Question: please help....its a tax research paper and it needs one case, one code, and one regulation... below is the problems and some answers and some

please help....its a tax research paper and it needs one case, one code, and one regulation... below is the problems and some answers and some hints...thank you so much

Code section 721, 704, 705

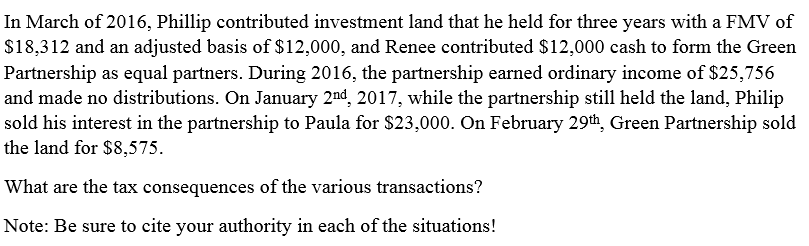

In March of 2016 Phillip contributed investment land that he held for three years with a FMV of $18,3 12 and an adjusted basis of $12,000, and Renee contributed $12,000 cash to form the Green Partnership as equal partners. During 2016, the partnership earned ordinary income of $25,756 and made no distributions. On January 2nd, 2017, while the partnership still held the land, Philip sold his interest in the partnership to Paula for $23,000. On February 29th, Green Partnership sold the land for $8,575 What are the tax consequences of the various transactions? Note: Be sure to cite your authority in each of the situations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts