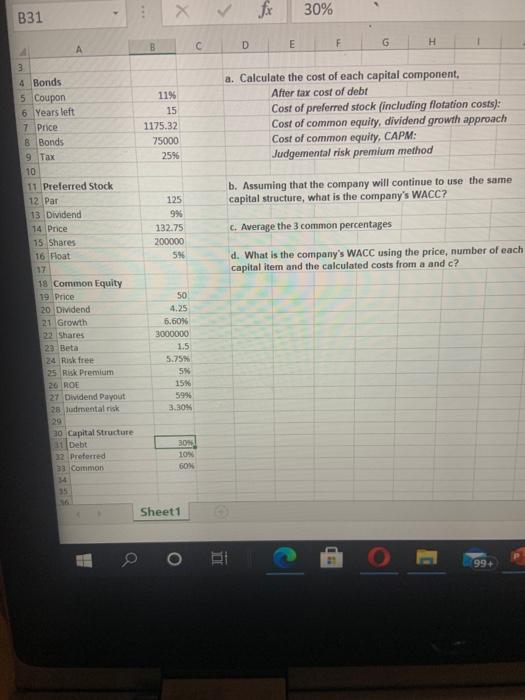

Question: please help X 30% B31 E B H D F G 1 A 11% 15 1175.32 75000 25% a. Calculate the cost of each capital

X 30% B31 E B H D F G 1 A 11% 15 1175.32 75000 25% a. Calculate the cost of each capital component, After tax cost of debt Cost of preferred stock (including flotation costs): Cost of common equity, dividend growth approach Cost of common equity, CAPM: Judgemental risk premium method b. Assuming that the company will continue to use the same capital structure, what is the company's WACC? 3 4 Bonds 5. Coupon 6 Years left 7 Price B Bonds 9 Tax 10 11 Preferred Stock 12 Par 13 Dividend 14 Price 15 Shares 16 Hot 17 18 Common Equity 19 Price 20 Dividend 21 Growth Shares 22 Beta 24 Risk free 35 Risk Premium 26 ROE 27 Dividend Payout 28 ludimental risk 125 996 132.75 200000 5% C Average the 3 common percentages d. What is the company's WACC using the price, number of each capital item and the calculated costs from a and c? 50 4.25 6.60% 3000000 1.5 5.75 SN 15% 59% 3.30 30 Capital Structure Debt 32 Preferred 33 Common 30 10 GON Sheet1 HE 994

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts