Question: please i have limited time solve it asap Case Study-1 ABC Inc. is a Corporation with a focus on Garment and textile manufacturing in the

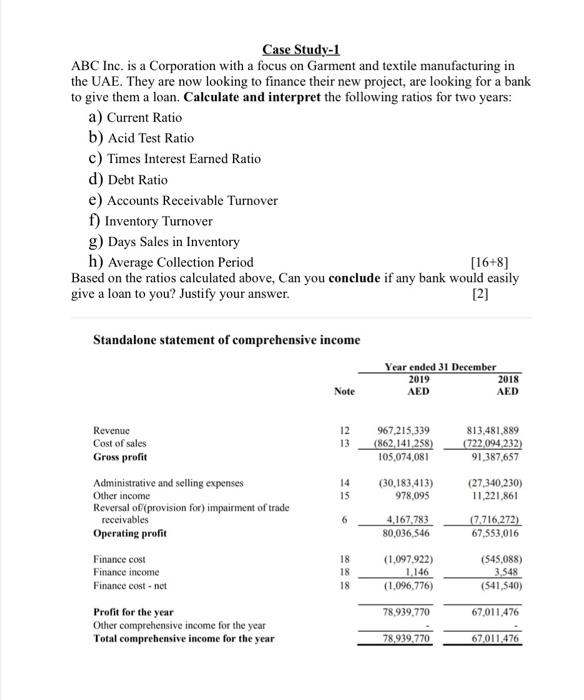

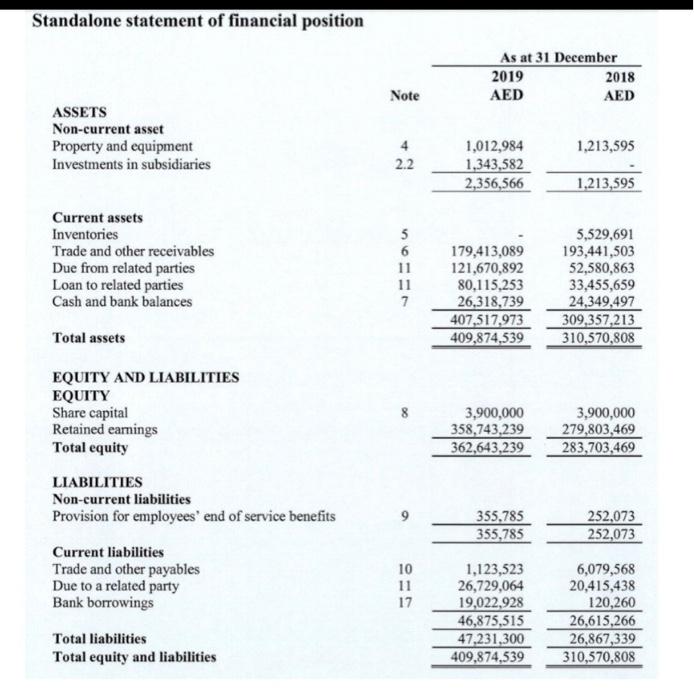

Case Study-1 ABC Inc. is a Corporation with a focus on Garment and textile manufacturing in the UAE. They are now looking to finance their new project, are looking for a bank to give them a loan. Calculate and interpret the following ratios for two years: a) Current Ratio b) Acid Test Ratio c) Times Interest Earned Ratio d) Debt Ratio e) Accounts Receivable Turnover f) Inventory Turnover g) Days Sales in Inventory h) Average Collection Period [16+8] Based on the ratios calculated above, Can you conclude if any bank would easily give a loan to you? Justify your answer. [2] Standalone statement of comprehensive income S CASE STUDY 1 ABC Inc, is a corporation with a focus on Garnent and textile manufacturing in the UAE, They are now looking to finance their new project, ate looking for a bank to give them a loan, Calculate and interpret the following ratios for two years. Determine whether the rise or fall of the following ratios is a good sign or a bad sign. (8+4+2=14 marks) a. Current Ratio b. Times Interest Earned Ratio e. Accounts Receivable Turnover d. Days Sales in Inventory Note: Piease find the financiaf statements fies in the course document. Case Study-1 ABC Inc. is a Corporation with a focus on Garment and textile manufacturing in the UAE. They are now looking to finance their new project, are looking for a bank to give them a loan. Calculate and interpret the following ratios for two years: a) Current Ratio b) Acid Test Ratio c) Times Interest Earned Ratio d) Debt Ratio e) Accounts Receivable Turnover f) Inventory Turnover g) Days Sales in Inventory h) Average Collection Period [16+8] Based on the ratios calculated above, Can you conclude if any bank would easily give a loan to you? Justify your answer. [2] Standalone statement of comprehensive income S CASE STUDY 1 ABC Inc, is a corporation with a focus on Garnent and textile manufacturing in the UAE, They are now looking to finance their new project, ate looking for a bank to give them a loan, Calculate and interpret the following ratios for two years. Determine whether the rise or fall of the following ratios is a good sign or a bad sign. (8+4+2=14 marks) a. Current Ratio b. Times Interest Earned Ratio e. Accounts Receivable Turnover d. Days Sales in Inventory Note: Piease find the financiaf statements fies in the course document

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts