Question: PLEASE I DO NOT HAVE MUCH TIME I ONLY HAVE 2 HOURS TO ANSWER IT PLEASE BE HURRY THANKS. QUESTION 4 (20 MARKS: 36 MINUTES)

PLEASE I DO NOT HAVE MUCH TIME I ONLY HAVE 2 HOURS TO ANSWER IT PLEASE BE HURRY

THANKS.

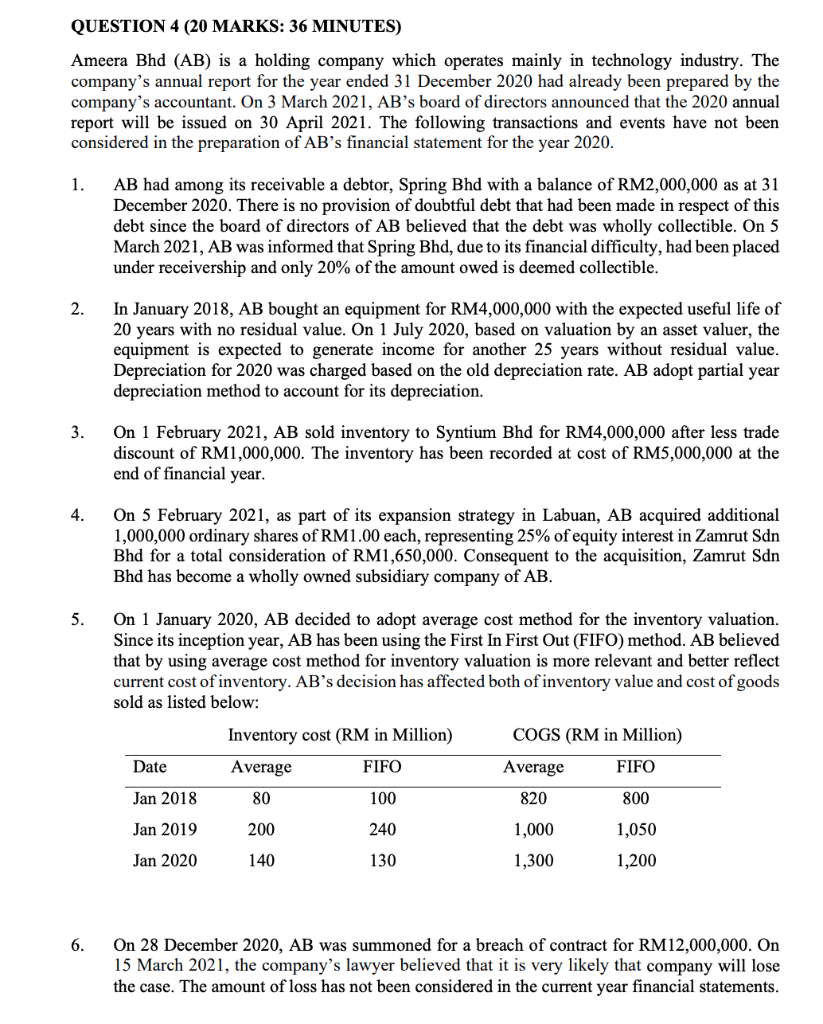

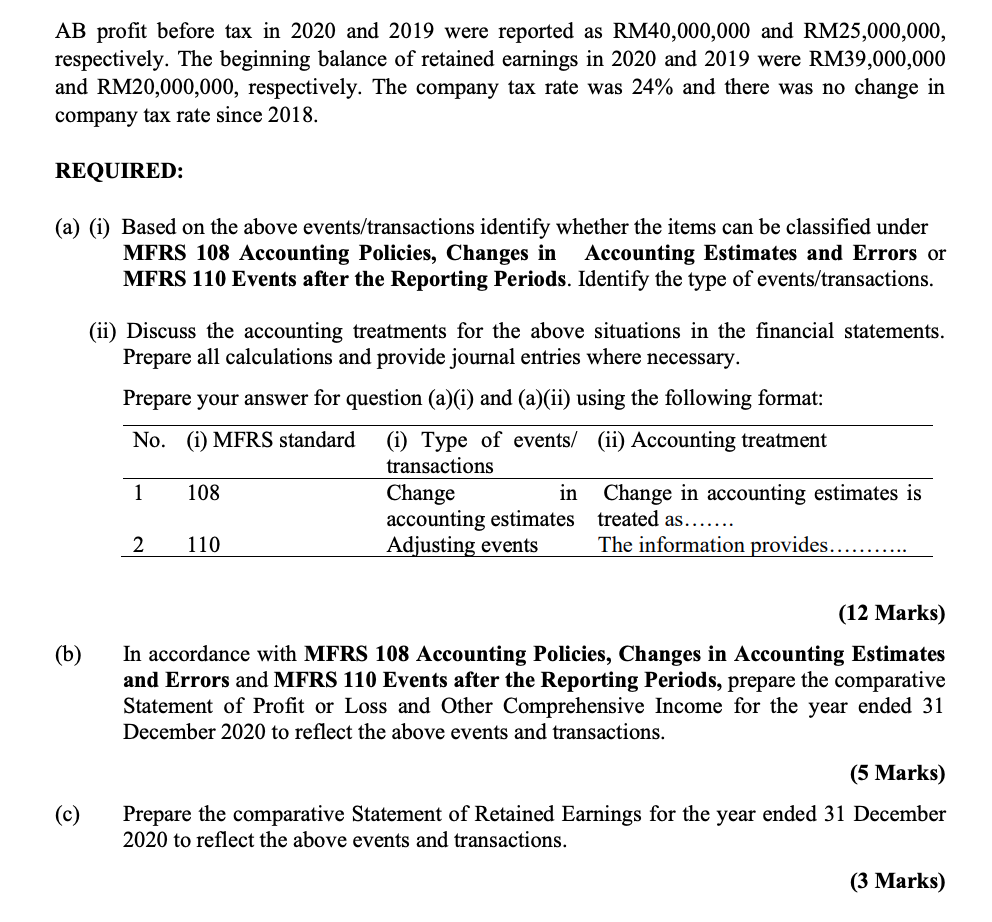

QUESTION 4 (20 MARKS: 36 MINUTES) Ameera Bhd (AB) is a holding company which operates mainly in technology industry. The company's annual report for the year ended 31 December 2020 had already been prepared by the company's accountant. On 3 March 2021, AB's board of directors announced that the 2020 annual report will be issued on 30 April 2021. The following transactions and events have not been considered in the preparation of AB's financial statement for the year 2020. 1. AB had among its receivable a debtor, Spring Bhd with a balance of RM2,000,000 as at 31 December 2020. There is no provision of doubtful debt that had been made in respect of this debt since the board of directors of AB believed that the debt was wholly collectible. On 5 March 2021, AB was informed that Spring Bhd, due to its financial difficulty, had been placed under receivership and only 20% of the amount owed is deemed collectible. 2. In January 2018, AB bought an equipment for RM4,000,000 with the expected useful life of 20 years with no residual value. On 1 July 2020, based on valuation by an asset valuer, the equipment is expected to generate income for another 25 years without residual value. Depreciation for 2020 was charged based on the old depreciation rate. AB adopt partial year depreciation method to account for its depreciation. 3. On 1 February 2021, AB sold inventory to Syntium Bhd for RM4,000,000 after less trade discount of RM1,000,000. The inventory has been recorded at cost of RM5,000,000 at the end of financial year. 4. On 5 February 2021, as part of its expansion strategy in Labuan, AB acquired additional 1,000,000 ordinary shares of RM1.00 each, representing 25% of equity interest in Zamrut Sdn Bhd for a total consideration of RM1,650,000. Consequent to the acquisition, Zamrut Sdn Bhd has become a wholly owned subsidiary company of AB. 5. On 1 January 2020, AB decided to adopt average cost method for the inventory valuation. Since its inception year, AB has been using the First In First Out (FIFO) method. AB believed that by using average cost method for inventory valuation is more relevant and better reflect current cost of inventory. AB's decision has affected both of inventory value and cost of goods sold as listed below: Inventory cost (RM in Million) COGS (RM in Million) Date Average FIFO Average FIFO Jan 2018 80 100 820 800 Jan 2019 200 240 1,000 1,050 1,200 Jan 2020 140 130 1,300 6. On 28 December 2020, AB was summoned for a breach of contract for RM12,000,000. On 15 March 2021, the company's lawyer believed that it is very likely that company will lose the case. The amount of loss has not been considered in the current year financial statements. AB profit before tax in 2020 and 2019 were reported as RM40,000,000 and RM25,000,000, respectively. The beginning balance of retained earnings in 2020 and 2019 were RM39,000,000 and RM20,000,000, respectively. The company tax rate was 24% and there was no change in company tax rate since 2018. REQUIRED: (a) (i) Based on the above events/transactions identify whether the items can be classified under MFRS 108 Accounting Policies, Changes in Accounting Estimates and Errors or MFRS 110 Events after the Reporting Periods. Identify the type of events/transactions. (ii) Discuss the accounting treatments for the above situations in the financial statements. Prepare all calculations and provide journal entries where necessary. Prepare your answer for question (a)(i) and (a)(ii) using the following format: No. (i) MFRS standard (i) Type of events/ (ii) Accounting treatment transactions 1 108 Change in Change in accounting estimates is accounting estimates treated as....... 2 110 Adjusting events The information provides... (12 Marks) (b) In accordance with MFRS 108 Accounting Policies, Changes in Accounting Estimates and Errors and MFRS 110 Events after the Reporting Periods, prepare the comparative Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2020 to reflect the above events and transactions. (c ) (5 Marks) Prepare the comparative Statement of Retained Earnings for the year ended 31 December 2020 to reflect the above events and transactions. (3 Marks) QUESTION 4 (20 MARKS: 36 MINUTES) Ameera Bhd (AB) is a holding company which operates mainly in technology industry. The company's annual report for the year ended 31 December 2020 had already been prepared by the company's accountant. On 3 March 2021, AB's board of directors announced that the 2020 annual report will be issued on 30 April 2021. The following transactions and events have not been considered in the preparation of AB's financial statement for the year 2020. 1. AB had among its receivable a debtor, Spring Bhd with a balance of RM2,000,000 as at 31 December 2020. There is no provision of doubtful debt that had been made in respect of this debt since the board of directors of AB believed that the debt was wholly collectible. On 5 March 2021, AB was informed that Spring Bhd, due to its financial difficulty, had been placed under receivership and only 20% of the amount owed is deemed collectible. 2. In January 2018, AB bought an equipment for RM4,000,000 with the expected useful life of 20 years with no residual value. On 1 July 2020, based on valuation by an asset valuer, the equipment is expected to generate income for another 25 years without residual value. Depreciation for 2020 was charged based on the old depreciation rate. AB adopt partial year depreciation method to account for its depreciation. 3. On 1 February 2021, AB sold inventory to Syntium Bhd for RM4,000,000 after less trade discount of RM1,000,000. The inventory has been recorded at cost of RM5,000,000 at the end of financial year. 4. On 5 February 2021, as part of its expansion strategy in Labuan, AB acquired additional 1,000,000 ordinary shares of RM1.00 each, representing 25% of equity interest in Zamrut Sdn Bhd for a total consideration of RM1,650,000. Consequent to the acquisition, Zamrut Sdn Bhd has become a wholly owned subsidiary company of AB. 5. On 1 January 2020, AB decided to adopt average cost method for the inventory valuation. Since its inception year, AB has been using the First In First Out (FIFO) method. AB believed that by using average cost method for inventory valuation is more relevant and better reflect current cost of inventory. AB's decision has affected both of inventory value and cost of goods sold as listed below: Inventory cost (RM in Million) COGS (RM in Million) Date Average FIFO Average FIFO Jan 2018 80 100 820 800 Jan 2019 200 240 1,000 1,050 1,200 Jan 2020 140 130 1,300 6. On 28 December 2020, AB was summoned for a breach of contract for RM12,000,000. On 15 March 2021, the company's lawyer believed that it is very likely that company will lose the case. The amount of loss has not been considered in the current year financial statements. AB profit before tax in 2020 and 2019 were reported as RM40,000,000 and RM25,000,000, respectively. The beginning balance of retained earnings in 2020 and 2019 were RM39,000,000 and RM20,000,000, respectively. The company tax rate was 24% and there was no change in company tax rate since 2018. REQUIRED: (a) (i) Based on the above events/transactions identify whether the items can be classified under MFRS 108 Accounting Policies, Changes in Accounting Estimates and Errors or MFRS 110 Events after the Reporting Periods. Identify the type of events/transactions. (ii) Discuss the accounting treatments for the above situations in the financial statements. Prepare all calculations and provide journal entries where necessary. Prepare your answer for question (a)(i) and (a)(ii) using the following format: No. (i) MFRS standard (i) Type of events/ (ii) Accounting treatment transactions 1 108 Change in Change in accounting estimates is accounting estimates treated as....... 2 110 Adjusting events The information provides... (12 Marks) (b) In accordance with MFRS 108 Accounting Policies, Changes in Accounting Estimates and Errors and MFRS 110 Events after the Reporting Periods, prepare the comparative Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2020 to reflect the above events and transactions. (c ) (5 Marks) Prepare the comparative Statement of Retained Earnings for the year ended 31 December 2020 to reflect the above events and transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts