Question: please i need answer D (17) O O Ma a incl Acc (17 Neit QP c [+] F COLSE Priv > (17 (17) 25 Exc|

please i need answer

please i need answer

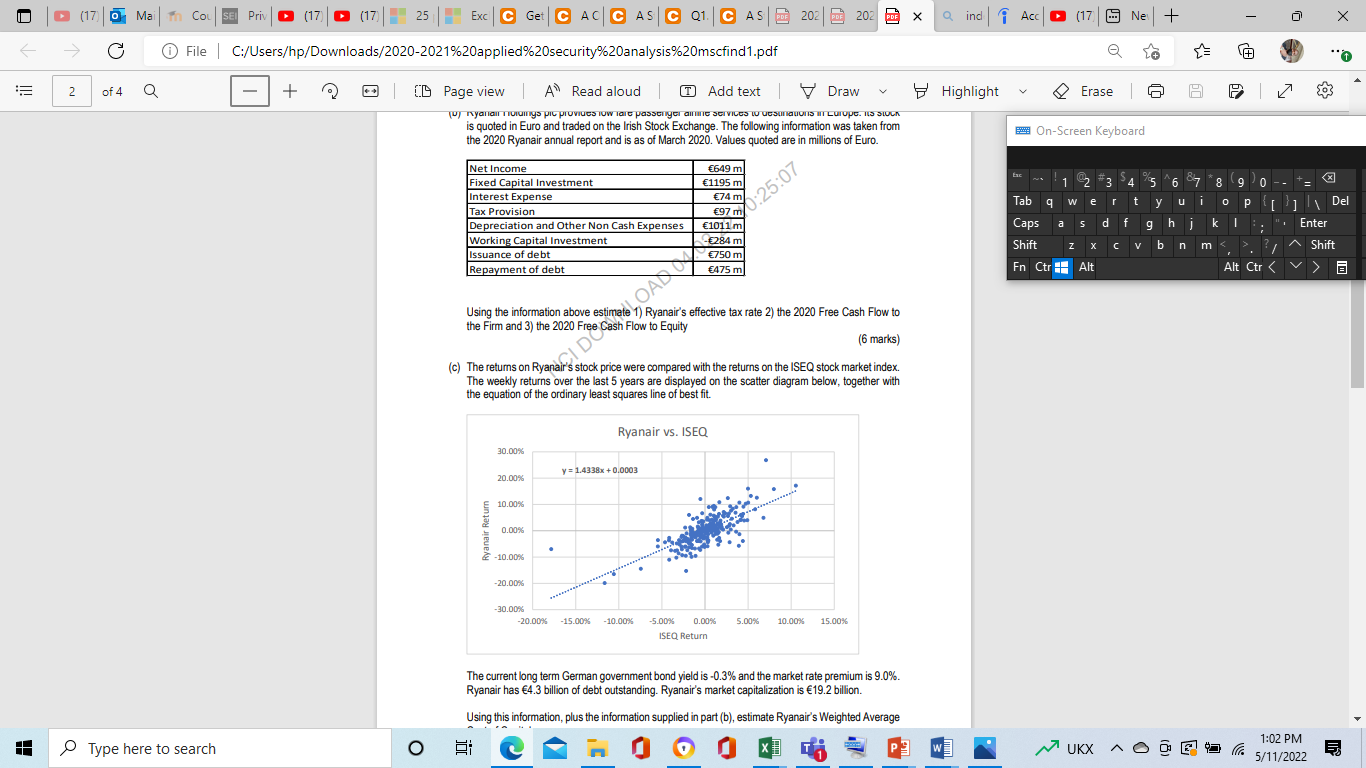

D (17) O O Ma a incl Acc (17 Neit QP c [+] F COLSE Priv > (17 (17) 25 Exc| Get CACAS C01CASE 201| 202 DE X File | C:/Users/hp/Downloads/2020-2021%20applied%20security%20analysis%20mscfind1.pdf + IL Page view | A Read aloud | D Add text | Draw Tu ryana Troimy pic proviUCS TOW TIC passengeramme SCIVICES w ucsunauons i Lurupe. ILS SOLA is quoted in Euro and traded on the Irish Stock Exchange. The following information was taken from the 2020 Ryanair annual report and is as of March 2020. Values quoted are in millions of Euro. 2 of 4 Q V Highlight Q Erase a 003 A On-Screen keyboard Exc 02 1 2 3 Taba W w e r Net Income Fixed Capital Investment Interest Expense Tax Provision Depreciation and Other Non Cash Expenses Working Capital Investment Issuance of debt Repayment of debt 649 m 1195 m 74 m 97 m 1011 m - 284 m m 750 m 475 m 7:25:07 a s d Caps Shift $4 5 6 7 8 9 0 4 t t y u u i op [Del O f f g g hi k I : ; Enter b n m ?/^ Shift Alt Ctrv> z x Z C V Fn CtrAlt Using the information above estimate 1) Ryanair's effective tax rate 2) the 2020 Free Cash Flow to 2 the Firm and 3) the 2020 Free Flow to Equity (c) The returns on an OAN (6 marks) s stock price were compared with the returns on the ISEQ stock market index. . The weekly returns over the last 5 years are displayed on the scatter diagram below, together with the equation of the ordinary least squares line of best fit. Ryanair vs. ISEQ 30.00% y = 1.4338x +0.0003 20.00% 10.00% 0.00% -10.00 -20.00% -30.00% -20.00% -15.00% -10.00% 5.00% 10.00% % 15.00% -5.00% 0.00% ISEQ Return The current long term German government bond yield is -0.3% and the market rate premium is 9.0% Ryanair has 4.3 billion of debt outstanding. Ryanair's market capitalization is 19.2 billion. Using this information, plus the information supplied in part (b), estimate Ryanair's Weighted Average c Type here to search o . w UKX AO 1:02 PM 5/11/2022 D (17) O O Ma a incl Acc (17 Neit QP c [+] F COLSE Priv > (17 (17) 25 Exc| Get CACAS C01CASE 201| 202 DE X File | C:/Users/hp/Downloads/2020-2021%20applied%20security%20analysis%20mscfind1.pdf + IL Page view | A Read aloud | D Add text | Draw Tu ryana Troimy pic proviUCS TOW TIC passengeramme SCIVICES w ucsunauons i Lurupe. ILS SOLA is quoted in Euro and traded on the Irish Stock Exchange. The following information was taken from the 2020 Ryanair annual report and is as of March 2020. Values quoted are in millions of Euro. 2 of 4 Q V Highlight Q Erase a 003 A On-Screen keyboard Exc 02 1 2 3 Taba W w e r Net Income Fixed Capital Investment Interest Expense Tax Provision Depreciation and Other Non Cash Expenses Working Capital Investment Issuance of debt Repayment of debt 649 m 1195 m 74 m 97 m 1011 m - 284 m m 750 m 475 m 7:25:07 a s d Caps Shift $4 5 6 7 8 9 0 4 t t y u u i op [Del O f f g g hi k I : ; Enter b n m ?/^ Shift Alt Ctrv> z x Z C V Fn CtrAlt Using the information above estimate 1) Ryanair's effective tax rate 2) the 2020 Free Cash Flow to 2 the Firm and 3) the 2020 Free Flow to Equity (c) The returns on an OAN (6 marks) s stock price were compared with the returns on the ISEQ stock market index. . The weekly returns over the last 5 years are displayed on the scatter diagram below, together with the equation of the ordinary least squares line of best fit. Ryanair vs. ISEQ 30.00% y = 1.4338x +0.0003 20.00% 10.00% 0.00% -10.00 -20.00% -30.00% -20.00% -15.00% -10.00% 5.00% 10.00% % 15.00% -5.00% 0.00% ISEQ Return The current long term German government bond yield is -0.3% and the market rate premium is 9.0% Ryanair has 4.3 billion of debt outstanding. Ryanair's market capitalization is 19.2 billion. Using this information, plus the information supplied in part (b), estimate Ryanair's Weighted Average c Type here to search o . w UKX AO 1:02 PM 5/11/2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts