Question: Please, I need a detailed eplanation Your firm is going to purchase a new machine to replace an old existing machine. Your firm purchased the

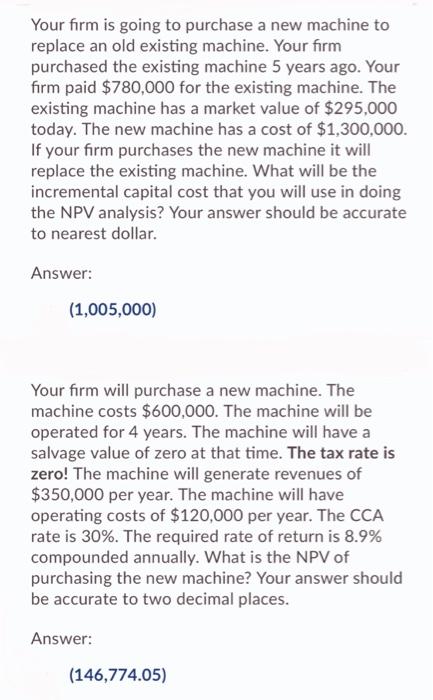

Your firm is going to purchase a new machine to replace an old existing machine. Your firm purchased the existing machine 5 years ago. Your firm paid $780,000 for the existing machine. The existing machine has a market value of $295,000 today. The new machine has a cost of $1,300,000. If your firm purchases the new machine it will replace the existing machine. What will be the incremental capital cost that you will use in doing the NPV analysis? Your answer should be accurate to nearest dollar. Answer: (1,005,000) Your firm will purchase a new machine. The machine costs $600,000. The machine will be operated for 4 years. The machine will have a salvage value of zero at that time. The tax rate is zero! The machine will generate revenues of $350,000 per year. The machine will have operating costs of $120,000 per year. The CCA rate is 30%. The required rate of return is 8.9% compounded annually. What is the NPV of purchasing the new machine? Your answer should be accurate to two decimal places. Answer: (146,774.05)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts