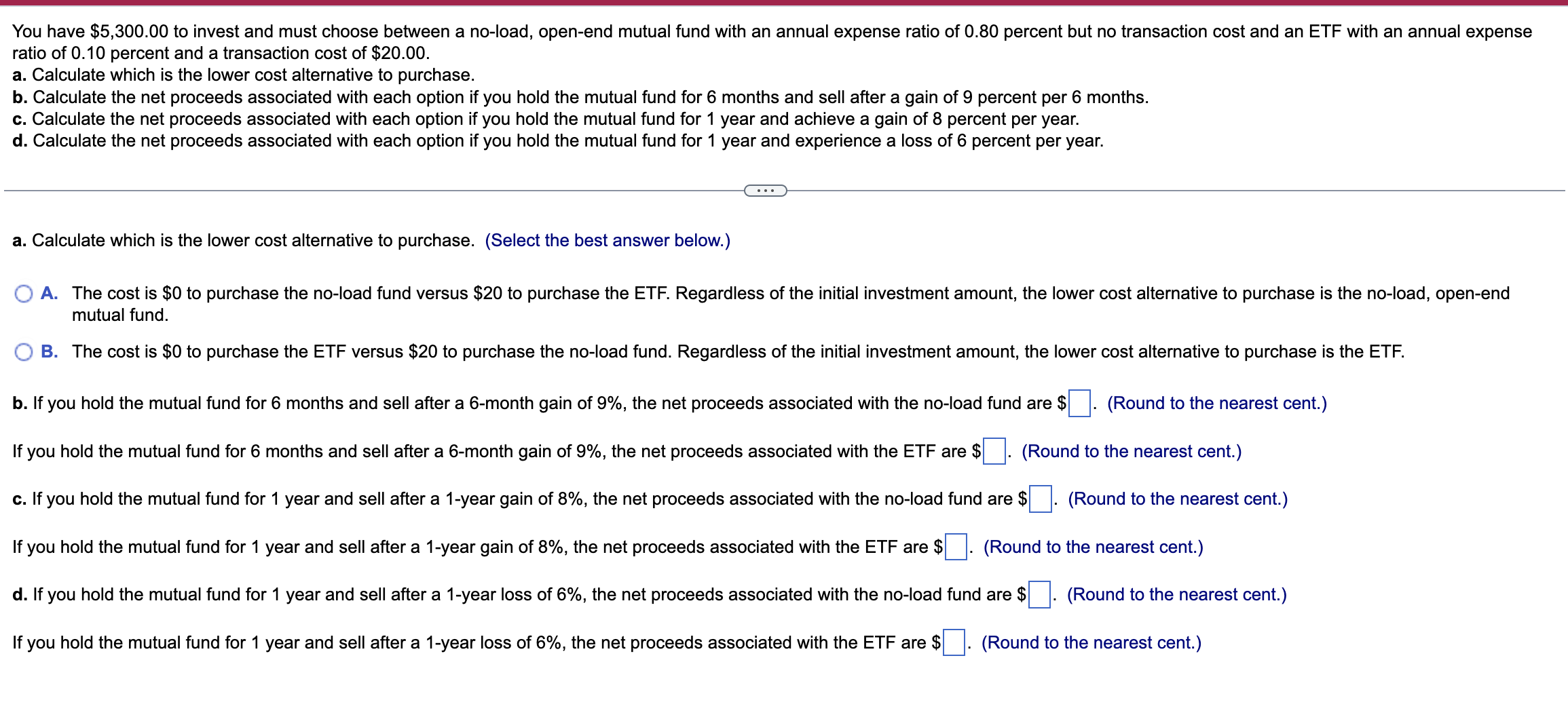

You have \\( \\$ 5,300.00 \\) to invest and must choose between a no-load, open-end mutual fund with an annual expense ratio of 0.80 percent but no transaction cost and an ETF with an annual expense ratio of 0.10 percent and a transaction cost of \\( \\$ 20.00 \\). a. Calculate which is the lower cost alternative to purchase. b. Calculate the net proceeds associated with each option if you hold the mutual fund for 6 months and sell after a gain of 9 percent per 6 months. c. Calculate the net proceeds associated with each option if you hold the mutual fund for 1 year and achieve a gain of 8 percent per year. d. Calculate the net proceeds associated with each option if you hold the mutual fund for 1 year and experience a loss of 6 percent per year. a. Calculate which is the lower cost alternative to purchase. (Select the best answer below.) A. The cost is \\( \\$ 0 \\) to purchase the no-load fund versus \\( \\$ 20 \\) to purchase the ETF. Regardless of the initial investment amount, the lower cost alternative to purchase is the no-load, open-end mutual fund. B. The cost is \\( \\$ 0 \\) to purchase the ETF versus \\( \\$ 20 \\) to purchase the no-load fund. Regardless of the initial investment amount, the lower cost alternative to purchase is the ETF. b. If you hold the mutual fund for 6 months and sell after a 6 -month gain of \9, the net proceeds associated with the no-load fund are \\( \\$ \\). (Round to the nearest cent.) If you hold the mutual fund for 6 months and sell after a 6-month gain of \9, the net proceeds associated with the ETF are \\( \\$ \\quad \\) (Round to the nearest cent.) c. If you hold the mutual fund for 1 year and sell after a 1 -year gain of \8, the net proceeds associated with the no-load fund are \\( \\$ \\quad \\) (Round to the nearest cent.) If you hold the mutual fund for 1 year and sell after a 1-year gain of \8, the net proceeds associated with the ETF are \\( \\$ \\quad \\) (Round to the nearest cent.) d. If you hold the mutual fund for 1 year and sell after a 1-year loss of \6, the net proceeds associated with the no-load fund are \\( \\$ \\). (Round to the nearest cent.) If you hold the mutual fund for 1 year and sell after a 1-year loss of \6, the net proceeds associated with the ETF are \\( \\$ \\quad \\) (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts