Question: please hurry, the answer choices are all the same Note: This problem relates to preparing the statement of cash flows (SCF) under the indirect method.

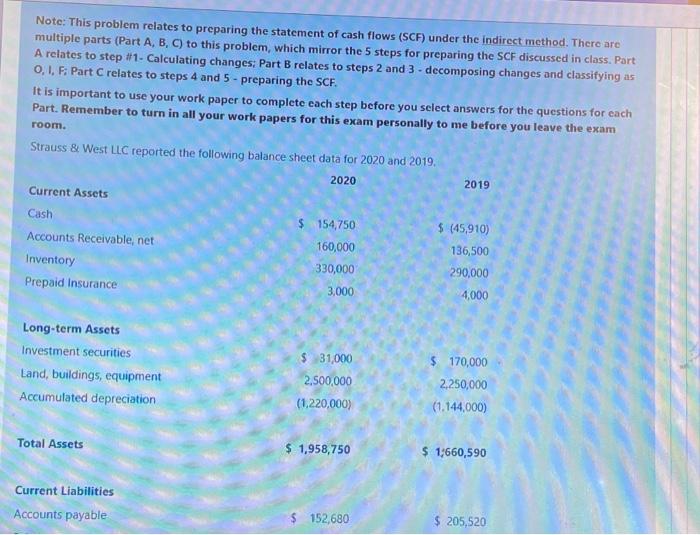

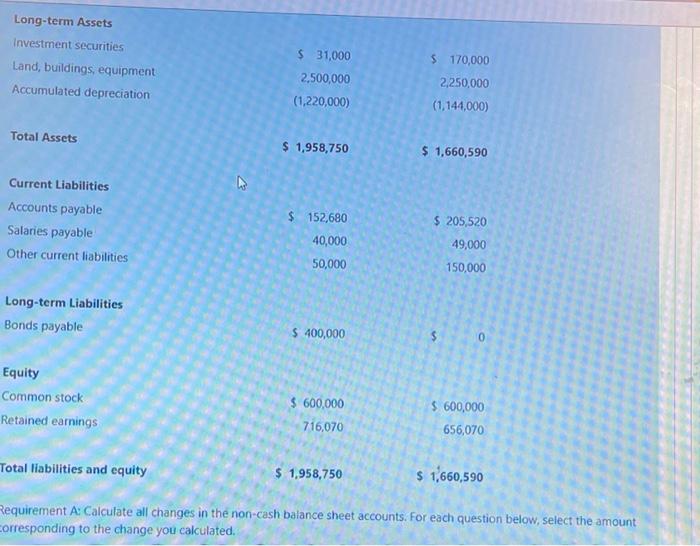

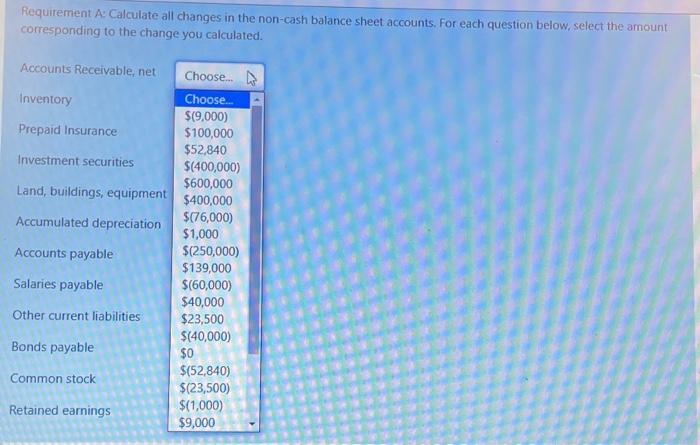

Note: This problem relates to preparing the statement of cash flows (SCF) under the indirect method. There are multiple parts (Part A, B, C) to this problem, which mirror the 5 steps for preparing the SCF discussed in class. Part A relates to step #1- Calculating changes: Part B relates to steps 2 and 3 - decomposing changes and classifying as 0,1,FPart Crelates to steps 4 and 5 - preparing the SCF. It is important to use your work paper to complete each step before you select answers for the questions for each Part. Remember to turn in all your work papers for this exam personally to me before you leave the exam room. Strauss & West LLC reported the following balance sheet data for 2020 and 2019, 2020 2019 Current Assets Cash $ 154,750 $ (45,910) Accounts Receivable, net 160,000 136,500 Inventory 330,000 290,000 Prepaid Insurance 3,000 4,000 Long-term Assets Investment securities Land, buildings, equipment Accumulated depreciation $ 31,000 2.500,000 (1,220,000) $ 170,000 2,250,000 (1.144,000) Total Assets $ 1,958,750 $ 1:660,590 Current Liabilities Accounts payable 152,680 $ 205,520 Long-term Assets Investment securities Land, buildings, equipment Accumulated depreciation $ 31,000 2,500,000 (1,220,000) $ 170,000 2,250,000 (1,144,000) Total Assets $ 1,958,750 $ 1,660,590 Current Liabilities Accounts payable Salaries payable $ 152,680 40,000 50,000 205,520 49,000 150,000 Other current liabilities Long-term Liabilities Bonds payable $ 400,000 0 Equity Common stock Retained earnings $ 600,000 716,070 $ 600,000 656,070 Total liabilities and equity $ 1,958,750 $ 1,660,590 Requirement A: Calculate all changes in the non-cash balance sheet accounts. For each question below, select the amount corresponding to the change you calculated. Requirement A Calculate all changes in the non-cash balance sheet accounts. For each question below, select the amount corresponding to the change you calculated. Accounts Receivable.net Inventory Prepaid Insurance Investment securities Land, buildings, equipment Accumulated depreciation Accounts payable Choose.. Choose. $(9.000) $100,000 $52,840 $(400,000) $600,000 $400,000 $(76,000) $1,000 $(250,000) $139,000 $(60,000) $40,000 $23,500 $(40,000) $0 $(52,840) $(23,500) $(1,000) $9,000 Salaries payable Other current liabilities Bonds payable Common stock Retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts