Question: please I need 100% correct answer will be upvote A risk manager is considering buying a $1,000 face value, semi-annual coupon bond with a quoted

please I need 100% correct answer will be upvote

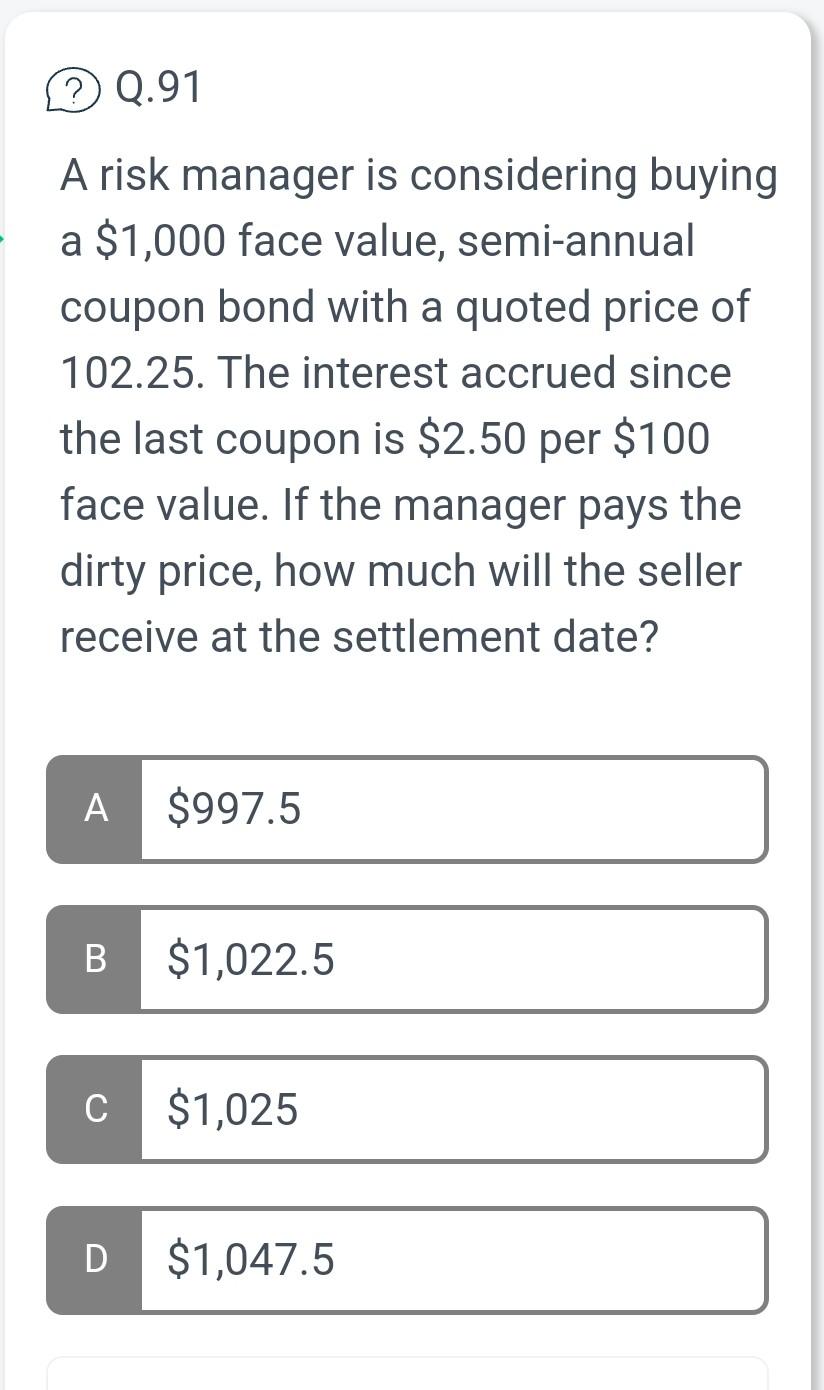

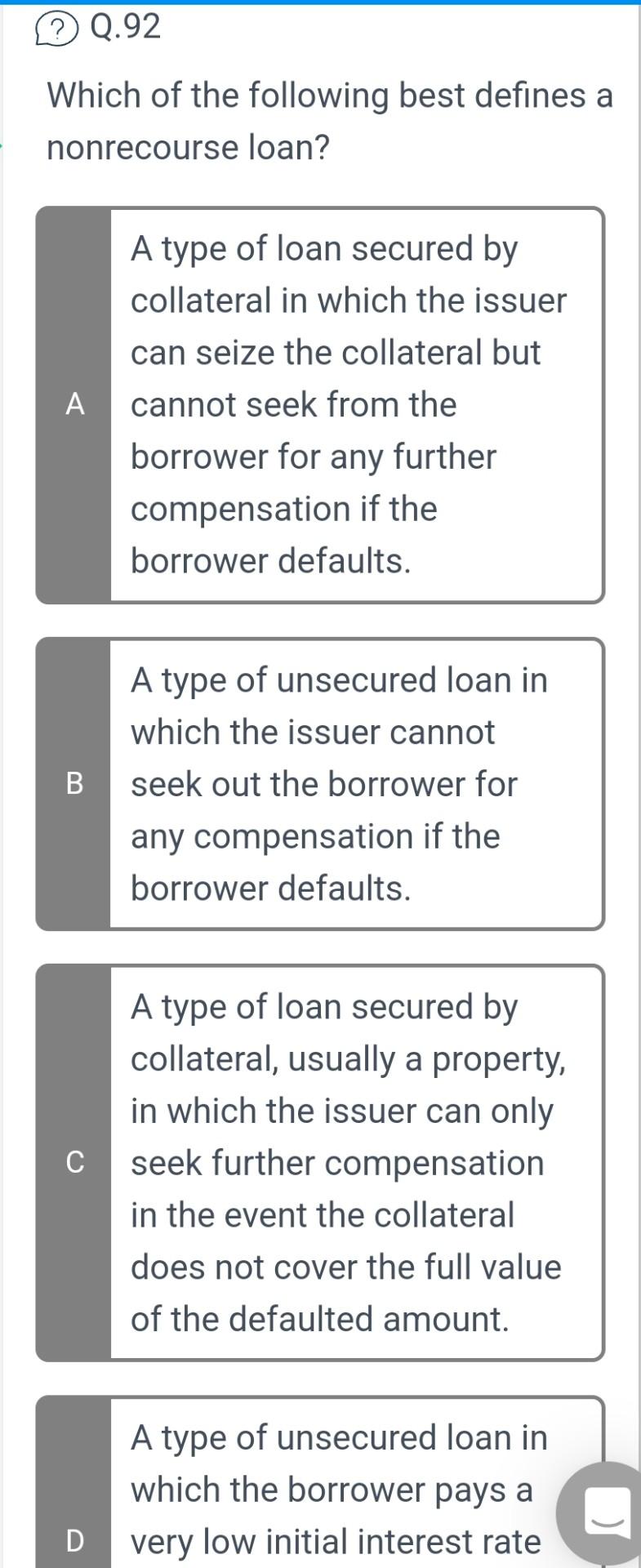

A risk manager is considering buying a $1,000 face value, semi-annual coupon bond with a quoted price of 102.25. The interest accrued since the last coupon is $2.50 per $100 face value. If the manager pays the dirty price, how much will the seller receive at the settlement date? (2) Q.92 Which of the following best defines a nonrecourse loan? A type of loan secured by collateral in which the issuer can seize the collateral but A cannot seek from the borrower for any further compensation if the borrower defaults. A type of unsecured loan in which the issuer cannot B seek out the borrower for any compensation if the borrower defaults. A type of loan secured by collateral, usually a property, in which the issuer can only seek further compensation in the event the collateral does not cover the full value of the defaulted amount. A type of unsecured loan in which the borrower pays a D very low initial interest rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts