Question: please I need help Eons and a sing e ind irect-cost category (Click the icon to vew the date.) ad the reculirements: Requirement 2. Explain

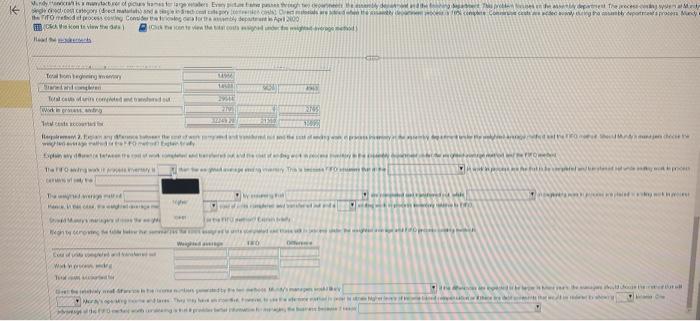

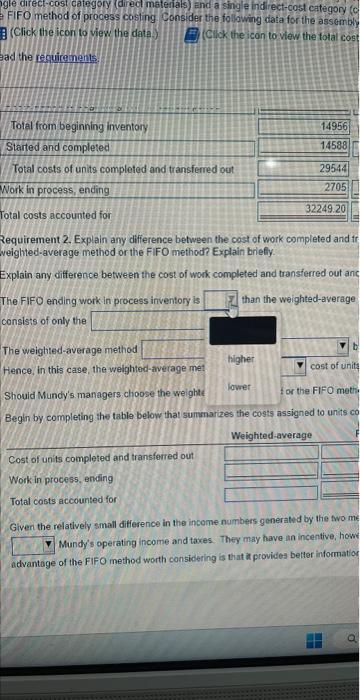

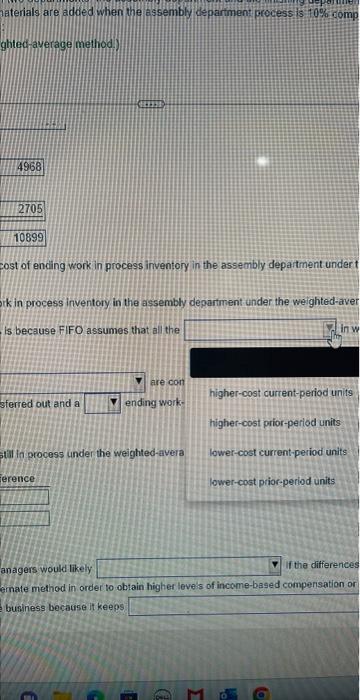

Eons and a sing e ind irect-cost category (Click the icon to vew the date.) ad the reculirements: Requirement 2. Explain any difference between the cost of work completed and tr weighted-average method or the FIFO method? Explain briefly. Explain any difference between the cost of work completed and transferred out anc The FIFO ending work in process inventory is than the weighted-average consists of only the The weighted-average method Hence, in this case, the weighted-average met. Should Mundy's. managers choose the weighte lower I or the FIFO metri Begin by completing the table below that summarizes the costs assigned to units co Given the relatively small difference in the income numbers generated by the two me Mundy's operating income and taxes. They may have an incentive, how: advantage of the FIFO method worth considering is that it provides better information aterials are added when the essembly department process is 100K comp ghtedaverage method.) cost of ending work in process inventory in the assembly department under k in process inventory in the assembly department under the weighted-aver Is because FIFO assumes that all the are con sfred out and a ending works til in process under the weighted-avera ference anagers would likely If the differences emate methed in order to obtain higher levels of income-based compersation or business because it keeps Eons and a sing e ind irect-cost category (Click the icon to vew the date.) ad the reculirements: Requirement 2. Explain any difference between the cost of work completed and tr weighted-average method or the FIFO method? Explain briefly. Explain any difference between the cost of work completed and transferred out anc The FIFO ending work in process inventory is than the weighted-average consists of only the The weighted-average method Hence, in this case, the weighted-average met. Should Mundy's. managers choose the weighte lower I or the FIFO metri Begin by completing the table below that summarizes the costs assigned to units co Given the relatively small difference in the income numbers generated by the two me Mundy's operating income and taxes. They may have an incentive, how: advantage of the FIFO method worth considering is that it provides better information aterials are added when the essembly department process is 100K comp ghtedaverage method.) cost of ending work in process inventory in the assembly department under k in process inventory in the assembly department under the weighted-aver Is because FIFO assumes that all the are con sfred out and a ending works til in process under the weighted-avera ference anagers would likely If the differences emate methed in order to obtain higher levels of income-based compersation or business because it keeps

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts