Question: please answer me question 9 and 10 because it is Link to each other please fast as soon as possible Use the following information for

please answer me question 9 and 10 because it is Link to each other please fast as soon as possible

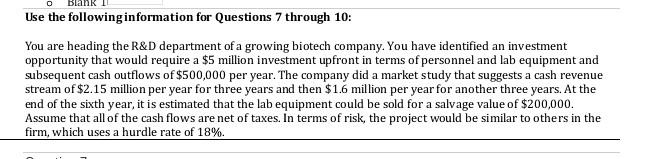

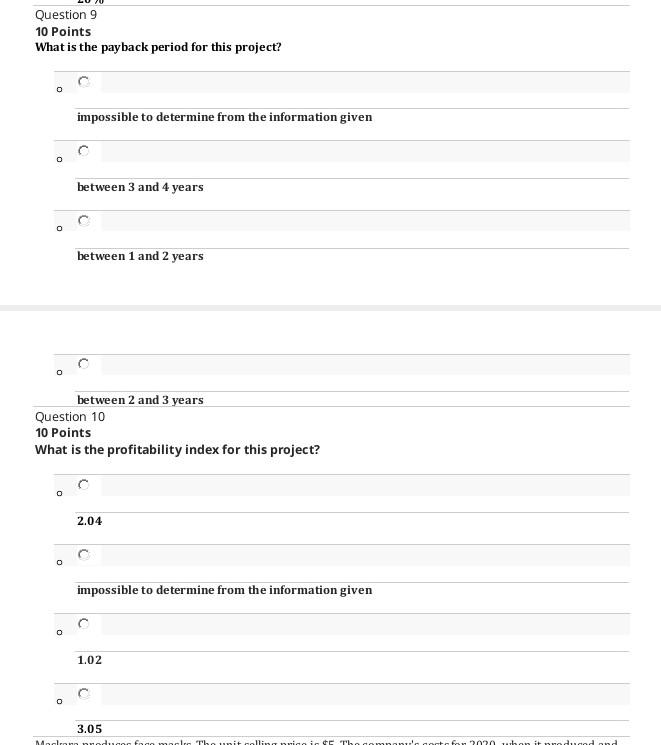

Use the following information for Questions 7 through 10: You are heading the R&D department of a growing biotech company. You have identified an investment opportunity that would require a $5 million investment upfront in terms of personnel and lab equipment and subsequent cash outflows of $500,000 per year. The company did a market study that suggests a cash revenue stream of $2.15 million per year for three years and then $1.6 million per year for another three years. At the end of the sixth year, it is estimated that the lab equipment could be sold for a salvage value of $200,000. Assume that all of the cash flows are net of taxes. In terms of risk, the project would be similar to others in the firm, which uses a hurdle rate of 18%. Question 9 10 Points What is the payback period for this project? 0 impossible to determine from the information given 0 between 3 and 4 years O between 1 and 2 years between 2 and 3 years Question 10 10 Points What is the profitability index for this project? o 2.04 O impossible to determine from the information given O 1.02 o 3.05 More noduce Tuit lisici 02 ansit roduced and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts