Question: Urgent, need help! A client with over $1 Million dollars in brokerage accounts comes to you for investment advice. The client currently has the following

Urgent, need help!

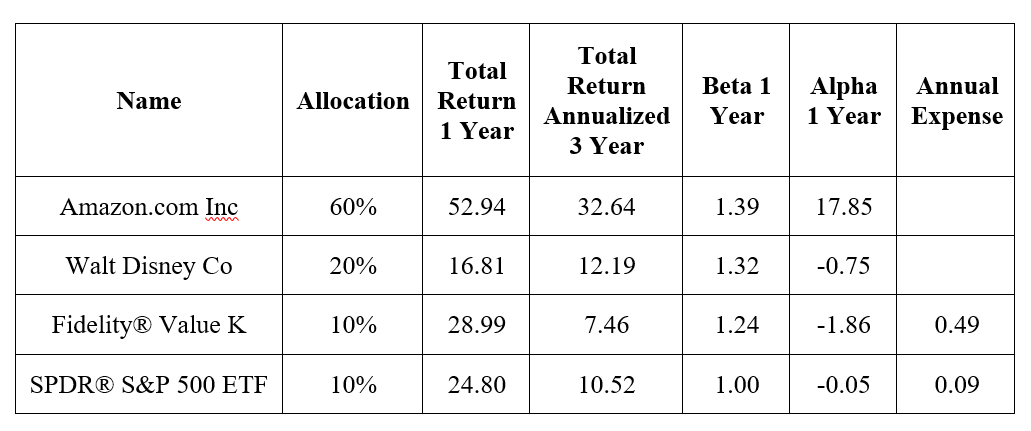

- A client with over $1 Million dollars in brokerage accounts comes to you for investment advice. The client currently has the following portfolio in his brokerage account.

- Discuss current portfolio

- Talk about current investments one by one

- Provide reasons whether it is good or not?

- Develop a portfolio following CAPM. Your client is relatively conservative and told you that he wants at least 30% of money in safe assets.

- Show clients graphically clients portfolio along CAPM.

- Discuss current portfolio

Explain briefly why it is following finance theories.

- c. Using the following supplements from Morningstar report, talk about the risk return characteristics of this mutual fund.

Name Allocation Total Return 1 Year Total Return Annualized 3 Year Beta 1 Year Alpha Annual 1 Year Expense Amazon.com Inc 60% 52.94 32.64 1.39 17.85 Walt Disney Co 20% 16.81 12.19 1.32 -0.75 Fidelity Value K 10% 28.99 7.46 1.24 -1.86 0.49 SPDR S&P 500 ETF 10% 24.80 10.52 1.00 -0.05 0.09 Name Allocation Total Return 1 Year Total Return Annualized 3 Year Beta 1 Year Alpha Annual 1 Year Expense Amazon.com Inc 60% 52.94 32.64 1.39 17.85 Walt Disney Co 20% 16.81 12.19 1.32 -0.75 Fidelity Value K 10% 28.99 7.46 1.24 -1.86 0.49 SPDR S&P 500 ETF 10% 24.80 10.52 1.00 -0.05 0.09

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts