Question: Please I am stuck with these questions can u help me as soon as possible, please please Question 1 (0.2 points) You want to buy

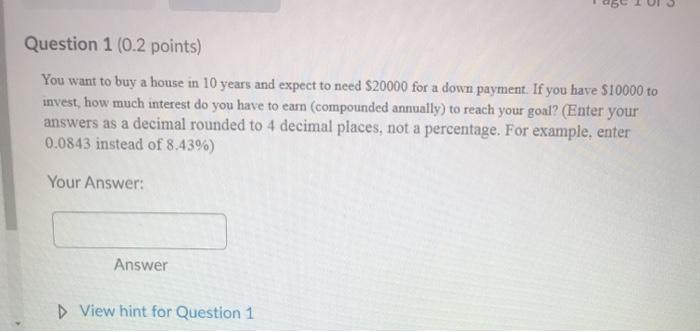

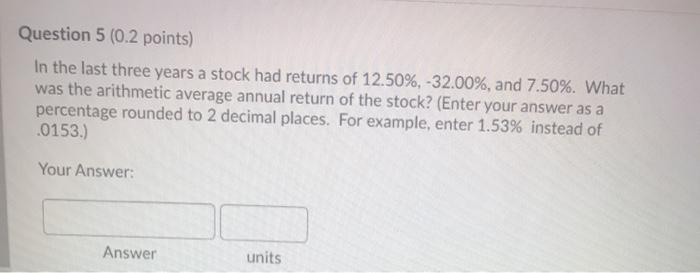

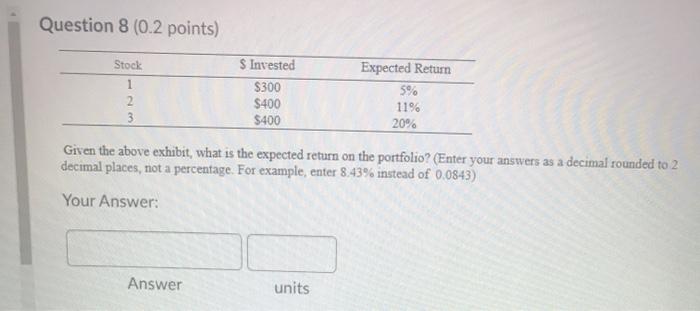

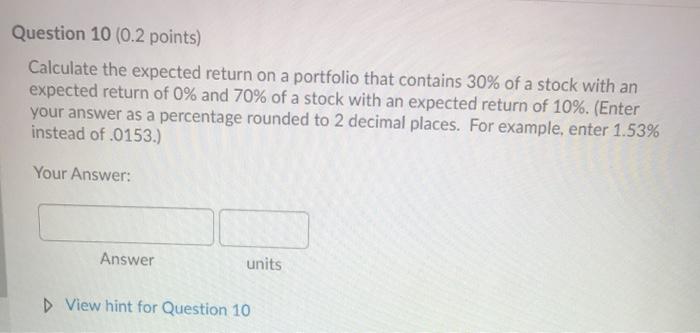

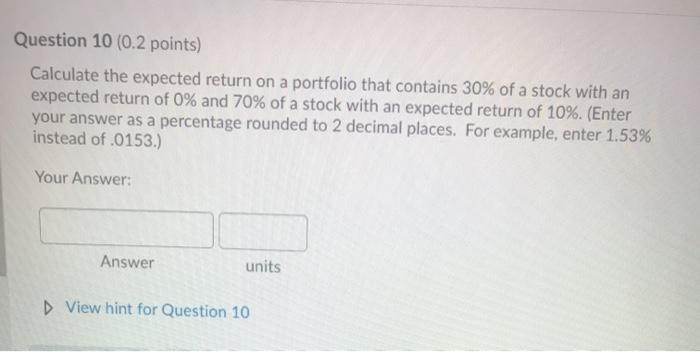

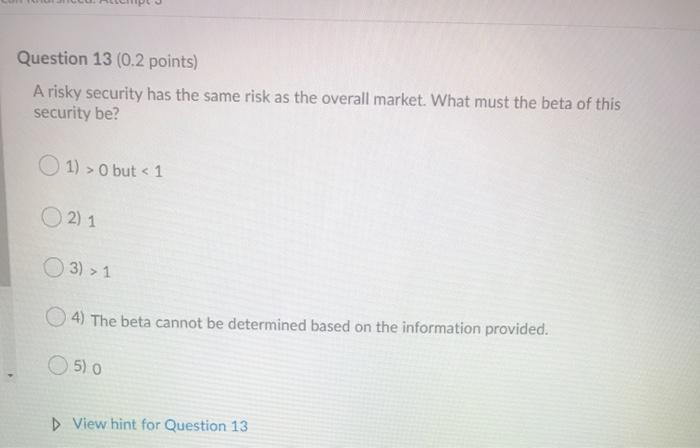

Question 1 (0.2 points) You want to buy a house in 10 years and expect to need $20000 for a down payment. If you have $10000 to invest, how much interest do you have to earn (compounded annually) to reach your goal? (Enter your answers as a decimal rounded to 4 decimal places, not a percentage. For example, enter 0.0843 instead of 8.43%) Your Answer: Answer View hint for Question 1 Question 5 (0.2 points) In the last three years a stock had returns of 12.50%, -32.00%, and 7.50%. What was the arithmetic average annual return of the stock? (Enter your answer as a percentage rounded to 2 decimal places. For example, enter 1.53% instead of .0153.) Your Answer: Answer units Question 8 (0.2 points) Stock 1 2 3 $ Invested $300 $400 $400 Expected Return 5% 11% 20% Given the above exhibit, what is the expected return on the portfolio? (Enter your answers as a decimal rounded to 2 decimal places, not a percentage. For example, enter 8.43% instead of 0.0843) Your Answer: Answer units Question 10 (0.2 points) Calculate the expected return on a portfolio that contains 30% of a stock with an expected return of 0% and 70% of a stock with an expected return of 10%. (Enter your answer as a percentage rounded to 2 decimal places. For example, enter 1.53% instead of .0153.) Your Answer: Answer units D View hint for Question 10 Question 10 (0.2 points) Calculate the expected return on a portfolio that contains 30% of a stock with an expected return of 0% and 70% of a stock with an expected return of 10%. (Enter your answer as a percentage rounded to 2 decimal places. For example, enter 1.53% instead of .0153.) Your Answer: Answer units D View hint for Question 10 Question 13 (0.2 points) A risky security has the same risk as the overall market. What must the beta of this security be? 1) > Obut 1 4) The beta cannot be determined based on the information provided. 5) D View hint for Question 13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts