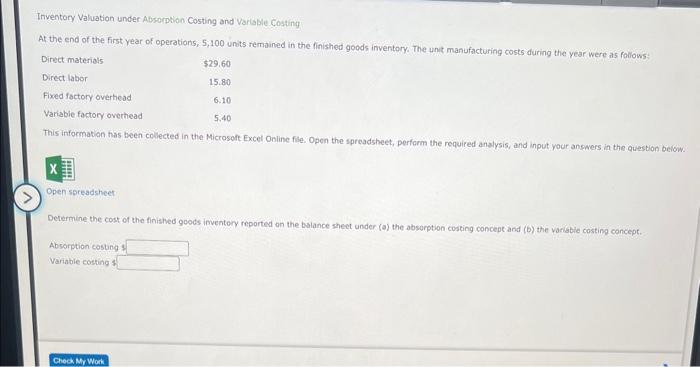

Question: please i need help Inventory Valuation under Absorption Costing and varlable Costing At the end of the first year of operations, 5,100 units remained in

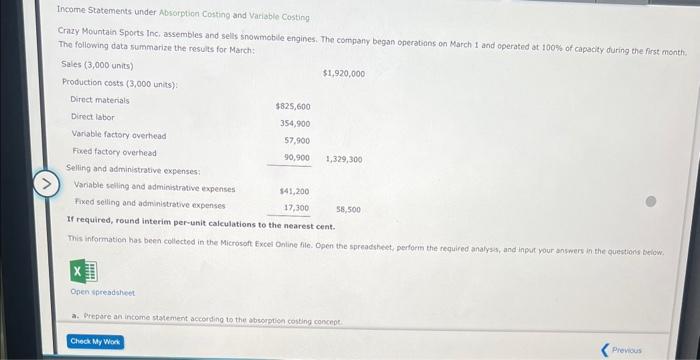

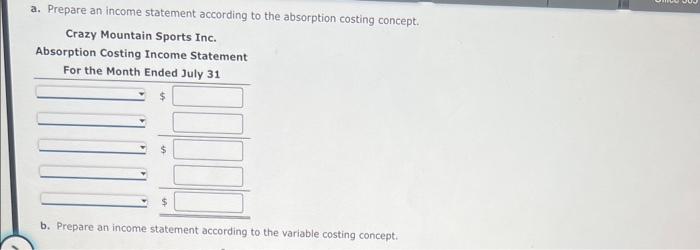

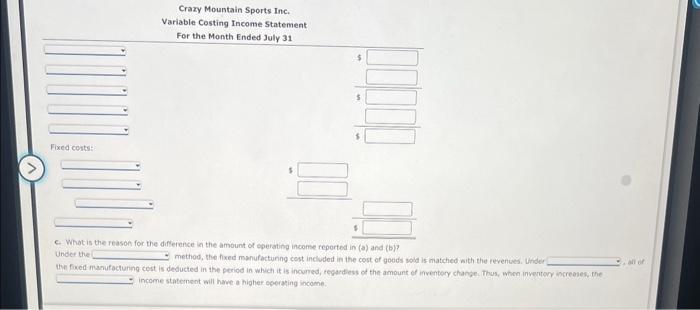

Inventory Valuation under Absorption Costing and varlable Costing At the end of the first year of operations, 5,100 units remained in the finished goods inventory. The unit manufacturing costs during the year were as foliows: This information has been collected in the Microsoft Excel Online flie. Open the spreadsheet, perform the required analysis, and input your answers in the question be Open spreadsheet Determine the cost of the finished goods inventory meported on the balance sheet under (o) the absorption costing concept and (b) the varisbie costing concept. Absorption costing : Variabie costing Income Statements under Absorption Costing and Variable Costing Crizy Mountain Sports Inc, assembles and sells snowmobile engines. The company began operatians on March 1 and operated at 100% of capacity during the first month. The following data summarize the results for March: * requares, roune unterim per-unit calculations to the nearest cent. This information has been collected in the Microsoft Excet Online file. Open the spreacshect, perform the required analysa, and inpur your answers in the quections kelow. Open spreadsheet a. Prepore an incoome stagement according to the absorption cosbing concepe: a. Prepare an income statement according to the absorption costing concept. Crazy Mountain Sports Inc. Absorption Costina Inenme Statama. b. Prepare an income statement according to the variable costing concept. c. Whotis the reason for the difference in the amount of eperating income reported in (a) and (b)? Under the method, the fixed manufacturng cest incloded in the cost of goods sold is matched ath the revenves. Whide: the foved macufactuning cest is deducted in the period in which it is incined, tegardest of the amount of ifventory change, thes, shon invertory increeses. the . income statement will have a higher soerasing income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts