Question: please helppp!! 1. A client with over $1 Million dollars in brokerage accounts comes to you for investment advice. The client currently has the following

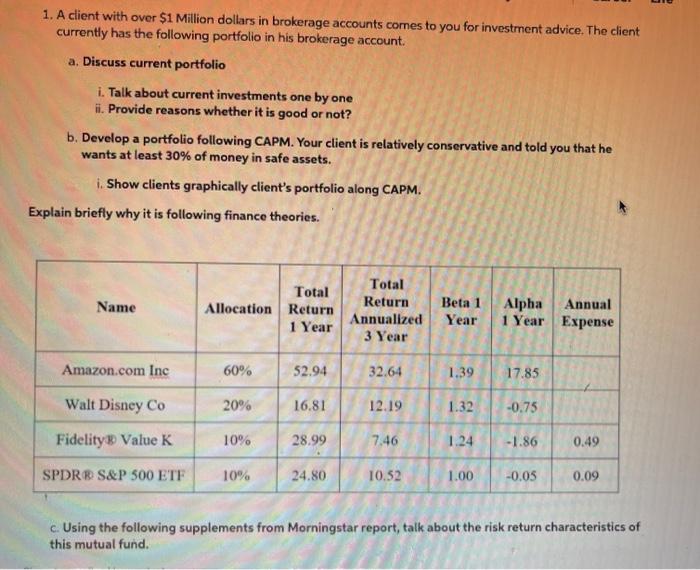

1. A client with over $1 Million dollars in brokerage accounts comes to you for investment advice. The client currently has the following portfolio in his brokerage account. a. Discuss current portfolio i. Talk about current investments one by one ii. Provide reasons whether it is good or not? b. Develop a portfolio following CAPM. Your client is relatively conservative and told you that he wants at least 30% of money in safe assets. i. Show clients graphically client's portfolio along CAPM. Explain briefly why it is following finance theories. Name Total Allocation Return 1 Year Total Return Annualized 3 Year Beta 1 Year Alpha Annual 1 Year Expense Amazon.com Inc 60% 52.94 32.64 1.39 17.85 Walt Disney Co 20% 16.81 12.19 1.32 -0.75 Fidelity Value K 10% 28.99 7.46 1.24 -1.86 0.49 SPDRE S&P 500 ETF 10% 24.80 10.52 1.00 -0.05 0.09 c. Using the following supplements from Morningstar report, talk about the risk return characteristics of this mutual fund. 1. A client with over $1 Million dollars in brokerage accounts comes to you for investment advice. The client currently has the following portfolio in his brokerage account. a. Discuss current portfolio i. Talk about current investments one by one ii. Provide reasons whether it is good or not? b. Develop a portfolio following CAPM. Your client is relatively conservative and told you that he wants at least 30% of money in safe assets. i. Show clients graphically client's portfolio along CAPM. Explain briefly why it is following finance theories. Name Total Allocation Return 1 Year Total Return Annualized 3 Year Beta 1 Year Alpha Annual 1 Year Expense Amazon.com Inc 60% 52.94 32.64 1.39 17.85 Walt Disney Co 20% 16.81 12.19 1.32 -0.75 Fidelity Value K 10% 28.99 7.46 1.24 -1.86 0.49 SPDRE S&P 500 ETF 10% 24.80 10.52 1.00 -0.05 0.09 c. Using the following supplements from Morningstar report, talk about the risk return characteristics of this mutual fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts