Question: please help You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice with expensive, high-tech equipment).

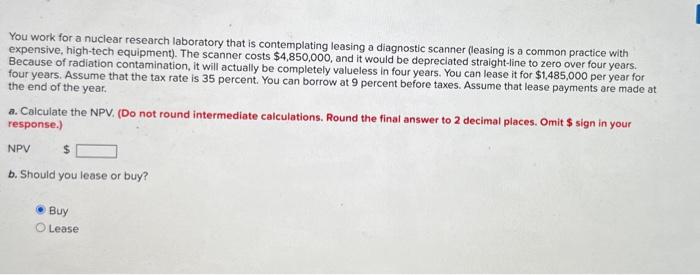

You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a common practice with expensive, high-tech equipment). The scanner costs $4,850,000, and it would be depreciated straight-line to zero over four years. Because of radiation contamination, it will actually be completely valueless in four years. You can lease it for $1,485,000 per year for four years. Assume that the tax rate is 35 percent. You can borrow at 9 percent before taxes. Assume that lease payments are made at the end of the year. a. Calculate the NPV, (Do not round intermediate caiculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV $ b. Should you lease or buy? Buy Lease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts