Question: please hurry Choose the correct statement An increase in interest rates increases the demand for loanable funds. According to the liquidity premium theory, investors preferring

please hurry

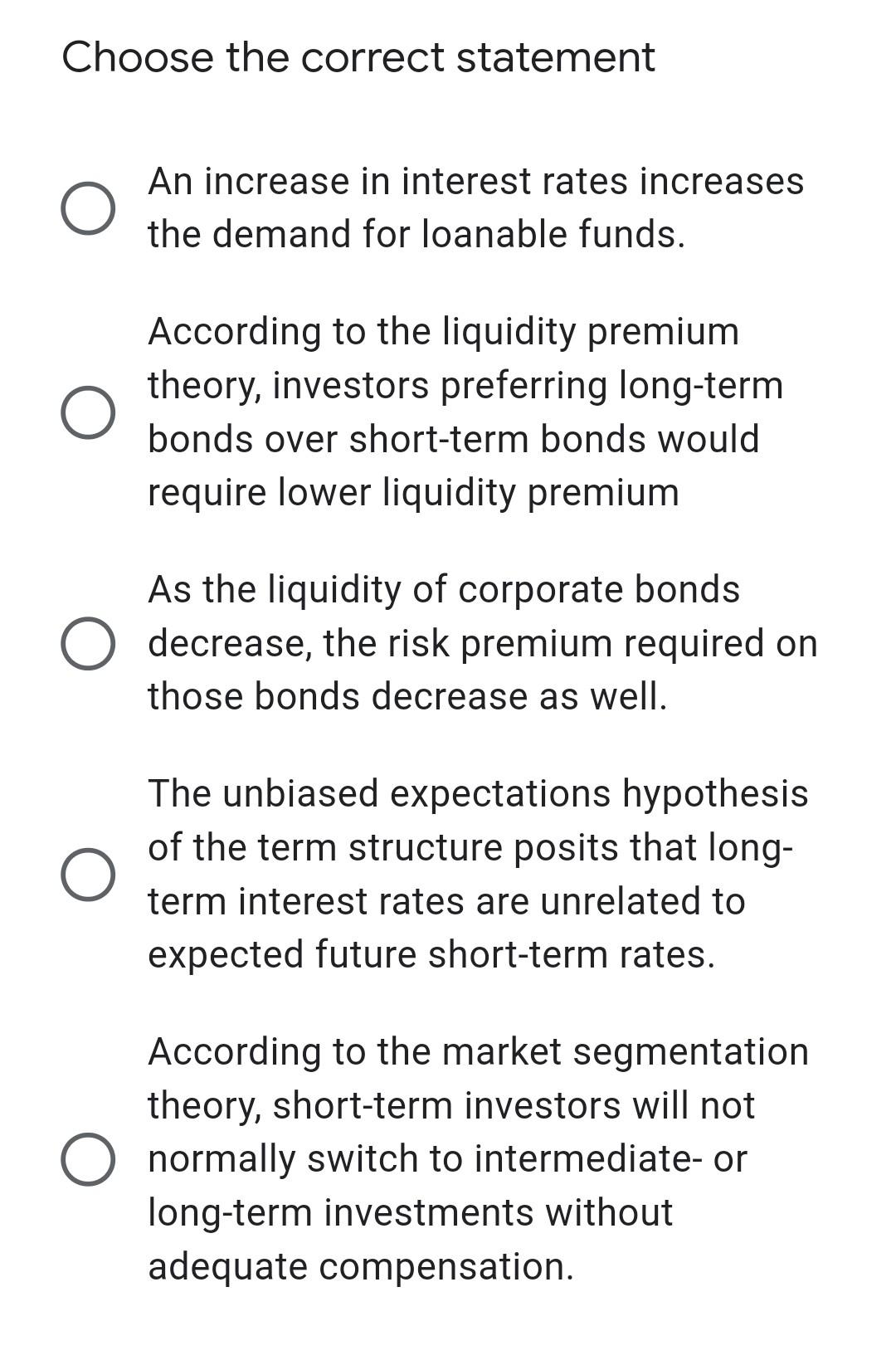

Choose the correct statement An increase in interest rates increases the demand for loanable funds. According to the liquidity premium theory, investors preferring long-term bonds over short-term bonds would require lower liquidity premium As the liquidity of corporate bonds decrease, the risk premium required on those bonds decrease as well. The unbiased expectations hypothesis of the term structure posits that long- term interest rates are unrelated to expected future short-term rates. According to the market segmentation theory, short-term investors will not normally switch to intermediate-or long-term investments without adequate compensation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts