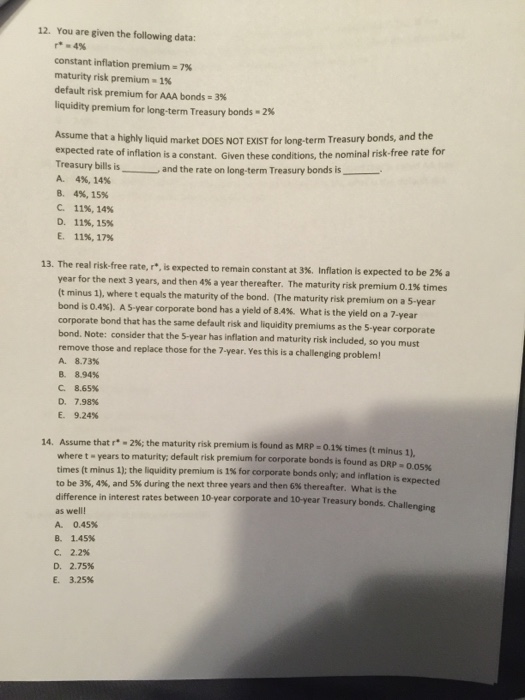

Question: Please help! You are given the following data: r*=4 percent constant inflation premium = 7 percent maturity risk premium =1percent default risk premium for AAA

You are given the following data: r*=4 percent constant inflation premium = 7 percent maturity risk premium =1percent default risk premium for AAA bonds = 3 percent liquidity premium for long-term Treasury bonds = 2 percent Assume that a highly liquid market DOES NOT EXIST for long-term Treasury bonds, and the expected rate of inflation is a constant. Given these conditions, the nominal risk-free rate for Treasury bills is and the rate on long term treasury bonds is 4 percent, 14 percent 4percent, 15 percent 11 percent, 14 percent 11 percent, 15 percent 11 percent, 17 percent The real risk free rate, r*, is expected to remain constant at 3 percent. Inflation is expected to be 2 percent a year for the next 3 years, and then 4 percent a year thereafter. The maturity risk premium 0.1 percent times (t minus 1), where t equals the maturity of the bond. (The maturity risk premium on a 5-year bond is 0.4 percent). A 5-year corporate bond has a yield of 8.4 percent What is the yield on a 7-year corporate bond that has the same default risk and liquidity premiums as the 5-year corporate bond. Note: consider that the 5-year has inflation and maturity risk included, so you must remove those and replace those for the 7-year. Yes this is a challenging problem 8.73 percent 8. 94 percent 8.65 percent 7.98 percent 9.24 percent Assume that r* = 2 percent: the maturity risk premium is found as MRP = 0.1 percent times (t minus 1) where t = years to maturity; default risk premium for corporate bonds is found as DRP = 0 05 percent times (t minus 1); the fluidity premium is 1 percent for corporate bonds only, and inflation is expected to be 3 percent, 4 percent and 5 percent during the next three years and then 6 percent thereafter. What is the difference in interest rates between 10 year corporate and 10-year Treasury bonds. Challenging as well! 0.45 percent 1.45 percent 2.2 percent 2.75 percent 3.25 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts