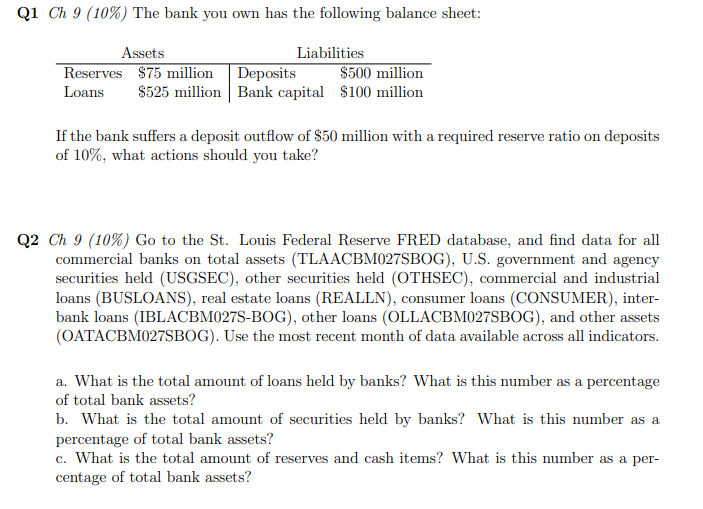

Question: Please I need all the steps and formulas in Excel so that I can follow them correctly. Q1 Ch I} {113%} The bank you own

Please I need all the steps and formulas in Excel so that I can follow them correctly.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts