Question: s New R... 14 AA- Aa Bbcode AaB X, X . A Normal NO Case Study ABC Inc. is a Corporation with a focus on

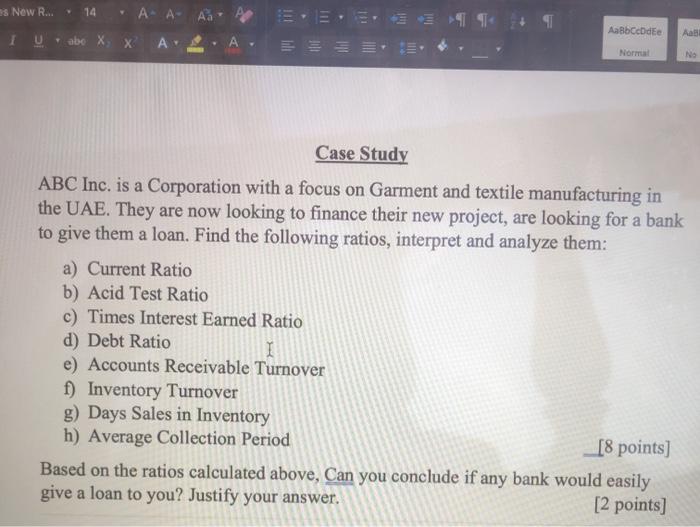

s New R... 14 AA- Aa Bbcode AaB X, X . A Normal NO Case Study ABC Inc. is a Corporation with a focus on Garment and textile manufacturing in the UAE. They are now looking to finance their new project, are looking for a bank to give them a loan. Find the following ratios, interpret and analyze them: a) Current Ratio b) Acid Test Ratio c) Times Interest Earned Ratio d) Debt Ratio I e) Accounts Receivable Turnover f) Inventory Turnover g) Days Sales in Inventory h) Average Collection Period [8 points) Based on the ratios calculated above, Can you conclude if any bank would easily give a loan to you? Justify your answer. [2 points) s New R... 14 AA- Aa Bbcode AaB X, X . A Normal NO Case Study ABC Inc. is a Corporation with a focus on Garment and textile manufacturing in the UAE. They are now looking to finance their new project, are looking for a bank to give them a loan. Find the following ratios, interpret and analyze them: a) Current Ratio b) Acid Test Ratio c) Times Interest Earned Ratio d) Debt Ratio I e) Accounts Receivable Turnover f) Inventory Turnover g) Days Sales in Inventory h) Average Collection Period [8 points) Based on the ratios calculated above, Can you conclude if any bank would easily give a loan to you? Justify your answer. [2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts