Question: PLEASE HELP Your client wants to know how much they will be able to spend on a house. They have an annual income of 5120,000

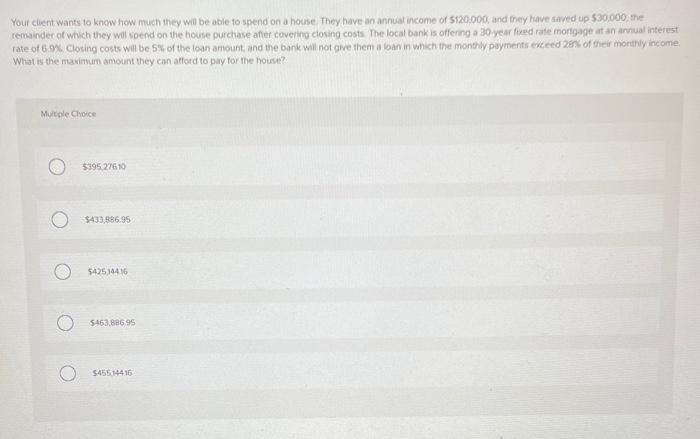

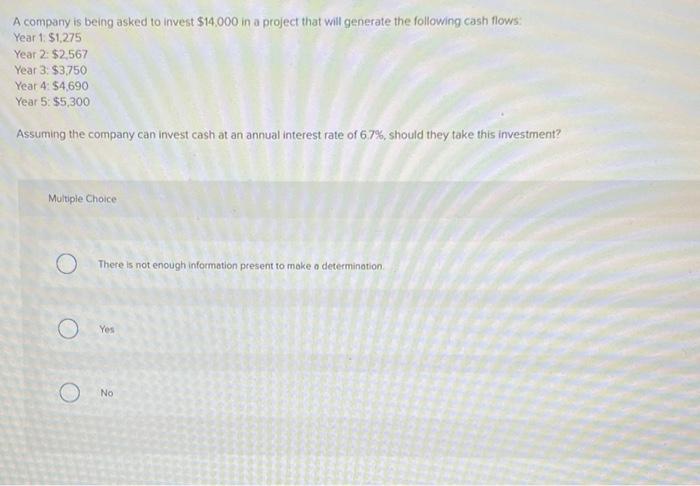

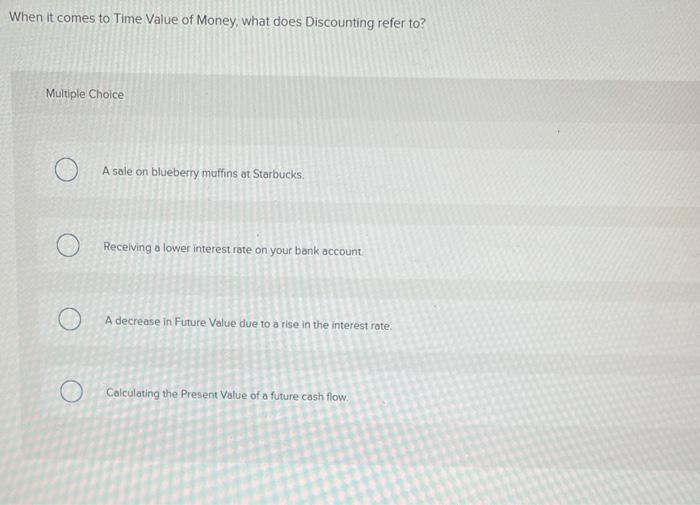

Your client wants to know how much they will be able to spend on a house. They have an annual income of 5120,000 , and they have saved up 530,000 , the remsinder of which they will spend on the house purchase after coveing ciosing cosis. The local bank is offerng a 30-year fixed rate mongage at an annual interest rate of 69%. Closing costs will be 5% of the loan amount, and the bank will not give them a loan in which the monthy peyments exceed 28x of their morthly income. What is the mavimum amount they can atford to pay for the house? Mutole Chose 539527610 \$433,886.95- $425144%6 5463,88695 345514416 A company is being asked to invest $14,000 in a project that will generate the following cash flows: Year 1: \$1,275 Year 2: $2.567 Year 3:$3.750 Year 4: $4,690 Year 5:$5,300 Assuming the company can invest cash at an annual interest rate of 67%, should they take this investment? Multiple Choice There is not enough information present to moke o determination. Yes No When it comes to Time Value of Money, what does Discounting refer to? Multiple Choice A sale on blueberry muffins ot Starbucks. Recelving o lower interest rate on your bank account. A decrease in Future Value due to a rise in the interest rate. Calculating the Present Value of a future cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts