Question: please help with work MedLabs Co. manufactures a device that measures the oxygen concentration in patients' blood. This device is sold to hospitals and medical

please help with work

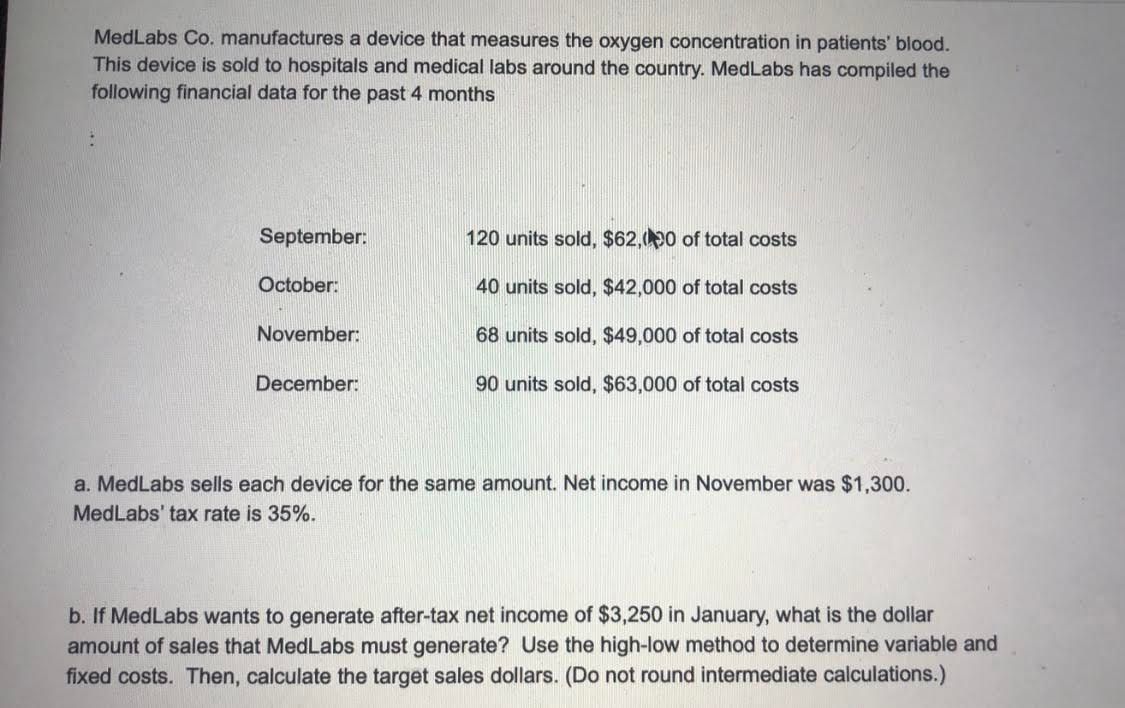

MedLabs Co. manufactures a device that measures the oxygen concentration in patients' blood. This device is sold to hospitals and medical labs around the country. MedLabs has compiled the following financial data for the past 4 months September: 120 units sold, $62,000 of total costs October: 40 units sold, $42,000 of total costs November: 68 units sold, $49,000 of total costs December: 90 units sold, $63,000 of total costs a. MedLabs sells each device for the same amount. Net income in November was $1,300. MedLabs' tax rate is 35%. b. If MedLabs wants to generate after-tax net income of $3,250 in January, what is the dollar amount of sales that MedLabs must generate? Use the high-low method to determine variable and fixed costs. Then, calculate the target sales dollars. (Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts