Question: please i need help in these QUESTION 27 If a bond portfolio manager wants to increase his credit exposure without significantly increasing the portfolio's interest

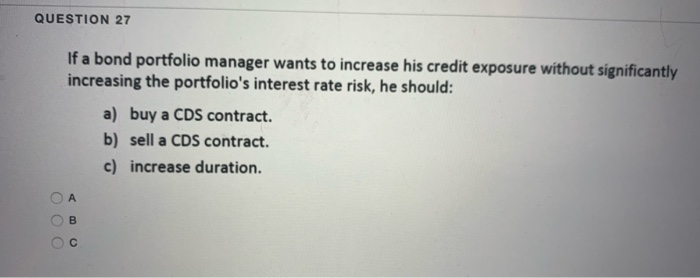

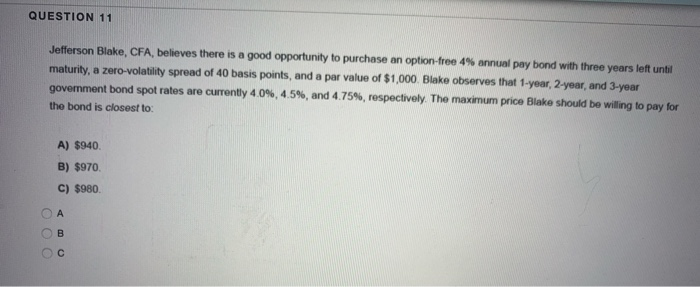

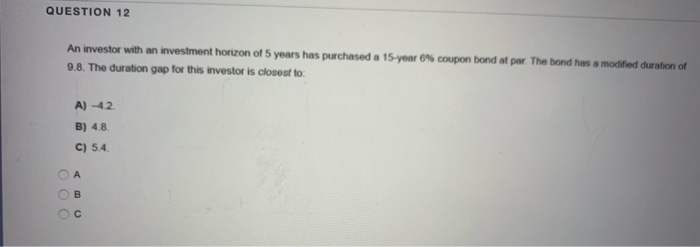

QUESTION 27 If a bond portfolio manager wants to increase his credit exposure without significantly increasing the portfolio's interest rate risk, he should: a) buy a CDS contract. b) sell a CDS contract. c) increase duration. OA OB OC QUESTION 11 Jefferson Blake, CFA, believes there is a good opportunity to purchase an option free 4% annual pay bond with three years left unt. maturity, a zero-volatility spread of 40 basis points, and a par value of $1,000. Blake observes that 1-year 2 year, and 3-year goverment bond spot rates are currently 4.0%, 4.5%, and 4.75%, respectively. The maximum price Blake should be willing to pay for the bond is closest to A) $940 B) $970 C) $980 QUESTION 12 An investor with an investment horizon of 5 years has purchased a 15-year 6% coupon bond at par. The bond has a modified duration of 9.8. The duration gap for this investor is closest to A) -42. B) 4.8 OOO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts