Question: please help You are evaluating a project that will cost $462,000, but is expected to produce cash flows of $120,000 per year for 10 years,

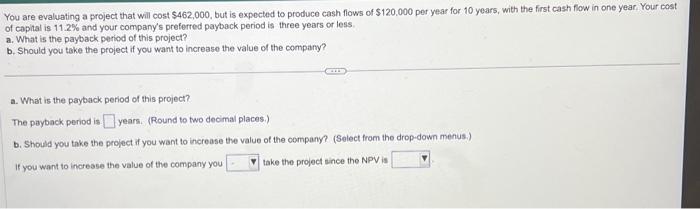

You are evaluating a project that will cost $462,000, but is expected to produce cash flows of $120,000 per year for 10 years, with the first cash fiow in one year, Your cost of copital is 11.2% and your company's preferted payback period is three years or less. a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company? a. What is the payback period of this project? The payback period is years. (Round to two decimal places.) b. Should you take the project if you want to increase the value of the company? (Select from the drop-down menus.) If you want to increase the value of the company you take the project since the NPV is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts