Question: Please help.Thank you. 1. 2. 3. 1 pts Question 2 You have $13,919 to invest in a stock portfolio. Your choices are Stock X with

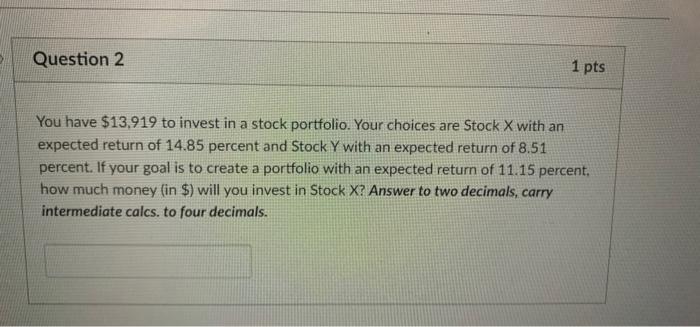

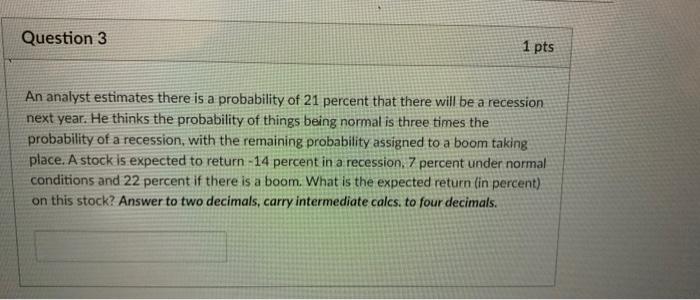

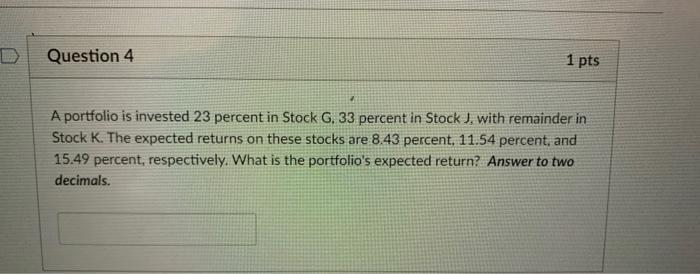

1 pts Question 2 You have $13,919 to invest in a stock portfolio. Your choices are Stock X with an expected return of 14.85 percent and Stock Y with an expected return of 8.51 percent. If your goal is to create a portfolio with an expected return of 11.15 percent, how much money (in $) will you invest in Stock X? Answer to two decimals, carry intermediate calcs. to four decimals. Question 3 1 pts An analyst estimates there is a probability of 21 percent that there will be a recession next year. He thinks the probability of things being normal is three times the probability of a recession, with the remaining probability assigned to a boom taking place. A stock is expected to return -14 percent in a recession, 7 percent under normal conditions and 22 percent if there is a boom. What is the expected return (in percent) on this stock? Answer to two decimals, carry intermediate calcs, to four decimals. Question 4 1 pts A portfolio is invested 23 percent in Stock G, 33 percent in Stock J, with remainder in Stock K. The expected returns on these stocks are 8.43 percent, 11.54 percent, and 15.49 percent, respectively. What is the portfolio's expected return? Answer to two decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts